This feature originally appeared in the 2018 FN50 supplement. Read the digital issue of the supplement

End of contract damage charges continue to be a bone of contention between leasing companies and their customers.

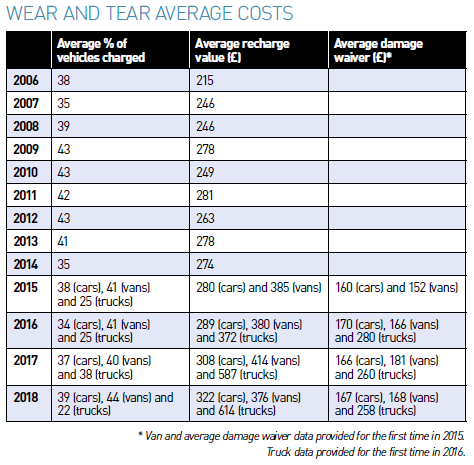

This year’s FN50 survey shows that the percentage of vehicles incurring damage recharges at end of contract has risen for both cars (up two percentage points from 37% to 39%) and vans (up four percentage points from 40% to 44%).

The average amount that van operators are being recharged has fallen from £414 last year to £376 but for cars it’s an upward trajectory.

Last year, the average recharge for cars broke the £300 mark for this first time and it has risen a further £14 this year to £322.

Whether this is due to rising repair costs, leasing companies being less lenient or treating damage charges as a ‘profit centre’ (a long-held accusation) or drivers failing to keep their vehicles in good condition (or to understand the required condition) is open to debate.

But it is clear that some fleet managers remain disgruntled with the process and that leasing providers still do not take a consistent approach – even with the British Vehicle Rental and Leasing Association (BVRLA) fair wear and tear guides in place for cars, vans and HGVs.

In this year’s FN50, the average recharge for vans varies from as low as £75 for two leasing companies to as high as £738 for one provider. In fact, six of the respondents charge £500 or more, on average. For cars, the average ranges from just £42 to £712.

One van fleet operator, who did not wish to be named, has had different experiences with two leasing companies despite having a number of controls in place to ensure vans are returned in good condition.

These controls include a company policy regarding the condition and damage of vehicles and what is allowed to be left and what should be repaired during the lease period; weekly vehicle condition audits completed by site super-visors; vehicle spot checks carried out during internal audits and by the transport compliance team and driver trainers when on site; and costs and images being checked by someone with a mechanical background at defleet.

With one lease provider “every bit of damage is noted and charged” while with the other, the fleet manager has managed to create “a reasonable relationship”.

The fleet manager believes it’s down to how the leasing companies remarket their vehicles.

The latter puts all its vehicles through auction without repairing them and offsets the recharges with the amount the vehicle was sold for at auction.

The former repairs all of its vehicles and puts them back into the retail market so it is, in the fleet manager’s view, “more focused on making the vehicle ‘showroom’ condition”.

As a result, the fleet manager has decided that they will not be using the provider again once the final batch of vehicles has been returned.

Another fleet manager, who also preferred not to be named, believes that while some leasing companies “take a measured approach” that takes into consideration a vehicle’s age/mileage and value, others don’t appreciate that vans have to be “worked hard for a living”.

He has “many thousands of off-lease invoices on hold”, some going back more than two years, for what he describes as “unreasonable charges”.

He has invited the leasing companies concerned to meet and resolve the invoices. One has done so and agreed that the charges appear to be around 25% higher than they should be, on average, while the other provider, despite being contacted multiple times, has not yet responded.

In this year’s FN50, the average recharge for vans varies from as low as £75 for two leasing companies to as high as £738 for one provider. In fact, six of the respondents charge £500 or more, on average.

For cars, the average ranges from just £42 to £712, with seven respondents charging more than £400 on average.

In some cases, leasing companies are prepared to overlook a degree of damage and damage waivers for cars can range from £75 to £250. The average is £167.

Damage waivers for vans range from £75 to £250, with an average of £168.

Caroline Sandall, deputy chairman of fleet operator association ACFO, does not believe that the issue of end of contract damage charges is getting worse but does acknowledge that there has been a rise in complaints, particularly from ‘non-traditional company car users’ such as car salary sacrifice drivers due to “a lack of understanding and experience of having a lease vehicle”.

She says that although salary sacrifice schemes can have a contingency fund this is usually to cover early terminations so drivers would still be hit with a recharge for damage.

The BVRLA regularly reviews its fair wear and tear guides and Sandall took part in its latest roundtables, working alongside other leasing companies and remarketing agents, to examine both the van and car guides to ensure they are fair and clear for drivers and clients.

The review led to an updated version of the van guide, which was launched at this year’s Commercial Vehicle Show in April.

Changes included an amendment to the definition of fair wear and tear (it now refers to ‘conventional operation’ rather than ‘normal usage’ of the vehicle), a change to the definition of ‘light scratch’ and the removal of unacceptable damage images (the working party felt there was a large spectrum of unacceptable damage and deterioration that would be almost impossible to capture in a small series of photos) along with the example vehicle appraisal form (as almost all de-fleet operators have hand-held technology that captures the image of the vehicle and a small A5-sized checklist was difficult to use effectively).

An updated guide for cars is due to be published in the first half of 2019, following further consultation.

The BVRLA also provides training to complement its guides and sets out the end of contract standards it expects from its members in its code of conduct.

If a customer believes a BVRLA member is not adhering to the code they can use the BVRLA’s conciliation service (provided they have fully exhausted the member’s own internal complaints procedure and received a final decision).

Fleet managers could also seek advice from consultants such as Damage Reclaim, which will help challenge end-of-contract vehicle charges on a no win, no fee basis (although it does take a 30% cut if successful).

Dean Miles founded the company after being charged more than £1,000 by a leasing company, which he felt was unjustified.

After seeking advice from somebody working in the leasing industry, he went back to the company and it admitted there was failure in process and some of the charges were unjustified.

Miles says: “The damage invoice was reduced and further negotiation ended with the bill to zero as a gesture of goodwill.”

Sandall believes that fleet operators must continue to “be vigilant” about end of contract charges and “ensure scrutiny is maintained, drivers are educated, understand what is expected and how to ensure the right types of damage are repaired”.

With a number of fleet operators extending contracts this year in the wake of WLTP and benefit-in-kind uncertainty, having the right processes in place and good communication with their leasing provider will become more important to avoid any nasty surprises when the vehicles are eventually returned.

Sandall warns that in these challenging times, leasing companies may be less able (or less willing) to offer goodwill gestures/write off costs.

Login to comment

Comments

No comments have been made yet.