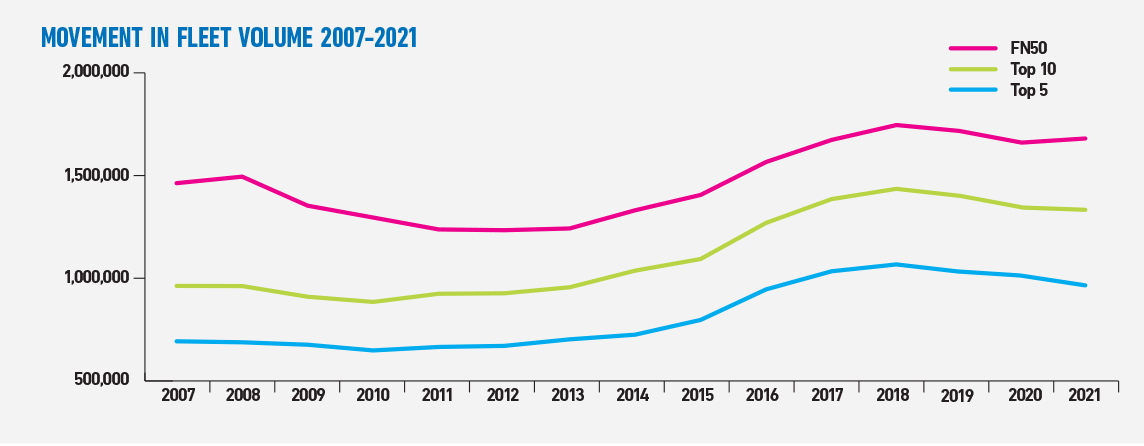

After two consecutive years of decline, the FN50 has stabilised over the past 12 months with a slight rise in the number of funded cars and vans to 1,663,421 (up by 1,101 units).

Despite the ongoing market turmoil and uncertainty, with the automotive industry lurching from three lockdown crises to the semiconductor shortages, resulting in contract extensions and mileage reductions, the order books at UK business have reopened.

The only thing holding fleets back is a lack of product, with delivery times lengthening to 12 months-plus for many models.

However, the fortunes of company cars and vans are in stark contrast.

“We may see a shift from outright purchase to leasing as organisations look to release capital to invest in other areas of their operations/front line services.” Venson director of client management Simon Stanton

Cars, under pressure from redundancies and cash opt-outs due to falling business and personal mileage, have reduced by more than 20,000 – or 1.7% - to 1,200,558, although that’s half the volume drop of 2020’s decline.

Perk and job-need cars have both been affected, but leasing bosses and manufacturer fleet directors are generally upbeat about the sector’s prospects, thanks to the proliferation of new electric vehicles (EVs) coming to market with their highly attractive benefit-in-kind (BIK) tax rates.

Near 5% rise in funded vans offsets 1.7% fall in cars as home delivery market drives overall FN50 growth for the first time since 2018, reports Stephen Briers

After two consecutive years of decline, the FN50 has stabilised over the past 12 months with a slight rise in the number of funded cars and vans to 1,663,421 (up by 1,101 units).

Despite the ongoing market turmoil and uncertainty, with the automotive industry lurching from three lockdown crises to the semiconductor shortages, resulting in contract extensions and mileage reductions, the order books at UK business have reopened.

The only thing holding fleets back is a lack of product, with delivery times lengthening to 12 months-plus for many models.

However, the fortunes of company cars and vans are in stark contrast.

“We may see a shift from outright purchase to leasing as organisations look to release capital to invest in other areas of their operations/front line services.” Venson director of client management Simon Stanton

Perk and job-need cars

Cars, under pressure from redundancies and cash opt-outs due to falling business and personal mileage, have reduced by more than 20,000 – or 1.7% - to 1,200,558, although that’s half the volume drop of 2020’s decline.

Perk and job-need cars have both been affected, but leasing bosses and manufacturer fleet directors are generally upbeat about the sector’s prospects, thanks to the proliferation of new electric vehicles (EVs) coming to market with their highly attractive benefit-in-kind (BIK) tax rates.

The picture is already far brighter for vans, though, with the booming home delivery sector fuelling significant fleet growth of 21,515 units to 462,863, a rise of almost 5% year-on-year.

The number of trucks funded by the FN50, while not included in the final tallies, also surged, with a 11,298-unit rise to 24,809.

Vans now account for 28% of the total FN50 funded fleet, up from 27% last year and a four percentage point rise on four years ago.

Lee Hamlett, commercial director at Toyota-owned Kinto, says lower mileage has been a “catalyst” for many businesses to conduct fleet reviews.

“Along with increased requests for mileage reconstructions, we have seen job-need requirements for cars reduce, but with increased home deliveries, more self-employed and down-sizing from LGV (light goods vehicles) to LCV (light commercial vehicles) due to compliance and driver availability, we have seen an increased demand for vans,” he says.

Leasing bosses predict continued strength in vans, with companies switching to leasing from short-term funding or outright purchase.

“This is offering a more stable proposition and a more competitive price,” says Alphabet (GB) head of corporate and international sales Stuart Cunningham.

Purchase or lease

Cashflow issues are convincing companies that have historically purchased their vehicles to release capital using sale and leaseback, according to ALD.

This will free up cash that will enable them to reinvest in their core business.

Venson director of client management Simon Stanton agrees.

“We may see a shift from outright purchase to leasing as organisations look to release capital to invest in other areas of their operations/front line services,” he says.

Several leasing companies believe personal contract hire schemes are ripe for growth, although the business-to-retail proportion of funded cars has strengthened year-on-year in favour of business.

It now accounts for 82.7% of funded cars, up from 80% last year but still down from 2018’s 87%.

Who's on the up?

Eight of the FN50 top 10 are in the same position as 2020; indeed, six have stayed put for the past couple of years.

The only movers this year are Zenith and Free2Move Lease which swap positions to take eighth and ninth respectively following an 8% rise in funded fleet for Zenith and a 14% reversal for Free2Move.

Zenith’s growth is entirely from cars – although the company has also made huge advances in the truck sector with its acquisition last year of Cartwright Group, giving it one of the UK’s biggest HGV and trailer fleets.

The largest increase in fleet size – both proportional and volume – was recorded by Santander, with a 60% year-on-year rise, all in its car fleet. The majority of the company’s car leasing business is in the retail market, which accounts for 84% of its funded fleet.

However, Santander isn’t the only heavy player in the private car market. Five other leasing companies also lean towards retail: ALD, which runs several white label finance schemes for manufacturers sold via their franchised dealers, sits at 52.6% retail; Hitachi is at 55%; Fiat-owned Leasys is 67% and Renault-owned RCI is 69.95%.

Both Leasys and RCI have posted double-digit increases as the retail market returned to growth as the country emerged from the third lockdown.

Leasys, up 12%, saw all its increase come from cars; despite UK managing director Sebastiano Fedrigo identifying vans as a growth opportunity, volumes shrank from 941 to just 348 this year.

RCI added almost 3,500 cars and 1,000 vans to its funded fleet to register a 36% rise, lifting it from 19th to 16th.

The largest proportion of retail funding is Affinity Leasing at 93%, which specialises in corporate affinity schemes for company employees.

“We expect to see shorter lease periods and greater tendency to outsource.” Karl Howkins, Sogo Mobility

Also enjoying a strong year of growth is Bridle Leasing which last year set up a franchise business to supplement its core leasing and fleet management proposition. Within nine months, 27 brokers had signed up, with Bridle franchised director Tano Di Girolamo predicting 100 by the end of this year.

While not part of its funded fleet – vehicles are financed via a panel of lenders – Bridle nevertheless enjoyed a 29% surge in risk fleet volumes, adding around 300 cars and 300 vans to its total.

Van and truck specialist Fraikin boosted its fleet size by 52%, taking it from 1,188 to 1,808 (of which 1,484 are vans), while double-digit increases were also achieved by Hitachi (12%), Total Motion (16%), Liquid Fleet (10%), Northern Ireland-based Traction Finance (12.2%) and Multifleet Vehicle Management (15%).

FN50 year-by-year

| Position | 2018 | 2019 | 2020 | 2021 |

Vol change 2020/2021 |

% change 2020/2021 | ||||

| 1 to 5 | 1,055,268 | 62% | 1,041,642 | 61% | 1,011,884 | 61% | 980,570 | 59% | -31,314 | -3.1% |

| 6 to 10 | 361,929 | 21% | 365,725 | 21% | 364,610 | 22% | 370,744 | 22% | 6,134 | 1.7% |

| 11 to 20 | 189,020 | 11% | 165,885 | 10% | 177,722 | 11% | 200,842 | 12% | 23,120 | 13% |

| 21 to 30 | 82,946 | 5% | 80,929 | 5% | 65,802 | 4% | 68,359 | 4% | 2,557 | 3.9% |

| 31 to 40 | 36,685 | 2% | 35,956 | 2% | 29,442 | 2% | 28,134 | 2% | -1,308 | -4.4% |

| 41 to 50 | 15,029 | 1% | 15,369 | 1% | 12,860 | 1% | 14,772 | 1% | 1,912 | 14.9% |

| TOTAL | 1,740,877 | 1,705,506 | 1,662,320 | 100% | 1,663,421 | 100% | 1,101 | 0.1% |

Who's suffered a drop in funded fleet size?

In total, just more than half (26) of FN50 companies have increased their funded fleet size on 2020, with two unchanged and 20 suffering a drop.

Four of the latter are in the top 10, including biggest funder Lex Autolease. Its 13% fall translates to 41,654 vehicles, spread across cars and vans.

The gap to second-place Volkswagen Financial Services, which breaks through the 200,000 mark for the first time, is now 80,565 vehicles, down from 136,975 in 2020 – by far the smallest margin since Lex Autolease was formed from the merger of Lex Vehicle Leasing and Lloyds Autolease in 2009.

Registering the biggest decline, down 56% (from 4,529 to 1,991), is Maxxia, which is likely to make its final appearance in the listing this year.

The company is no longer writing new contract hire business for cars and vans and, since August 2020, has been running off its fleet.

Dave Mitchell, Maxxia group finance director, says: “We are focusing now as a business and a group on being an asset finance originator (equipment) and brokering transactions.”

New entrants to the FN50

Two companies enter the FN50 for the first time. Surging into 28th position is VMS Fleet Management. Its fleet of 4,650 vehicles is all, bar 150 vehicles, vans.

The company also has a large truck fleet and rental business.

The other newcomer is Sogo Mobility, headed by experienced automotive campaigner Karl Howkins, a former Vauxhall head of fleet and Citroën UK managing director.

Sogo’s funded fleet of 2,147 sees it take 41st place, but Howkins has ambitious plans for growth in the coming years.

The company, backed by franchised dealer group Cambria Automobiles, sees an opportunity to exploit shorter term leasing among SMEs, micro-businesses and corporates alike.

“The fleet sector is adjusting to more flexible solutions as opposed to traditional contract hire and leasing,” says Howkins.

“We expect to see shorter lease periods and greater tendency to outsource.”

Exiting the FN50 are Northern Ireland-based Donnelly Fleet and Wheels4Sure.

Fleet management, accident management and rental

FN50 companies also provide figures for cars and vans under fleet management (vehicles that are not funded), accident management and rental.

Almost universally, numbers have fallen for cars but risen for vans from the same respondents year-on-year.

The FN50 in numbers

The FN50 now fleet manages:

- 248,512 cars (2020: 259,518)

- 65,942 vans (2020: 62,129),

- 174,298 cars and 93,221 vans on accident management programmes (2020: 246,920 and 87,209 respectively)

- operates a rental fleet of 264,702 cars (2020: 267,639) and 16,495 vans (2020: 19,692).

View the FN50 2021 supplement (premium content)

Video: The FN 50 countdown

Login to continue reading.

This article is premium content. To view, please register for free or sign in to read it.

Login to comment

Comments

No comments have been made yet.