Peter Millichap, UK marketing director Teletrac Navman UK

Semiconductors are now an integral part in a diverse array of products from humble toasters, to freight vehicles and highly sophisticated military equipment. Not only that, but they are also an intrinsic part of the factories that produce these products.

During the global pandemic, there have been winners and losers in the race to secure supply of this diminutive part, during which, the automotive industry has firmly been shunted into the slow lane.

A global shortage of semiconductors became apparent during the first quarter of 2021, with some experts now forecasting it to last beyond 2022 and into 2023.

Semiconductor sales revenue has seen an increase of between 7.3–10.8% since 2019 and is expected to reach $522 billion (£375bn) in 2021. This could have a damaging impact on the advancement of auto and telematics industries, as a lack of semiconductors could hamper the development of truly connected vehicles.

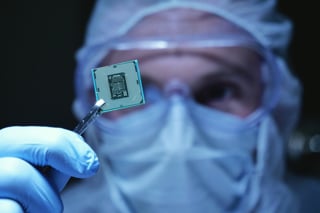

Numerous factors have contributed to the current situation, aside from the fact that the product can take up to 16 weeks to manufacture, requires a highly skilled workforce, sophisticated machinery, clinically clean production environment and a lot of water.

One of the most obvious factors was the impact of Covid-19. It caused a fall in demand for new cars in February 2020, which had a knock-on effect for the auto industry, as the need for semiconductors crashed.

Luckily for chip manufacturers, the increase in demand for IT products more than absorbed the excess. And with a requirement for higher product volumes, the tech industry became more attractive to chip manufacturers.

As such, once vehicle sales picked up and manufacturers tried to reorder to their old levels, the auto industry found that the supply of microchips had been reallocated and manufacturers couldn’t increase production levels sufficiently to satisfy both markets.

To make matters worse, some astute auto manufacturers read the marketplace and realising a shortage was on the horizon, started to increase their stocks.

To manage the shortage, manufacturers are revisiting their product portfolios to assess priority lines and models and focussing production on them. The specification of models are also being revised and features dependent on semiconductors, such as reversing systems and satnavs, often aren’t being included.

If this goes on for any length of time, we could see a situation where manufacturers and suppliers need to make do with what they have, rather than developing what they need or what customers want from their connected vehicles.

Due to the rising demand for logistics and transport, worldwide, the global telematics solutions market is estimated to rise at a CAGR of 16.3% and generate US $82.9bn (£58bn) in the forecast period from 2020 to 2027. So in this interim, better utilisation of existing fleets and their usage through telematics, is a must.

Governments across the globe are quickly coming to the realisation that having their own semiconductor manufacturing industry is a good step to support and protect their industry.

The required capital investment is huge but already some countries are striking up agreements between government and private equity companies to get manufacturing sites established.

The Biden administration for instance, called on Congress to invest $50bn (£37bn) in semiconductor manufacturing and research.

The issue regarding supply may be around for some time, so there are a couple of tactics that manufacturers should consider to weather the storm.

Search out new chip suppliers where possible, but be mindful that some chips contain protected intellectual property of the manufacturer and may require lengthy licensing if sent to another manufacturer, similarly, if the supplier is new to manufacturing a specific chip format, there may be a delay whilst the factory is re-tooled and equipment and raw materials purchased.

If the manufacturer can change supplier to one that is more local, keeping the business within the immediate locality will help that community to thrive and develop.

If staying with the same chip supplier, manufacturers should aim to foster stronger trading relationships, which could improve the security of future orders. This could include paying a premium for low volume orders; investing in the supplier’s operations in some way; or making longer term commitments regarding volume, i.e. placing orders for 2022 to enable the supplier to buy in raw materials or make investments with confidence.

Smaller companies could form simple associations and bundle together their smaller volume orders into more significant ones.

As the world opens back up to life that mirrors pre-Covid-19 times, it’s clear that we will still face disruption. The transport and logistics industry may feel the effects for a considerable amount of time, however, fleet operators can focus on utilising telematics in the meantime, to gain competitive advantage and thrive.

Login to comment

Comments

No comments have been made yet.