Fleet leasing is an important growth area for large French banks as their core retail banking operations continue to face margin pressure from low interest rates, according to Fitch Ratings.

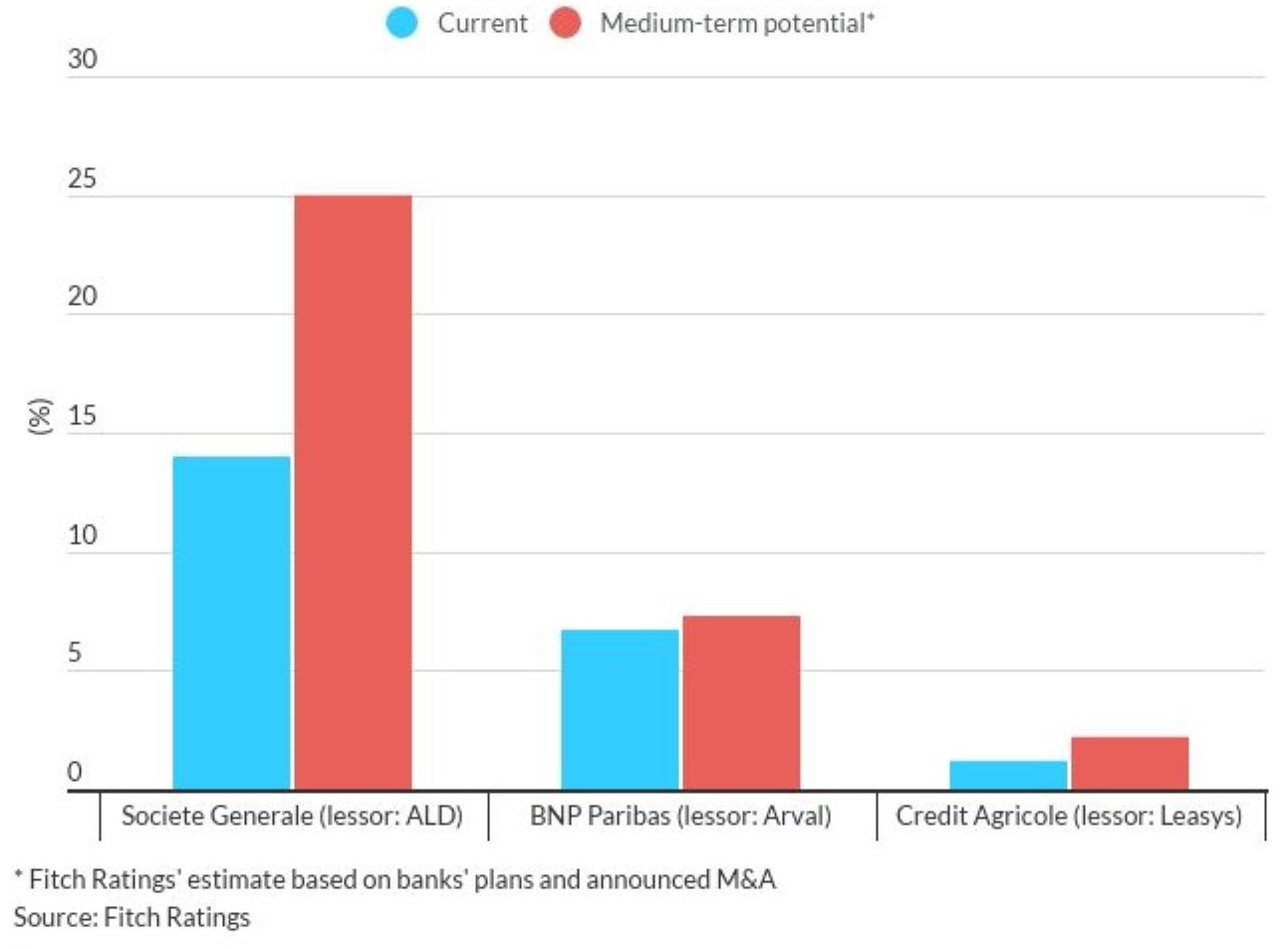

French bank-owned lessors have significantly outperformed their parent banks in recent years, with pre-tax earnings/average assets of 3% in from 2016 to June 30, 2021, compared with 0.3% for the banks’ overall business.

UK fleets will be familiar with Arval and Leasys, owned by BNP Paribas and Credit Agricole, respectively.

ALD, which is owned by Societe Generale, recently agreed to buy LeasePlan for €4.9 billion (£4.1bn), with the new leasing powerhouse to be called NewALD.

Fitch says it expects French banks to expand their fleet leasing operations further, largely through bolt-on acquisitions or partnerships.

Fleet leasing contribution to group pre-tax profit

Fitch continued: “Fleet leasing is an extension of the diversified business models of large French banks, which already have consumer and car finance operations, helping to offset low profitability in domestic retail banking businesses.”

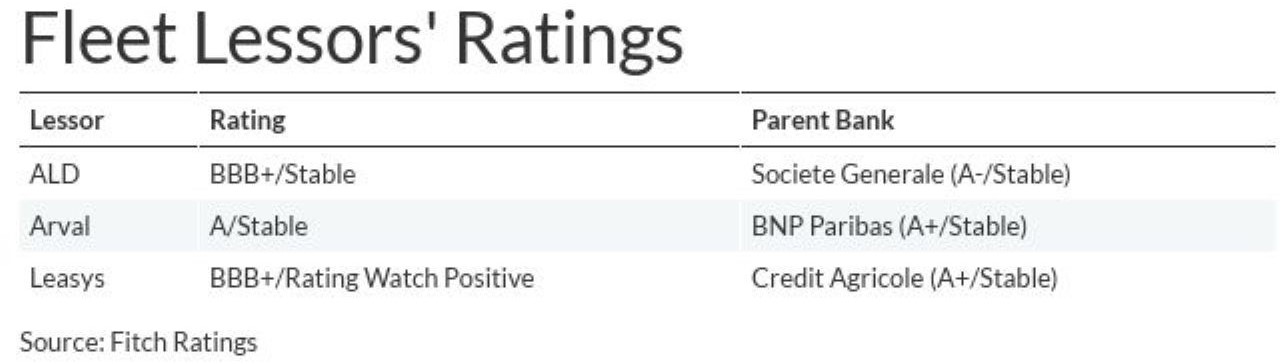

Fitch views fleet lessors as strategically important to their parent banks given their contributions to profits and their complementary offerings.

It says that the lessors are generally well-integrated with their parent banks for funding, capital management and risk management.

However, it added: “We do not equalise the lessors’ ratings with those of their parents. This is because the banks could divest the lessors, at least partly, to release capital or generate liquidity, without fundamentally altering their group profiles or franchises.

“Equalisation would require a lessor to be a key contributor to group earnings, and the parent to have an ownership stake of over 75%.”

Expansion into fleet leasing increases the banks’ direct exposure to energy transition risks, although this is unlikely to affect ratings in the near term, says Fitch.

The transition to electric vehicles (EVs) exposes lessors to higher residual value (RV) risk given the potential pressure on second-hand prices for internal combustion engine vehicles, and the volatility and unpredictability of second-hand EV prices due to rapidly evolving battery technologies. However, Fitch highlighted how quick fleet turnover helps to mitigate these risks.

The report, Fleet Leasing: Growth Area for French Banks, is available here.

Login to comment

Comments

No comments have been made yet.