The scale of the squeeze on supply in the UK’s used car market has been revealed in new figures published today (Friday, February 10) by the Society of Motor Manufacturers and Traders (SMMT).

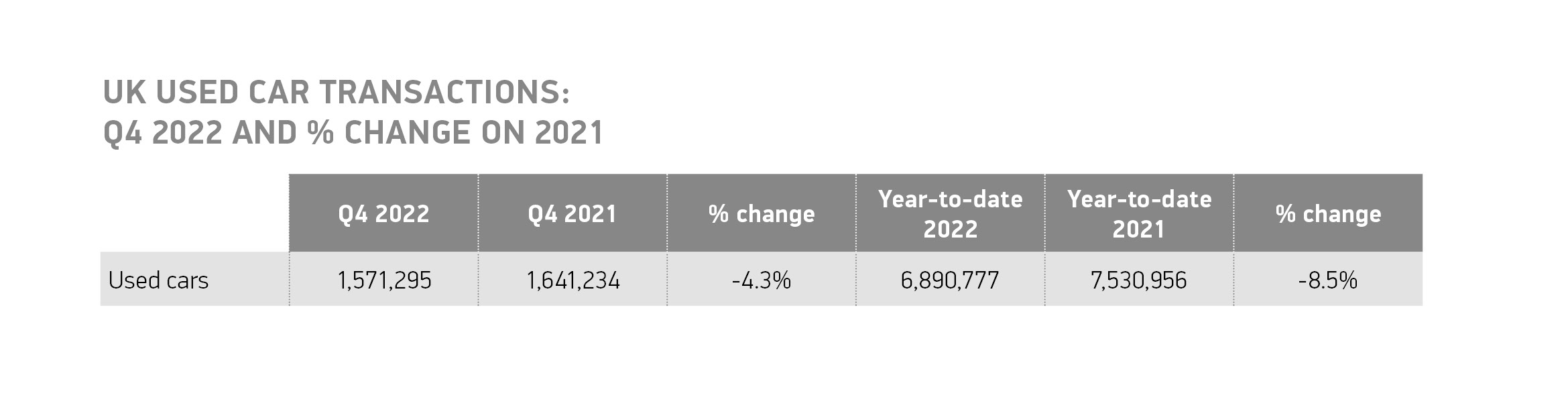

The data shows that used car transactions fell by 8.5% in 2022, with 640,179 fewer vehicles changing hands than in 2021.

The squeeze on the supply of used cars has primarily been driven by the global shortage of semiconductors restricting the amount of stock entering the second-hand market.

Separate figures from the SMMT for the new car market have shown that, despite underlying demand, pandemic-related global parts shortages meant that last year it ended 700,000 units below pre-Covid levels.

There were 6,890,777 used car transactions in the UK in 2022, which is 13.2% below 2019’s pre-pandemic total.

Used electric vehicles

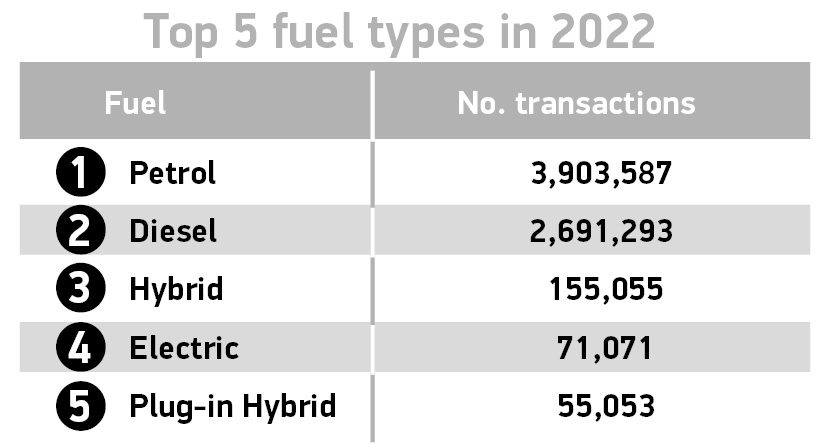

Bucking the overall downward trend in 2022 was used battery electric vehicle (BEV) transactions, recording their best-ever annual performance with a record 71,071 units sold, a rise of 37.5%.

However, used BEV transactions remain an incredibly small proportion of overall sales, equating to a market share of 1%, up from 0.7% in 2021.

There was growing demand for other alternatively fuelled vehicles, with sales of hybrid electric vehicles (HEVs) rising 8.6% and plug-in hybrid electric vehicle (PHEVs) transactions up 3.6%.

Combined, they represented 4.1% of the market (up from 3.3% in 2021) and while transactions of used diesel and petrol cars fell by 11.8% and 7.7% respectively, they remained the dominant powertrains with a combined 6,594,880 units changing hands.

Mike Hawes, the SMMT’s chief executive, said: “While the market headlines are negative, and reflective of the squeeze on new car supply last year, record electrified vehicle uptake is a bright spot and demonstrates a growing appetite for these models.”

Transactions increased by 0.8% in December in the first monthly rise since February, and while Q4 was down by 4.3%, the third successive quarterly decline, it was not as steep as in quarters two (18.8%) and three (12.2%).

This, says the SMMT, reflects the renewed growth seen in the new car market, helping more vehicles enter used car stock. For example, there were 131,994 new cars registered in January – a 14.7% year-on-year increase. Fleet and business sales equated to 55% of the market.

It was the best start to the year since January 2020’s pre-Covid 149,279 units and marked the sixth successive month of expansion.

Hawes continued: “With new car registrations growth expected this year, more of the latest low and zero emission models should become available to second owners.

“Accelerating uptake is key and will be dependent on drivers being assured of a positive ownership experience. This means ensuring charging infrastructure keeps pace with demand as more, new and used car buyers make the switch to zero emission motoring than ever before.”

Most popular used car colour

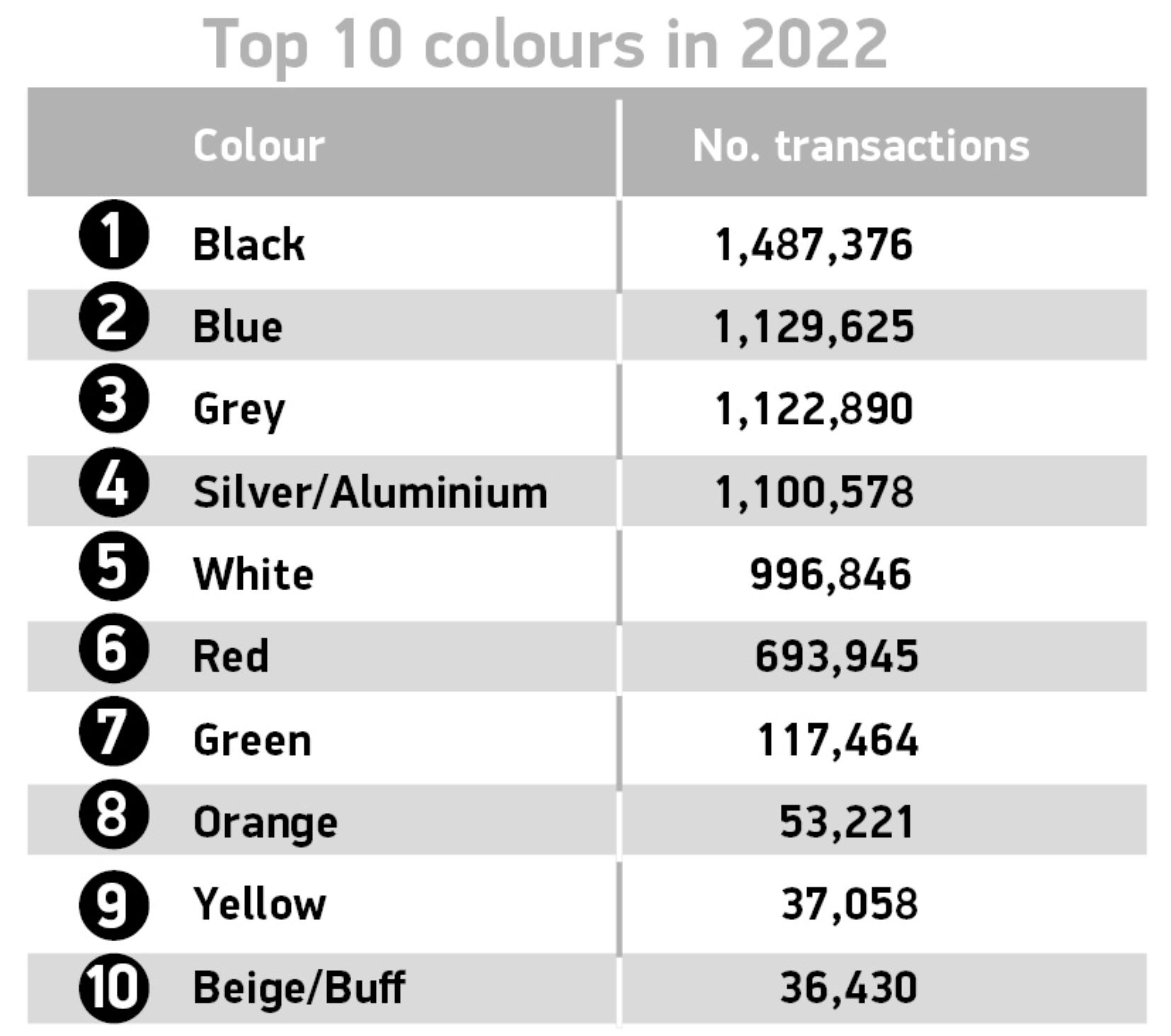

Used car buyers went back to black as it proved to be the most popular colour for the year, accounting for a fifth (21.6%) of the market.

Blue was ranked second, with 16.4% share, and, despite grey topping the new car market, it ranked third for used cars at 16.3% market share.

There were also 4,461 pink, 6,708 turquoise and 18,658 bronze used vehicle transactions during the year.

Used car market segments

In terms of market segments, all sectors saw transactions decline aside from dual purpose, which was the third most popular body type, recording a small growth of 0.8% as just over a million changed hands.

Superminis once again took the title for most popular segment, taking a third of the market (32.3%) despite recording a 9.0% fall in volumes.

Following behind, lower mediums were the second most popular and were responsible for 26.3% of the market, but also noted a 9.6% decline.

The smallest volume segment type was luxury saloons with a 0.6% market share.

Lisa Watson, director of sales at Close Brothers Motor Finance, said: “The global chip shortage stalled the production of new cars, pushing prices of both new and used cars up significantly.

“As inflation spiralled in the latter half of the year and the cost-of-living crisis started to bite, used car transactions dipped. But the 0.8% December rise gives us reasons to be positive about the resilience of that market heading into 2023.”

Login to comment

Comments

No comments have been made yet.