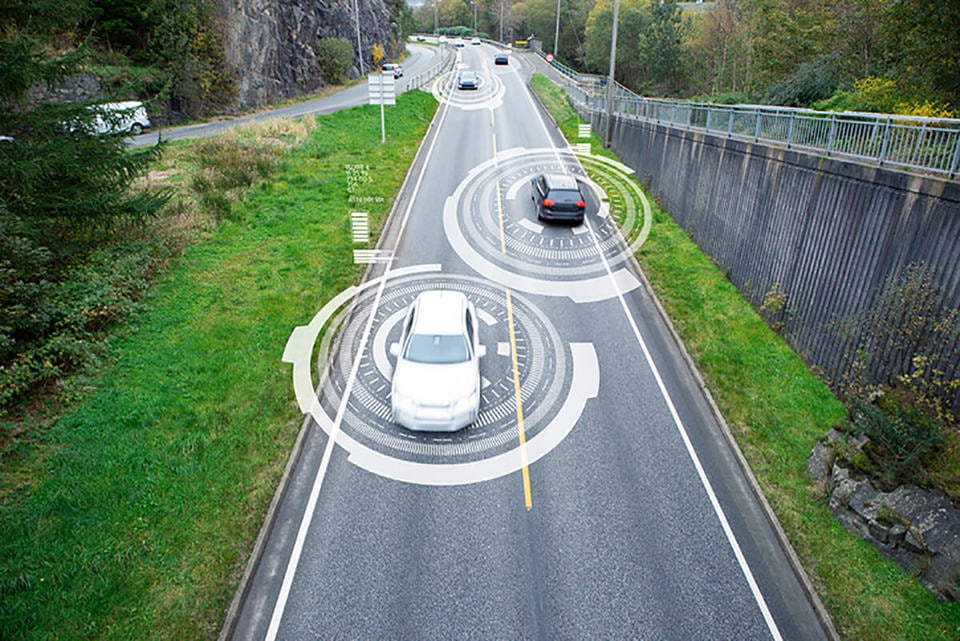

Thatcham has formed a working group with vehicle manufacturers to urgently address spiralling repair costs associated with collision avoidance advanced driver assistance systems (ADAS).

According to statistics from the Association of British Insurers (ABI) from Q3 2016, average vehicle bills have increased by 32% over the last three years to £1,678.

Andrew Miller, Thatcham chief technology officer, said that while ADAS may not account for the entire increase, it is definitely a major contributor. This is through the need for additional training and specialist equipment.

He added: “Cars are only getting more complex and the repair of sensors, cameras and automated vehicles will mean this problem will continue to grow.”

John Pryor, chairman of fleet operators association ACFO, agreed that ADAS on new vehicles is becoming an issue, with anecdotal evidence suggesting an increase in downtime and costs for fleets.

He said: “We have heard of vehicles that are off the road for longer due to the availability and complexity of parts.

“Windscreens have been a problem for some members with downtime affected due to not being able to get the right sensors, or they don’t have the right screen as there are 10 different types. It is getting crazy. The more complex cars become the more difficult this will be.”

Miller said windscreens are proving to be a particular problem, due to them having to be recalibrated after repair to make sure complex sensors and screen-mounted cameras are operating correctly.

He said: “The message is that there needs to be an open dialogue between manufacturers, fleets and insurers around this subject. We have already established a working group to discuss the cost of ADAS repairs.

“Part of the solution could be agreeing to lower pricing on parts and repairs to help stabilise the rising costs.”

While costs may be increasing, Miller said fleets should not let this put them off adopting new technologies due to the increase in safety and vehicle downtime they can provide.

He said: “The data we have seen around automatic emergency braking (AEB) is that it can help with up to a 40% reduction in frequency of front and rear crashes.”

As a result some insurers are passing on discounts to fleets that have vehicles with AEB fitted.

Miller added: “My message for fleets is that the benefits still outweigh the costs, but we are aware of the problem and we’re not sitting back. We are actively working with manufacturers to tackle the problem.”

Miller said the cost of repairs for ADAS is not currently on the minds of fleet managers when considering their choice lists, with them looking at the potential benefits rather than increased repair costs.

Pryor said it is a “fine balancing act” to choose vehicles with ADAS for the increased safety benefits but also being aware of the increased service costs they can incur.

He said: “Fleets aren’t really factoring in these costs with advanced technology, it’s more of a hidden cost as depending on the type of incident, it’s usually an insurance claim.

“Leasing companies aren’t going to want to factor this into their SMR costs because they can’t predict that you’re going to go through three windscreens over the life of the vehicle.”

Pryor suggested leasing companies could work to include an advisory price list menu that spells out the cost of replacement for different types of technologies.

He said: “Having said that, I also don’t want to trivialise the importance of this technology with safety. Of course these technologies aid much safer driving and in turn that can have a positive effect on driver safety, a reduction in risk and a potential reduction in insurance premiums.”

Jeremy Rochfort, Autoglass national sales manager, said his company has already worked to address the downtime issue with new windscreens, to make sure 96% of current vehicles can be fixed and calibrated at the roadside.

He said: “ADAS functionality is designed to make vehicles safer, so their correct operation and maintenance should reduce accident damage, ultimately also reducing overall costs.

“However, it’s important that calibration is carried out as quickly as possible, to get motorists back on the road.”

Rochfort said that while its own research shows the majority of insurers are willing to pass on premium reductions on AEB, he said they tend to take a “wait-and-see” approach on other new ADAS until the benefits are fully proven.

He said: “It’s too early to say what the impact of ADAS will be on costs but it’s likely that it will vary across the market as insurers become even more sophisticated with data, and design policies to suit the detailed needs of individual drivers and fleets.”

Mr.Bean - 28/06/2017 10:35

And no one seen this coming? The costs are only going up due to the extra equipment being fitted to the cars. Not only that, look at the number of cars being fitted with LED headlights, these cost around £800 per unit. Repair costs will only increase even for cars with very low insurance groups.