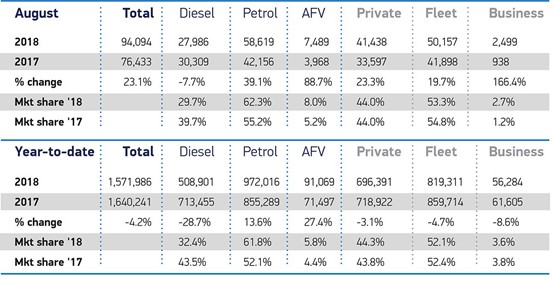

Fleet and business new car registrations were up 23% in August, compared to the same month last year, according to figures from the Society of Motor Manufacturers and Traders (SMMT).

There were 52,656 cars registered to fleet and business, with 41,438 private registrations, equating to a 56% market share.

In August 2017, almost 10,000 fewer cars (42,836 units) were registered to fleet and business.

Year-to-date however, fleet and business registrations are down by 5% (45,724 units), with 875, 595 cars registered compared to 921,319 units in the first eight months of 2017.

Overall, the new car market remains down by 4.2%, in line with forecasts after a turbulent first eight months.

Meanwhile, diesel new car registrations were down 7.7% in the month and 28.7% year-to-date.

Superminis remained the most popular buy, followed by small family and dual purpose cars, with the luxury saloon and city car segments recording the most notable growth, up 120.8% and 39.6%.

The UK’s growing range of hybrid, plug-in hybrid and pure electric cars continued to attract buyers, with demand up by a substantial 88.7%, with the sector accounting for 8% of the market.

Mike Hawes, SMMT chief executive, said: “It’s great to see such strong growth, particularly in the important electric vehicle market. However, given August is always a small month in new car registrations ahead of the important plate-change month of September, it would be wrong to view the market as booming.

“Indeed, this past month has seen some significant variances as regulatory changes have disrupted some supplies.

“In the long term, however, the new emissions certification test will give consumers renewed confidence in the performance of all vehicles, helping them choose the latest, cleanest technology that best suits their driving needs, whether that be petrol, diesel, hybrid or plug-in.”

Ashley Barnett, head of consultancy at Lex Autolease, told Fleet News that August is traditionally a weaker month for new car registrations as many drivers await the new number plate release and consumer spending is diverted over the summer.

“This year is no exception, although it is encouraging to see that the market is up compared with 2017,” said Barnett.

“It is positive to see record demand for alternatively-fuelled vehicles (AFVs), but to meet the ambitious targets set out in the government’s Road to Zero strategy, we need to build on this momentum.

“An additional 100,000 new AFVs will be needed each year between now and 2030, in order for Ultra Low Emission Vehicles to comprise 50% of new car sales.

“The UK leasing industry will play a significant role in helping to meet government targets, and is key to transitioning the 31m cars on UK roads to newer, cleaner technology – not just in the company car market, but for individual drivers too.”

Looking ahead to September, Lex Autolease is confident that the market will pick up in line with demand for the new 68 plates.

Barnett added: “Although Worldwide Harmonised Light Vehicle Test Procedure (WLTP) data will be more widely available, we do not expect this to have an impact until after the Autumn Budget, which we hope will bring much-needed clarity around vehicle taxation.”

Ian Gilmartin, head of retail and wholesale at Barclays Corporate Banking, urged caution in interpreting the figures. He said: “At first glance, the highest August new car registrations this century appear to be an extraordinary achievement, and the efforts made to secure sales over the summer shouldn’t be entirely dismissed.

“However, we need to consider this result more cautiously, as regulatory changes that came into force at the start of September led to some very generous deals being offered in August which will have brought sales forward.

“In any case, August figures can’t be used as a bellwether for the overall state of the industry. To give some context, September sales are typically five or six times bigger than August, with buyers rushing to snap up new plate models.

“All eyes will now be on next month’s data to get a better picture of where we stand and the likely overall annual performance for 2018.”

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, concluded: “An 88.7% year-on-year surge in motorists buying hybrid or electric cars marks a real milestone for the sector. One in 12 of all cars bought in August was hybrid or electric and we can see that these types of vehicles are rapidly growing their market share, which suggests that consumer demand for alternative fueled vehicles (AFVs) is gaining pace.

“August is traditionally a quieter time for new car sales, as many motorists look ahead to September’s new number plates, so the real proof will be whether this trend continues next month.

“For businesses, going green can save huge amounts of money. Our own research has found that if every van and HGV was powered by electricity, approximately £14 billion could be saved on fuel costs. While greater investment in infrastructure for AFVs is still needed, it’s hugely encouraging to see the industry adopting cleaner vehicles.”

Buckets - 05/09/2018 11:50

Don't let us kid ourselves. Dealers were under pressure to register all old stock to beat the deadline. Prices were reduced, deals all over the place and used prices might cascade over the next few weeks. Commercially, fleets have been tempted but drivers are waiting for the major news before committing themselves to paying the income tax. January will be the time to evaluate what has really happened.