Fresh inward investment in the UK automotive sector plummeted in 2018 – down almost half (46.5%) on 2017 to £588.6 million – amid fears over a ‘no deal’ Brexit, according to the Society of Motor Manufacturers and Traders (SMMT).

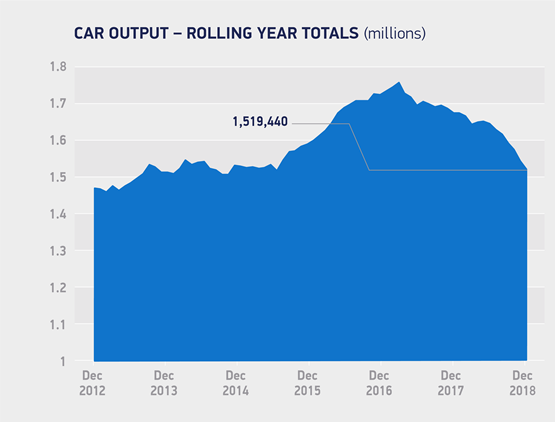

British car production also fell to its lowest level for five years in 2018, with 1,519,440 new cars leaving UK factories, a decline of 9.1% and the second consecutive annual fall.

As a result, UK automotive companies are today (Thursday, January 31) urging all politicians to do whatever it takes to avoid a ‘no deal’ Brexit ahead of March 29.

Mike Hawes, SMMT chief executive, said: “With fewer than 60 days before we leave the EU and the risk of crashing out without a deal looking increasingly real, UK Automotive is on red alert. Brexit uncertainty has already done enormous damage to output, investment and jobs.

“Yet this is nothing compared with the permanent devastation caused by severing our frictionless trade links overnight, not just with the EU but with the many other global markets with which we currently trade freely.

“Given the global headwinds, the challenges to the sector are immense. Brexit is the clear and present danger and, with thousands of jobs on the line, we urge all parties to do whatever it takes to save us from ‘no deal’.”

Exports have also been hit, with output for overseas markets dropping 7.3% as slowdowns in important European and Asian markets took effect.

UK car exports to China slumped by a quarter (24.5%), while EU demand fell by 9.6%, less steep than the decline at home, with registrations of British-built cars in the UK down 20.9% in the year.

Overall, EU27 countries still accounted for the vast majority of UK exports (52.6%) – amounting to 650,628 cars.

Elsewhere, consumers responded to increased availability of several new premium models currently built only in the UK.

Exports to the US grew 5.3%, cementing the country’s position as the UK’s second biggest customer after EU and underlining the risk to output if tariffs are imposed. Meanwhile, exports to Japan rose 26% and South Korea also showed growth (23.5%).

Both countries, along with other key markets, including Canada and Turkey, are (or will imminently become) subject to preferential EU trade agreements, from which the UK benefits – together representing 15.7% of UK car exports.

Time has almost run out to guarantee continuity of any of these arrangements before Brexit, and ‘no deal’ could therefore put more than two thirds of UK Automotive’s global trade under threat, claims the SMMT.

The decline in UK car manufacturing in 2017 and 2018, it said, follows seven years of unprecedented growth for the sector as it emerged from recession faster than any other major EU market, with output rising more than 70% in that time.

Today, UK Automotive is Britain’s biggest exporter in goods, and one of the country’s most important economic pillars, employing 186,000 people directly in vehicle and component factories and delivering an annual £20.2 billion direct to the Treasury.

Much of this success is due to its global competitiveness, drawn from economic and political stability, investment, a highly skilled workforce and beneficial trading conditions with our biggest markets.

As a highly-integrated sector that has maximised the benefits of the European single market and customs union, a ‘no-deal’ Brexit is the most significant threat to the competitiveness of the UK automotive sector in a generation, said the SMMT.

Stuart Apperley, director and head of UK automotive at Lloyds Bank Commercial Banking, believes the figures show that UK carmakers are facing a number of risks.

“Many depend on frictionless trade, and manufacturers will fear anything that disrupts that, but slowing sales in China, Europe and the UK are arguably a more immediate threat,” he said.

“The potential for US tariffs on imports of European cars could also have a detrimental impact on those UK firms that make models and parts for the US market.

“Without strong sales of their existing models, carmakers will find it difficult to invest in the technology that will one day power electric and autonomous vehicles.

“With governments around the world stalling on giving strong backing for diesel in particular, consumers and businesses are parking their investment decisions too.

“While some of the headwinds carmakers are facing are cyclical, manufacturers would certainly welcome a little certainty about either their future trading relationships or the future of diesel.”

Justin Benson, head of automotive at KPMG UK, also believes such a significant fall in volume is a major cause for concern to the automotive industry and together with a 20 per cent reduction in December 2018, compared to December 2017, the trend appears to be worsening.

"Consumer confidence is vital for a vibrant automotive sector in the UK, as is investment, which is why significant reductions in investment over the last few years are extremely worrying," he said.

“Global automotive manufacturers look for the right business environment to invest in and there has been too much uncertainty to provide the confidence to invest at the levels that the industry needs for new models to be made in the UK.

"With 80% of vehicles made in the UK produced for export, the UK’s carmakers are desperate for clarity on future trading arrangements if they are to reignite the confidence of overseas headquarters to invest in the UK again.”

James Barrington-Binns - 31/01/2019 11:31

Another completely unsubstantiated project fear announcement on behalf of the UK government. There are a few contributing factors that might well be down to the uncertainty of the impending leave date but filter out the rubbish and scaremongering and you will find that the whole world trading markets / economies are changing and its this that is having the biggest impact on the fleet sector in the UK and Europe, not Brexit.