New car registrations took another blow in May, as the Coronavirus pandemic continues to cripple the car industry.

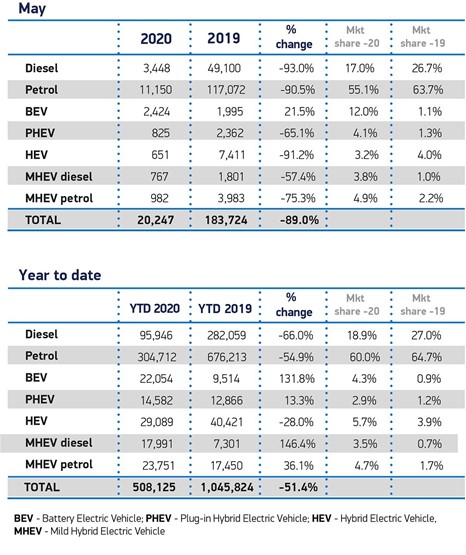

A little more than 20,000 vehicles were registered last month. While this represents an improvement on the 4,300 registered in April, it is still a decline of 89% on May 2019.

Figures from the Society of Motor Manufacturers and Traders (SMMT) show the fleet and business sector was the hardest hit with 7,347 registrations, a reduction of 93%.

Michael Woodward, UK automotive lead at Deloitte, said: “Prior to COVID-19 fleet sales far outstripped private sales, but this month private sales made up 64% of total sales. An uptick in business confidence will hopefully see companies invest in their car fleets again and return sales to pre-COVID levels.”

Private car sales achieved 12,900 registrations in May, driven by the industry’s move towards “click and collect” car sales.

There were severe declines across all segments and fuel types, apart from battery electric vehicles, with 429 more units registered year on year as pre-orders of the latest premium models were delivered to customers.

The overall market is now down -51.4% in the first five months of 2020, at just over half a million registrations compared with more than one million at this point last year. The news comes in the week that car showrooms in England were given the green light to re-open following more than two months of lost trading. In Scotland, Wales and Northern Ireland (until next week), however, car showrooms remain closed.

Mike Hawes, SMMT chief executive, said, “After a second month of shutdown and the inevitable yet devastating impact on the market, this week’s re-opening of dealerships is a pivotal moment for the entire industry and the thousands of people whose jobs depend on it. Customers keen to trade up into the latest, cutting-edge new cars are now able to return to showrooms and early reports suggest there is good business given the circumstances, although it is far too early to tell how demand will pan out over the coming weeks and months.

“Restarting this market is a crucial first step in driving the recovery of Britain’s critical car manufacturers and supply chain, and to supporting the wider economy. Ensuring people have the confidence to invest in the latest vehicles will not only help them get on the move safely, but these new models will also help address some of the environmental challenges the UK faces in the long term.”

Andrew Burn, partner and head of automotive at KPMG, said registration figures were "unsurprising", with year-on-year reductions broadly in line with those seen in Europe at a comparable time during Covid-19 lockdowns.

“In reality, all eyes should be on June’s results as this data will give us a greater indication of the speed at which the UK’s car market could return to healthier levels," he said.

"As we start to see more data, it will become more evident whether consumer demand has changed, as it is currently too soon to tell.

"What will also be telling is whether consumers see lead times as having greater importance in their buying decisions, or whether Covid-19 has driven a change in consumer behaviour, with more leaning towards less expensive, more economical cars."

He continued: “What is worthy of note is that electric vehicles and alternative fuel vehicles have faired better in these results. However, this may be due to pre-Covid-19 orders being fulfilled as typically lead times for these vehicles are longer."

The Tesla Model 3 was the best selling car in May, with more than 800 registrations. Ford's Fiesta, which usually tops the chart, slipped to third place this month with 760 registrations.

James Fairclough, CEO of AA Cars, added: “There are encouraging signs for the industry that latent demand has been building during the lockdown period and boosted by people who usually commute by public transport, now considering the purchase of a car.

“In the last few weeks we have seen a really positive shift in consumer interest on the AA Cars platform, with a 71% month-on-month increase in views of used cars for sale. We’ve also seen requests for car finance jump by 134% compared to April, suggesting that interest is translating into intent to purchase. These are the glimmers of hope to be optimistic about.

“At the same time, the financial uncertainty caused by the lockdown means there is no guarantee that new car sales will recover straight away. Many people have either eaten into their savings due to reduced levels of income or still face significant uncertainty about their future job security, potentially putting the brakes on any decision to make a high-value purchase, or a long-term financial commitment.

“For those in a position to buy, dealership discounts and special offers are likely to be widely available, providing consumers with an incentive to purchase now.”

Login to comment

Comments

No comments have been made yet.