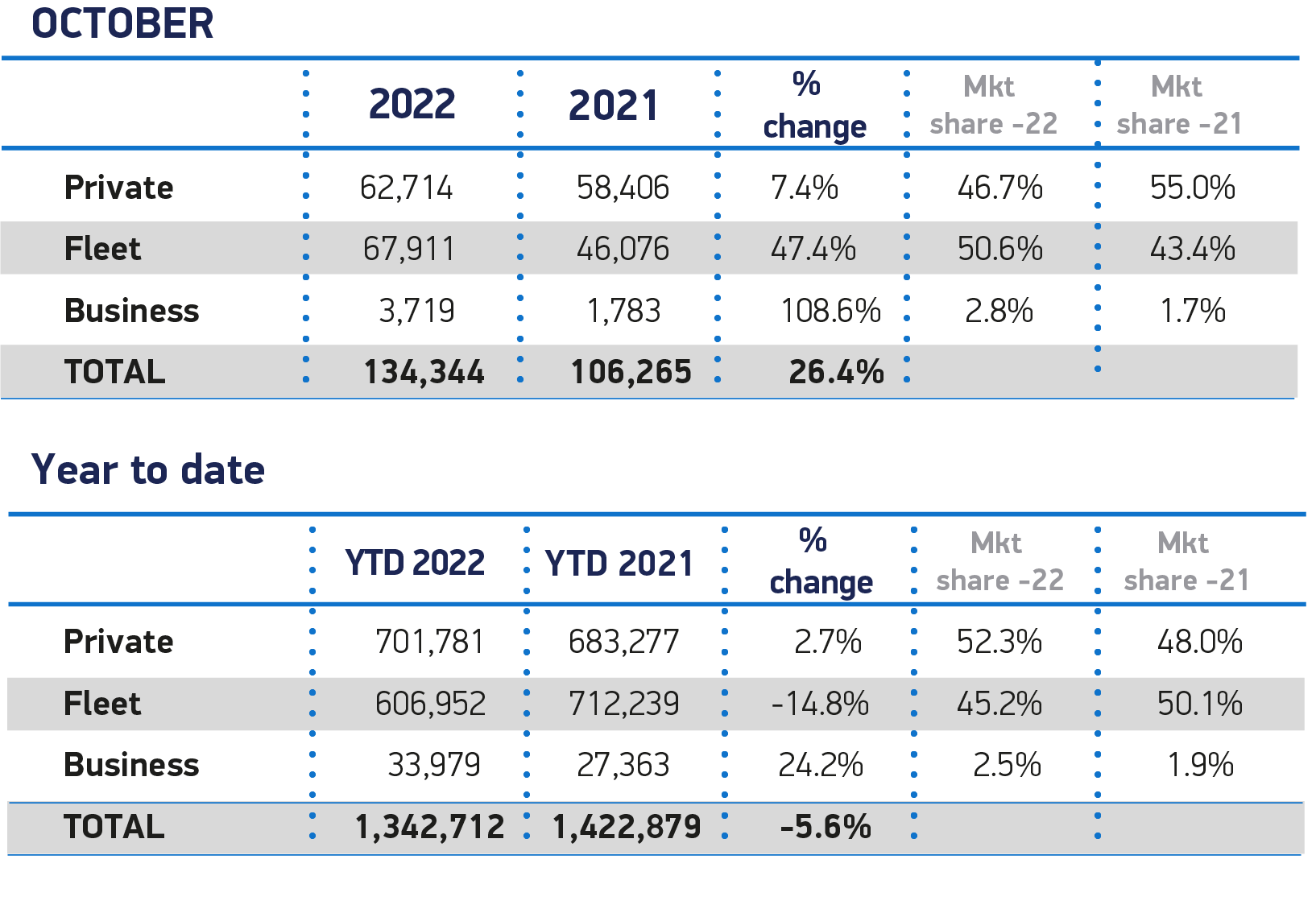

Fleet and business new car registrations were up by 49% – 23,771 units – in October compared to the same month last year, according to the latest sales figures published by the Society of Motor Manufacturers and Traders (SMMT).

There were 71,630 new company cars registered in the month, compared to 62,714 private sales, with fleet and business accounting for 53.4% of the market.

Year-to-date, fleet and business new car registrations are still down, however, with almost 641,000 new cars registered, compared to nearly 740,000 over the same period last year – a 13% decline.

Overall, the UK new car market recorded a third month of growth in October, with registrations rising by more than a quarter (26.4%).

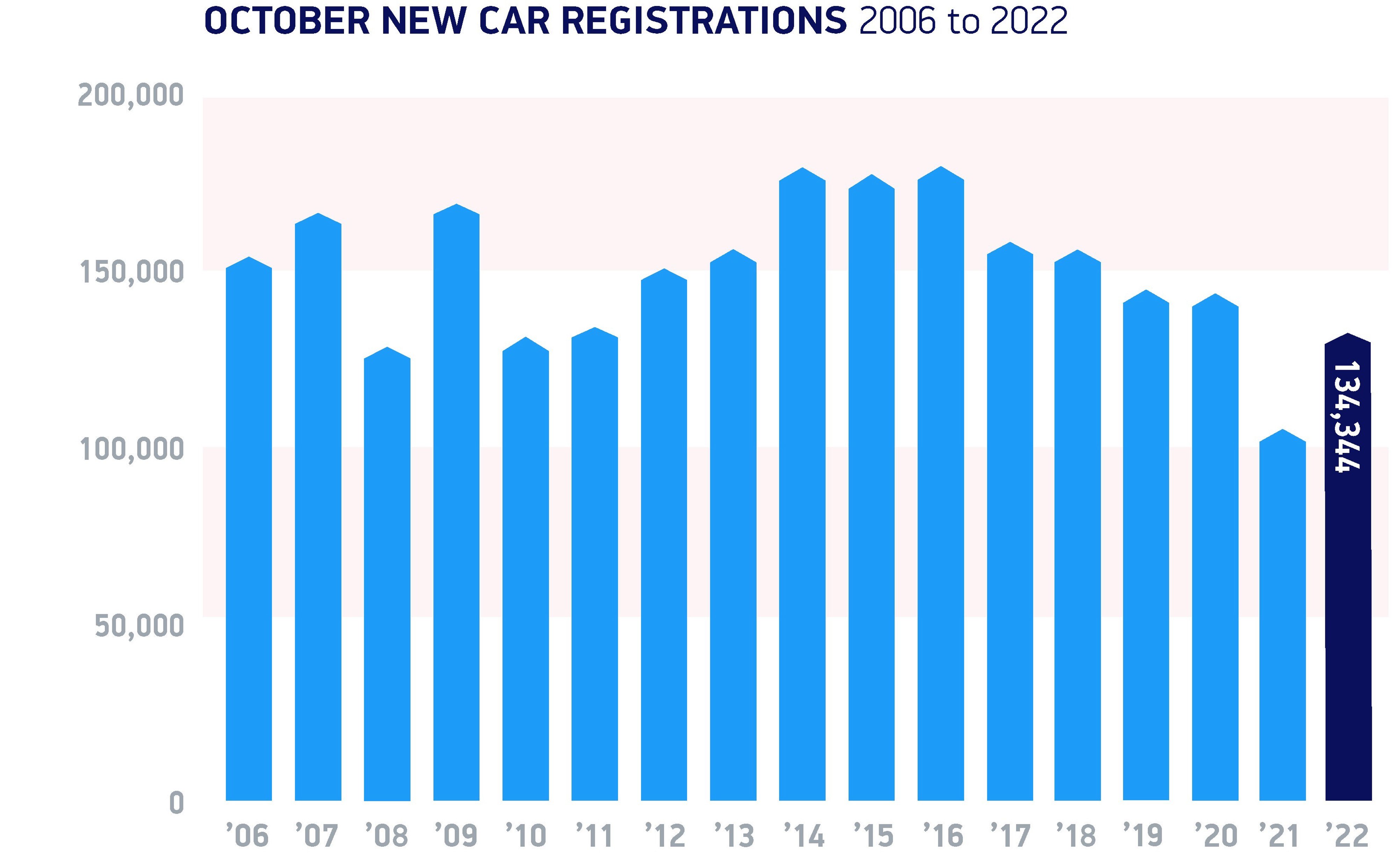

Fulfilment of strong order books helped deliver the bounce-back, although the increase follows a particularly disappointing October 2021 when deliveries fell by almost a quarter.

Year-to-date, the UK new car market is down 5.6% on the same period in 2021, but still a third below pre-Covid levels.

Mike Hawes, SMMT Chief Executive, said, “A strong October is hugely welcome, albeit in comparison with a weak 2021, but it is still not enough to offset the damage done by the pandemic and subsequent supply shortages.

Mike Hawes, SMMT Chief Executive, said, “A strong October is hugely welcome, albeit in comparison with a weak 2021, but it is still not enough to offset the damage done by the pandemic and subsequent supply shortages.

“Next year’s outlook shows recovery is possible and EV growth looks set to continue but, to achieve our shared net zero goals, that growth must accelerate and consumers given every reason to invest.

“This means giving them the economic stability and confidence to make the switch, safe in the knowledge they will be able to charge – and charge affordably – when needed. The models are there, with more still to come; so must the public charge points.”

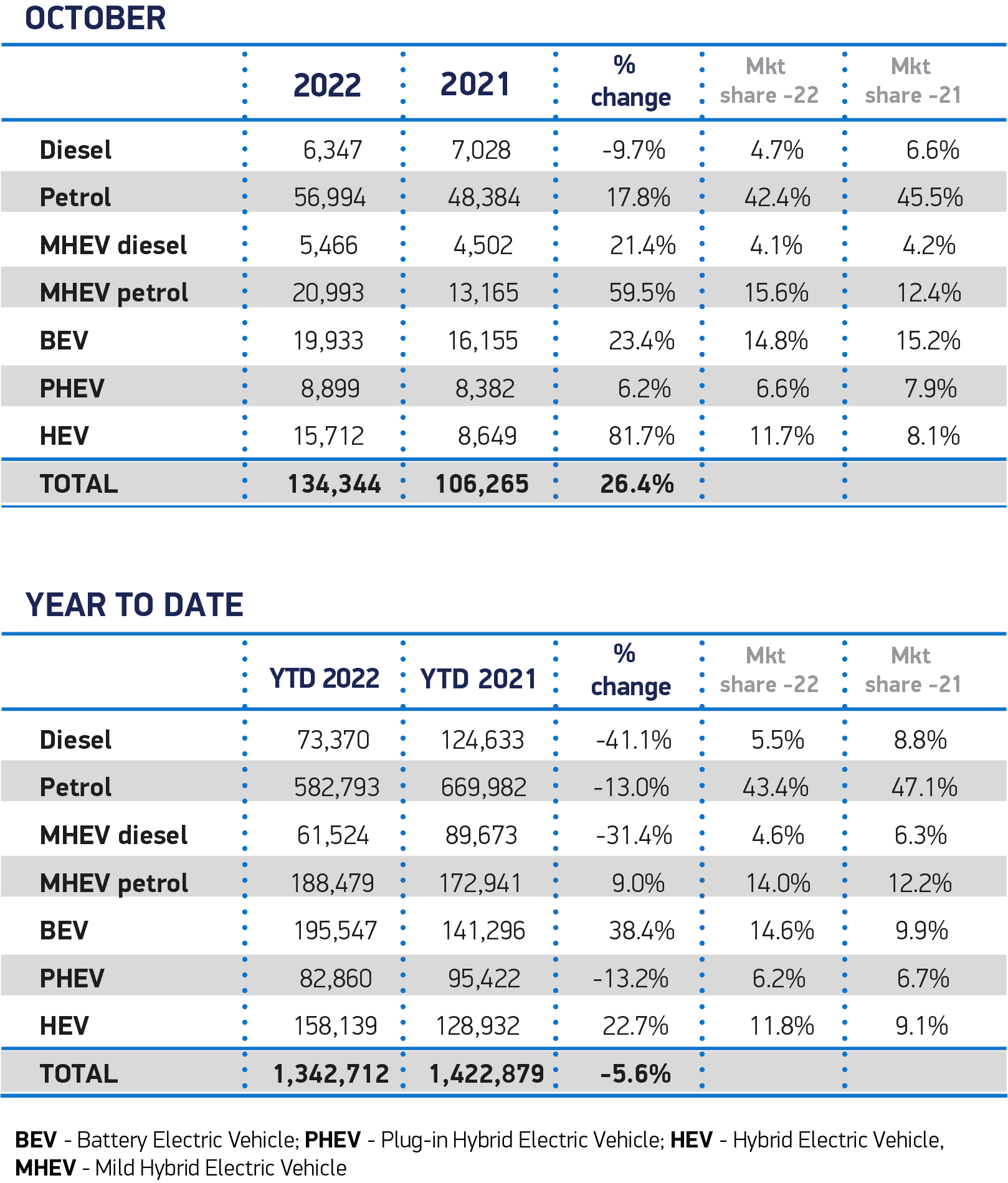

Zero emission capable car deliveries continued to grow in volume, with battery electric vehicle (BEV) registrations increasing by 23.4% to 19,933 and plug-in hybrids (PHEVs) by 6.2% to 8,899.

However, BEV uptake grew by less than the overall market for the first time since the pandemic, meaning October is the first month to see BEV market share fall year on year since May 2021, primarily down to supply challenges.

Deliveries of hybrid electric vehicles (HEVs), meanwhile, rocketed 81.7% to account for more than one in 10 new cars, as supply was prioritised for a raft of popular new models.

Overall, electrified vehicles accounted for one in three registrations, while more than a fifth (21.5%) came with a plug.

Meryem Brassington, electrification propositions lead at Lex Autolease, said: “The figures demonstrate real sustained progress along the UK’s electrification journey and paint a promising picture for achieving net zero.

“However, supply chain issues and economic uncertainty continue to present challenges for the market.

“To ensure that the momentum we have built doesn’t stall, fleet managers must be given the confidence they need to make the switch to electric.

“All eyes will be on the Chancellor’s autumn statement this month in the hope that he will provide a long-awaited update on company car tax tables beyond 2025 to give businesses the cost clarity to make long-term decisions.”

Jon Lawes, managing director of Novuna Vehicle Solutions, says that with the cost-of-living crisis intensifying and a recession now all but imminent, the industry faces "tough months ahead".

“For all of the immediate priorities the Chancellor has to grapple with in the upcoming Autumn Statement, it’s imperative the Government remains steadfast in its conviction to support the transition to zero emission mobility by accelerating the rollout of EV charging infrastructure and finally providing much needed clarity for corporate fleets on BIK rates beyond 2025,” he added.

Ongoing supply chain shortages, surging inflation and a growing cost of living crisis have led to a 2.2% downward revision of the market outlook for the year, with 1.566 million registrations now anticipated. This puts 2022 on course to be the market’s toughest year since 1982.

More positively, demand for electric vehicles is anticipated to result in a plug-in market share of 21.9%. Overall market recovery is anticipated to continue through 2023, with an outlook of 1.808 million units and plug-ins accounting for 26.7% of registrations next year.

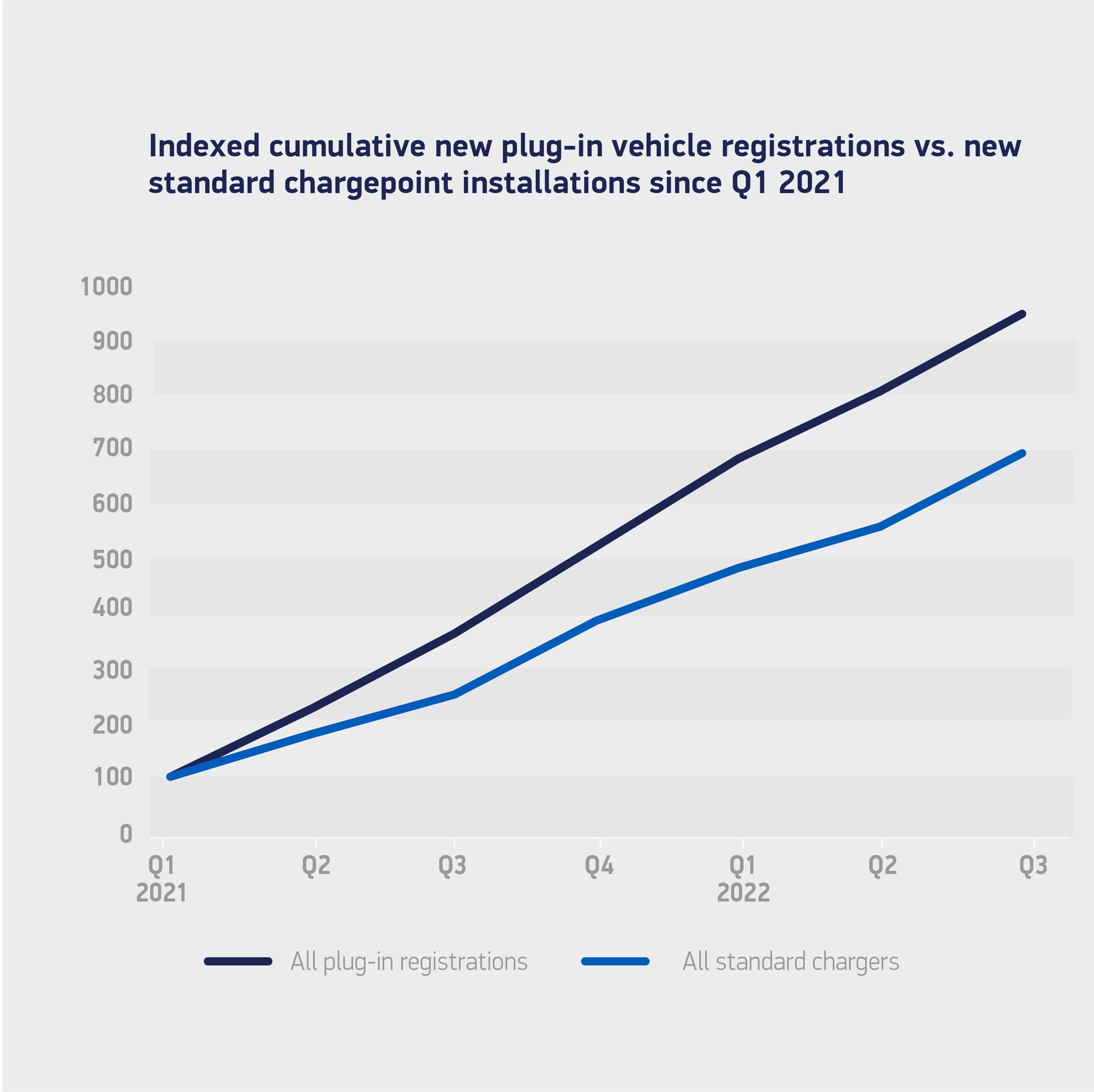

Such growth underlines the importance of increasing public charge point provision, says the SMMT.

At the start of October 2022, the UK had 34,637 public standard, rapid and ultra-rapid electric vehicle charging devices, with 1,239 new rapid chargers and 5,023 new standard chargers installed during the first nine months of the year.

With 249,575 new plug-in registrations during the same period, just one new standard public charger has been installed for every 50 new plug-in EV registrations.

At this rate, it is unlikely that government’s ambition for 300,000 public chargers by 2030 will be met, says the SMMT.

Chris Knight, UK automotive partner at KPMG, said: “The order books for manufacturers remain strong, particularly for EVs, with long wait times still in place for new vehicles - reflecting the importance consumers place in having a new car.

“However, rising interest rates are impacting monthly repayment costs and inflation is putting pressure on manufacturers to raise prices.

“With an expensive winter looming, many consumers are reassessing or pausing new car purchase decisions.

“With more consumers having to be led by price, some car makers feel there is a market space to be seized upon – including manufacturers from the east moving into western car markets, particularly hoping to secure lower-cost electric vehicle market share.”

Login to comment

Comments

No comments have been made yet.