Fleet and business new car registrations were up by more than a third in January compared to the start of last year, newly published sales data suggests.

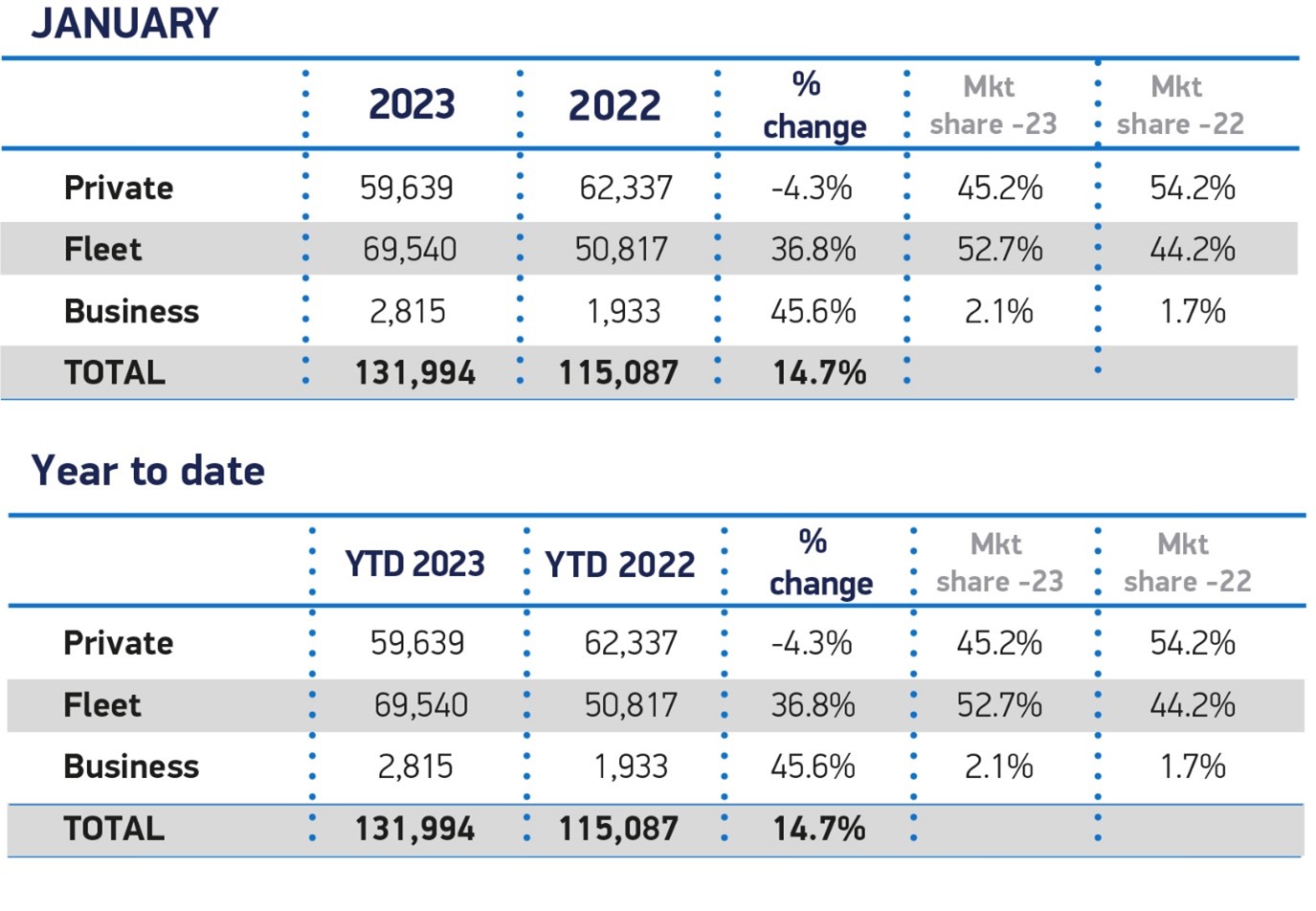

The figures, from the Society of Motor Manufacturers and Traders (SMMT), show that 72,355 new company cars were registered to fleet and business last month – 37% more than the 52,750 units in January 2022.

Overall, 131,994 new cars were registered during the month – a 14.7% year-on-year increase, with fleet and business sales equating to 55% of the market.

It was the best start to the year since January 2020’s pre-Covid 149,279 units and marks the sixth successive month of expansion.

The strong start to the year is mirrored in the latest market outlook, which anticipates 1.79 million new car registrations in 2023, an 11.1% increase on the past year but still well below 2019 levels.

This also represents a -0.8% reduction on October’s outlook, against a weak economic backdrop.

However, a further 9.3% increase is expected next year, with 1.96 million new cars expected to join the road in 2024.

SMMT chief executive, Mike Hawes, said: “The automotive industry is already delivering growth that bucks the national trend and is poised, with the right framework, to accelerate the decarbonisation of the UK economy.

“The industry and market are in transition, but fragile due to a challenging economic outlook, rising living costs and consumer anxiety over new technology.

“We look to a Budget that will reaffirm the commitment to net zero and provide measures that drive green growth for the sector and the nation.”

Jon Lawes, managing director of Novuna Vehicle Solutions, believes there is “cautious optimism” within the industry for a sustained upturn over the coming months, with a gradual easing of supply chain shortages.

However, he said: “Maintaining this momentum relies heavily on increased Government-led intervention to prioritise an exponential growth in the rollout of public charge points, to match the demand for EVs, and clarity for the industry, on its commitment to introduce a ZEV mandate.

“Without this, the Government’s ambition to realise an EV revolution by 2030 frankly looks implausible.”

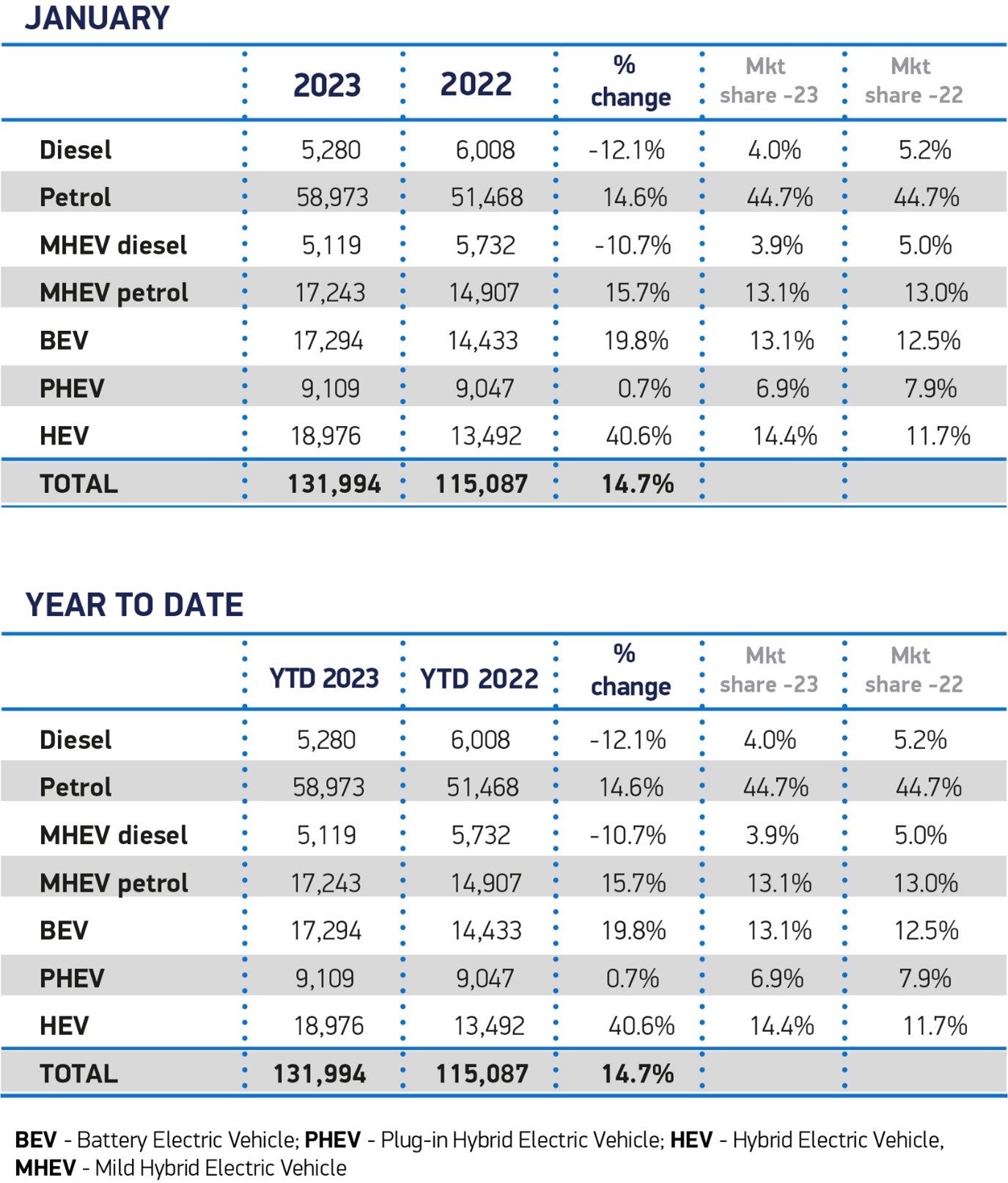

Electric vehicles (EVs) helped drive the increase. Hybrid electric vehicles (HEVs) comprised 14.4% of new car registrations, increasing volumes by 40.6%.

Meanwhile, battery electric vehicle (BEV) registrations rose 19.8% to reach 17,294 units, or 13.1% of new registrations – slightly below the average recorded for 2022.

Plug-in hybrid vehicles (PHEVs) recorded a 0.7% rise, although their share fell to 6.9% of new cars reaching the road.

As a result, one in five new cars registered in the month came with a plug.

Plug-ins are anticipated to comprise of more than one in four new registrations this year, representing growth of 32.1% or approximately 487,140 units, and almost a third (31%) of the market in 2024 at 607,150 units.

However, the SMMT says that the rollout of infrastructure needed to charge them is failing to keep pace.

During Q4 2022, the ratio of new charge point installations to new plug-in car registrations dropped to one for every 62 – a significant fall compared with the same quarter last year, when the ratio was 1:42, it says.

As a result, in 2022, one standard public charger was installed for every 53 new plug-in cars registered, the weakest ratio since 2020.

Mandating rollout targets for infrastructure and regulating service standards would, SMMT argues, give drivers certainty they can always find a working, available charger.

Infrastructure must be built ahead of demand else poor provision risks delaying the electric transition, it says.

More immediately, the SMMT hopes that the upcoming Budget provides an opportunity to implement measures that support the transition.

Reducing VAT on public charge point use from 20% to 5% in line with home charging would ensure more affordable access for all and underpin a fair net zero transition, it says.

Government should also review proposals to graft a Vehicle Excise Duty (VED) regime designed for fossil fuel cars onto zero emission vehicles (ZEVs).

The higher production costs associated with electric vehicles means that currently more than half of all available BEVs would be subject to the expensive car supplement due to apply to ZEVs from 2025.

While it is right that all drivers pay their fair share, the SMMT says that existing plans would unfairly penalise those making the switch, and risk disincentivising the market at the time when EV uptake should be encouraged.

Government should also tackle other fiscal blocks to uptake by raising recommended business mileage rates, added the SMMT.

Nick Williams, transport managing director at Lloyds Banking Group says to make an electric dream a reality for more drivers this year “we need to see continued investment and incentives from policymakers”.

“This includes rapidly expanding the nationwide rollout of charging points – which, at its current rate, is one of the biggest hurdles to widespread EV ownership," he said.

“The increases we’re seeing in new EV registrations are promising, but our infrastructure must be able to support them – only then will the UK be able to truly deliver on its ambition to be a global leader in the electrification of transport.”

Kim Royds, EV director at British Gas, added: “Maintaining the momentum in the number of EVs arriving on UK roads is not going to be an easy ride without boosting the levels of investment in the charging network.

“It is vital that the Government increases the pace at which public chargers are being installed across the country. What’s more, it needs to work with organisations and public authorities to maintain these services, and ensure they are accessible to those without off-street parking that need them the most.

“Ultimately, we need drivers to have the confidence that there are enough charge points for them to use if the UK’s EV revolution is to gather pace.

“If not, we may see a tipping point where the supply of vehicles outstrips the number of chargers available, stalling the good progress that has already been made.”

Login to comment

Comments

No comments have been made yet.