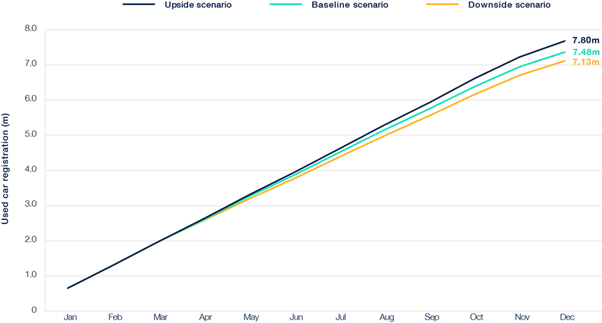

The UK used car market is projected to see only modest growth in the coming years, with transactions expected to rise from 7.4 million in 2024 to just under 7.9 million by 2027, according to the latest analysis from Cox Automotive.

Baseline projections for 2025, shared in Cox Automotive’s Insight Quarterly (IQ), indicate 7,458,356 used car transactions, a marginal 0.3% increase on 2024 levels.

This subdued trajectory highlights a market still lagging behind pre-pandemic trends and constrained by economic pressures and ongoing supply limitations.

Cox Automotive’s 2024 baseline accuracy (until the end of Q3) has tracked at 96.7% and 99.6% for its upside forecast.

“Demand for used vehicles remains stable, but the UK car parc is contracting, and overall vehicle registrations and transactions continue to fall short of peak levels seen from 2002-2008 and 2014-2019,” says Cox Automotive Insight Director, Philip Nothard.

He continues: “Our forecast highlights the enduring appeal of used vehicles but also emphasises the reality that this sector, like much of the broader automotive market, faces ongoing pressures as consumer priorities shift and the vehicle landscape continues to adapt.”

The influence of zero emission vehicles

The market’s evolving landscape is heavily influenced by increasing numbers of new energy vehicles (NEVs) along with changing production strategies among original equipment manufacturers (OEMs).

With more OEMs prioritising NEVs, the availability of traditional internal combustion engine (ICE) vehicles is expected to gradually decline.

Nothard says there is still a long way to go in bringing more dealers onboard to stock EVs, but those that have become early adopters are seeing certain models holding their value and even moving faster out the forecourts than some of their ICE equivalents.

In line with this, the forecast shows also predicts significant growth in NEV adoption within the used market, with battery electric vehicles (BEVs) increasing their share of transactions by over 50% in early 2024.

Despite this growth, ICE vehicles still dominate, especially given consumer concerns around EV charging infrastructure and affordability. However, BEV registrations in the used market are expected to grow from 21% to 34% by 2027, indicating a slow but steady shift in consumer preferences.

While the used car market is seeing gradual growth, it remains constrained by current economic conditions.

Modest declines in UK interest rates are expected over the next few years, though inflation remains above historical averages, limiting consumer purchasing power.

As a result, affordability will be a primary factor shaping consumer decisions, with many buyers viewing used cars as a more financially viable alternative to higher-priced new vehicles.

“Our data suggest economic pressures will continue to influence consumer behaviour,” Nothard explains.

“While new car prices rise, affordability concerns and a strong demand for lower-cost alternatives are likely to keep used car sales steady. With ongoing supply constraints and a shrinking car parc, we expect vehicle values for certain in-demand segments, particularly ICE, to remain high.”

UK car park to decline by nearly 5% over next three years

Over the next three years, the UK’s car parc is expected to decline by around 4.47%.

This shift presents new challenges for a sector that must balance dwindling ICE inventory with the growing demand for used EVs. As OEMs pivot to producing fewer ICE models, consumers may face fewer choices within the traditional fuel category, driving competition for high-quality used vehicles.

Cox Automotive’s data indicate a critical tipping point for the UK used car market by 2027.

The supply chain challenges brought about by the pandemic, which reduced new car registrations by over three million, have permanently affected the composition of the used car parc.

Now, as economic conditions stabilise and new vehicle supply becomes more consistent, the used market faces ongoing changes.

While UK used car transactions fell 12% between 2020 and 2023 compared to 2016-2019, forecasts suggest a gradual return to pre-pandemic levels by 2027. As NEV options become more accessible and consumer interest continues to build, demand for used cars of all types is likely to remain strong.

“The affordability and appeal of used cars will play a central role in the UK’s transition to an electrified future,” notes Nothard.

“The market is evolving, but the sector’s resilience is clear.

"Those in the sector who proactively adjust to shifting consumer preferences and stock needs will be well-positioned to thrive in a transformative market. But it certainly won’t be plain sailing ahead.”

Used market remains strong in November despite Budget concerns

Meanwhile, Cap HPI has added further context around used car market developements, with its latest data showing the market outperformed the seasonal norms in November, despite concerns about the Budget and disruption to the availability of vehicle finance.

The value of an average three-year-old vehicle with 60,000 miles decreased by 1.6%, equating to approximately £280. Since the introduction of Cap Live in 2012, the average movement into December has been a reduction of 2.1%.

Notably, movements have outperformed the seasonal average every month of 2024, emphasising the market's robustness this year.

Chris Plumb, head of current car valuation at Cap HPI, says: “November has proven to be an intriguing month for the used car retail sector, as several potential headwinds loomed, threatening to disrupt business activity.

"The combination of half-term holidays, the Autumn Budget announcement and a pivotal court ruling on undisclosed commission payments created a challenging and uncertain backdrop for the market.

“The autumn Budget generated initial concern about its potential impact on consumers. However, the immediate fallout appeared limited.”

Values for one-year-old vehicles decreased by 1.3%, equivalent to approximately £400. Five-year-old examples saw a reduction of 1.6%, or around £200, while 10-year-old vehicles experienced a modest decline of 1.6%, equating to approximately £70.

The weakest sectors at the three-year point remain convertibles and coupe cabriolets, with reductions of 3.5%, approximately £740, and 4%, around £640, respectively.

Of the mainstream sectors, city cars saw the largest drop at the three-year point, with values down 1.9%, equivalent to £150.

Large executive vehicle sector shows resilience

The Large executive sector emerged as the best-performing category at the three-year mark, recording only a modest drop of 0.3% or £130.

Over half of the vehicles in this sector experienced no adjustment to values. The BMW 7 Series, in both petrol and hybrid variants, stood out with a 2% increase, adding between £600 and £680 to used values.

SUVs now account for one-third of all vehicle sales data, rising to 60% for models up to three years old.

The average value decline for SUVs at this age is 1.7%, translating to a £300 decrease.

Large SUVs show the least reduction at 0.6% (£190), while small and medium SUVs face greater declines of 2.1% (£255) and 1.9% (£350), respectively

Both petrol and diesel vehicles recorded the largest reductions at the three-year point, with declines of 1.7%, equivalent to £300.

Plug-in hybrid electric vehicles (PHEV) saw a decrease of 1.3% (£280), while hybrid electric vehicles performed best, with only a very slight drop of 0.7% (£100).

After leading the market for two consecutive months, BEV dropped to the second best-performing fuel type in November, with an average drop of 0.9% (£180).

Plumb concludes: “BEV sold volumes have continued to rise sharply, with year-to-date figures up 175% on 2023 and 370% on 2022.

"October set a new record for the highest volume of used BEVs sold in a single month, surpassing the previous peak in July.

"For vehicles up to three years old, BEVs now account for 14% of sold data, making them the second-largest fuel type after petrol, which holds a 60% share.

“November's movements reflect a continued return to typical seasonal declines despite the presence of various factors that could have negatively impacted the market.

"The used car sector has demonstrated remarkable resilience as 2024 approaches its conclusion.”

Login to comment

Comments

No comments have been made yet.