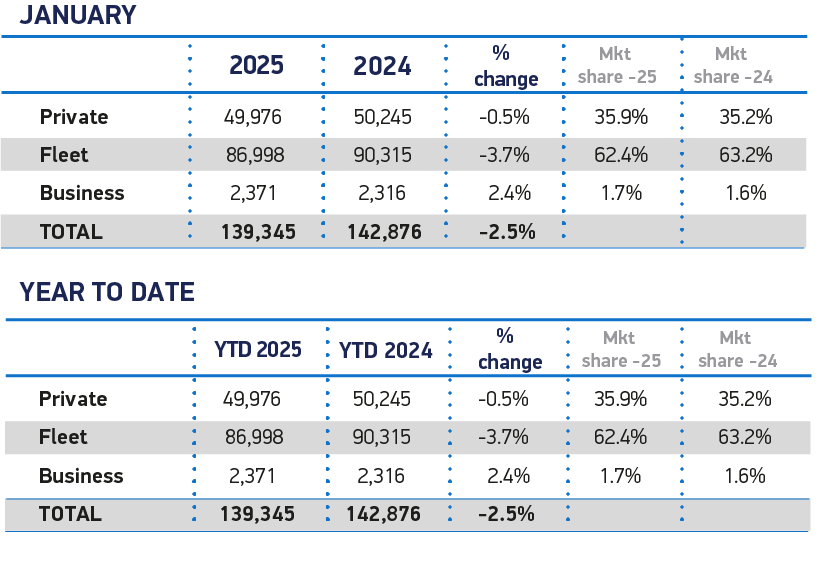

Fleet and business new car registrations fell by 3.5% year-on-year, according to new data published by the Society of Motor Manufacturers and Traders (SMMT).

There were 89,369 new cars registered to fleet and business in January, some 3,262 fewer vehicles than were reported in the same month last year.

However, with SMMT figures showing that, overall, 139,345 new cars were registered in the UK, fleet and business accounted for 64% of the market, virtually the same year-on-year.

Meanwhile, a year-on-year decline of just 0.5% in private sales meant that total new car registrations fell by just 2.5%.

In terms of fuel types, petrol new car registrations dropped by 15.3% to comprise just over half (50.3%) the market, with diesel down 7.7% to claim a 6.2% share.

Both hybrid electric vehicles (HEVs) and plug-in hybrids (PHEVs) recorded volume growth and saw their market shares rise to 13.2% and 9.0%, respectively.

Battery electric vehicle (BEV) registrations, meanwhile, continued recent growth trends, with volumes up by 41.6% year on year to take a 21.3% market share.

Despite the increase in the month, BEV market share still remains short of the 22% target set by Government for last year, and even further behind the 28% requirement for 2025.

This gap between demand and ambition is why the review of the Vehicle Emissions Trading Scheme and its flexibilities is essential and must deliver meaningful changes urgently, else there will likely be significant negative consequences for the market, industry and, potentially, the consumer, says SMMT.

It believes that private retail buyers still lack a meaningful fiscal incentive to buy an EV and, moreover, the application of the Vehicle Excise Duty (VED) expensive car supplement (ECS) to BEVs in just two months comes at the worst time for the industry.

It means EV models costing more than £40,000 – the majority on the market, given higher production costs – will incur a £3,110 tax bill over the first six years of ownership – compared with zero at present.

The change, it argues, will impact both the new and used car markets, undermining the goal of a mass market transition. As a result, the industry is calling for tax plans to be revised to ensure the system is fair and avoids dissuading those who want to buy an EV.

Mike Hawes, SMMT chief executive, said: “January’s figures show EV demand is growing – but not fast enough to deliver on current ambitions.

“Affordability remains a major barrier to uptake, hence the need for compelling measures to boost demand, and not just from manufacturers.

“The application, therefore, of the expensive car Supplement to VED on electric vehicles is the wrong measure at the wrong time.

“Rather than penalising EV buyers, we should be taking every step to encourage more drivers to make the switch, helping meet Government, industry and societal climate change goals.”

The threshold for the ECS – dubbed the ‘luxury car tax’ when launched – has remained unchanged at £40,000 since it was set eight years ago, when the overall market was 30% larger than today and BEVs barely featured.

With more than twice as many BEVs registered this January than in the whole of 2017, raising the eligibility threshold for EVs – or exempting them from the ECS entirely – would send the message that EVs are essentials, not luxuries, and ensure vehicle taxation remains fair and appropriate for today’s market conditions, says the SMMT.

The latest market outlook anticipates the new car market declining slightly in 2025 by 0.2% to 1.95 million units, with BEV uptake rising by 20.9% to 462,000 – a 23.7% market share, but still short of the mandated 28% target for the year.

The gap is anticipated to widen in 2026, when BEVs are expected to comprise 28.3% against a target of 33%.

The SMMT says that the growing disparity between market demand and regulated targets further underscores the need for substantive market incentives that match ambition.

Jon Lawes, managing director of Novuna Vehicle Solutions, welcomed the rise in EV registrations but argues that manufacturers remain in limbo over the zero emission vehicle (ZEV) mandate, which requires a 45% increase in EV sales over the previous year.

Moreover, he said: “Escalating trade tensions, particularly the threat of tariffs from the United States, risk inflating costs and stalling momentum in EV adoption and potentially igniting a trade war that could have damaging effects on both sides.

“With so many uncertainties and trade disputes looming, the Government must set out a clear industrial and trade strategy—one that fosters long-term growth rather than relying on short-term fixes.”

Nick Williams, managing director of Lex Autolease, part of Lloyds Banking Group, added: “Manufacturers will be buoyed by steady growth in electric vehicle registrations and the emergence of the UK as Europe’s biggest market for EV sales in 2024.

“However, more needs to be done to boost consumer confidence in EV technology and range levels, as well as the country’s ability to meet its ambitious targets.

“We need a concerted effort to meet the country’s ZEV mandate, with dealers, manufacturers and government pulling together to reinforce the benefits of electric vehicles, dispel myths and help divers find the right hybrid or fully electric vehicles to meet their needs.”

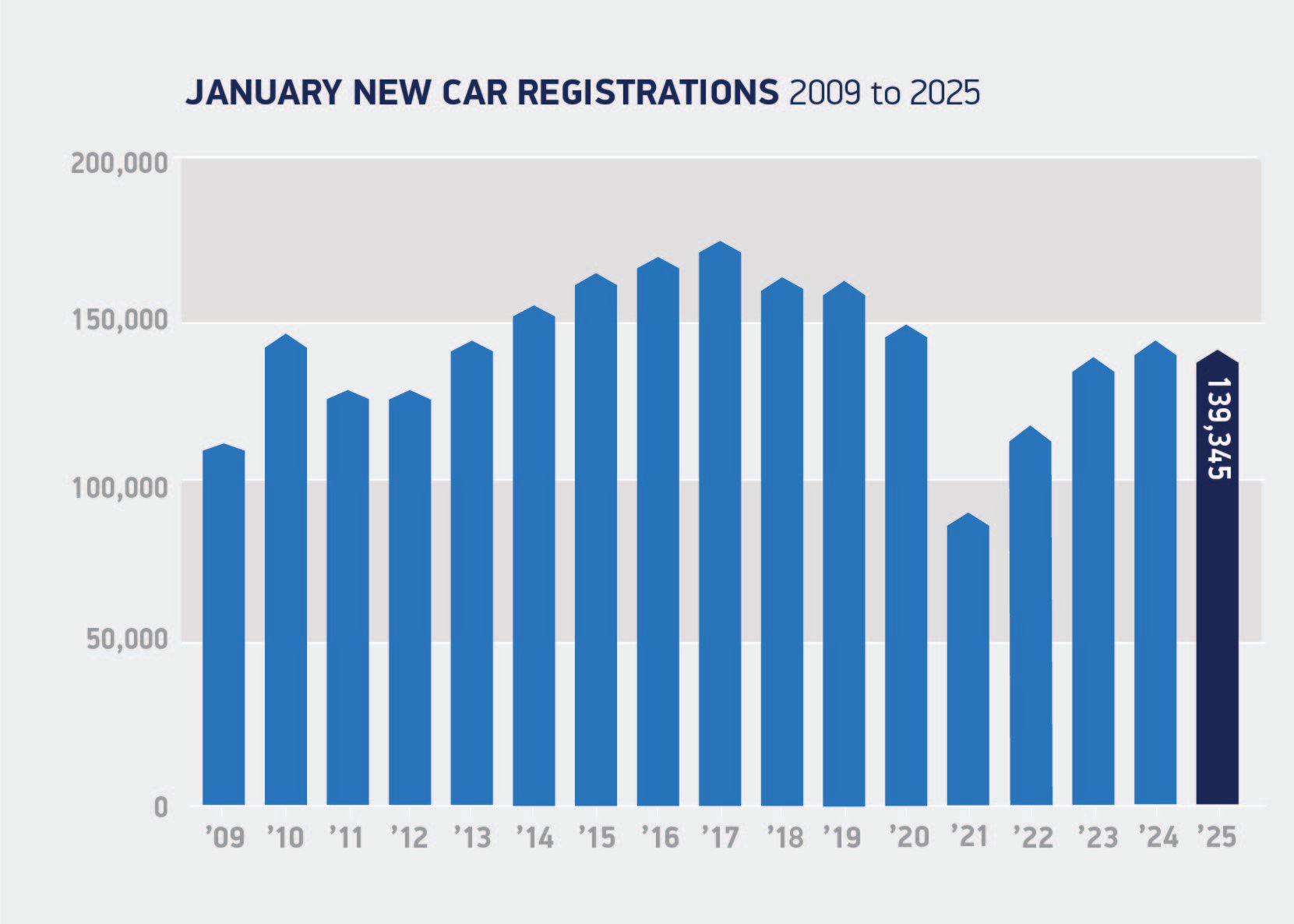

Philip Nothard, insight director at Cox Automotive, says that the yearly decline in new car registrations reflects the current challenges the UK automotive sector faces, with economic uncertainty continuing to weigh on consumer confidence.

“While EV adoption maintains steady growth, private buyers remain cautious,” he explained. “This highlights the pressing need for significant support and incentives to accelerate adoption, especially as new consumer data from Cox Automotive and Regit highlights that 86% of drivers don’t think there are sufficient incentives to support EV adoption in the UK.

“The industry has made significant investments to drive the shift, yet many consumers still need reassurance on affordability and infrastructure before switching.

“With ambitious EV targets ahead, there is concern that upcoming tax changes could slow progress at a critical time.

“A balanced approach to taxation and incentives will maintain momentum and ensure the UK remains on track for a successful transition to electrified mobility.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, believes that without clearer industry support, a fully electric future risks “stalling on the road”.

He said: “The Government’s reported plans to introduce subsidies for EV consumer loans could provide a much-needed boost to the private market.

“Making EVs more financially accessible is crucial to driving mass adoption and achieving net zero ambitions.

“However, this must be part of a broader strategy that provides manufacturers clarity on 2030 zero emission vehicle targets and addresses the needs of all drivers, including investment in public charging infrastructure.”

Login to comment

Comments

No comments have been made yet.