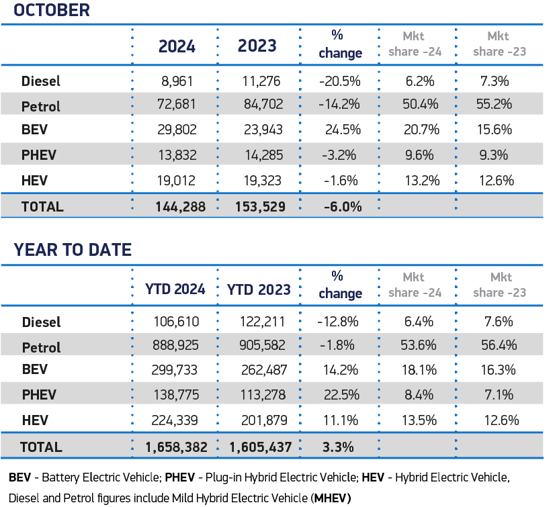

New car registrations declined by 6% in October, driven by a heavy fall in petrol and diesel sales.

Data from the Society of Motor Manufacturers and Traders (SMMT) revealed that 144,288 new cars were registered during the month.

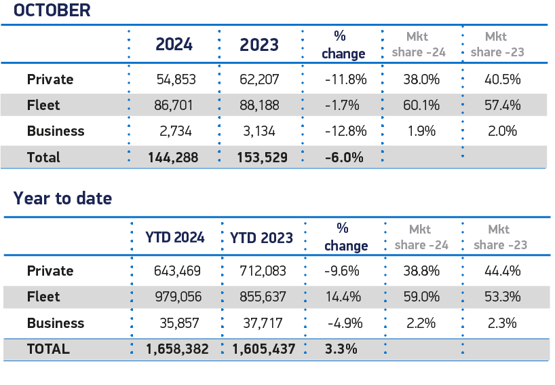

Retail sales were the hardest hit, enabling the fleet and business channels to gain market share.

While electric vehicle (EV) registrations grew during the month (+25.4%), the volume of EVs sold was not enough to stem the declines in petrol (-14.2%) and diesel (-20.5%) sales.

Mike Hawes, SMMT chief executive, said: “Massive manufacturer investment in model choice and market support is helping make the UK the second largest EV market in Europe.

“That transition, however, must not perversely slow down the reduction of carbon emissions from road transport.

“Fleet renewal across the market remains the quickest way to decarbonise, so diminishing overall uptake is not good news for the economy, for investment or for the environment.

“EVs already work for many people and businesses, but to shift the entire market at the pace demanded requires significant intervention on incentives, infrastructure and regulation.”

The new car market is up by 3.3% year-to-date (YTD), driven by strong sales in the fleet and business channels.

While almost 300,000 new EVs have reached the road in 2024, the SMMT says this represents 18.1% of the market – an increase on 2023, but still significantly short of the 22% target for this year and of the 28% which must be achieved in 2025 under the Vehicle Emissions Trading Scheme.

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said: “Sales were subdued in October as new car registrations fell by 6% which can likely be attributed to the current financial strains faced by consumers. However, it is encouraging to see market share of battery electric vehicles increasing, but more needs to be done to meet the zero-emission vehicle target of 22% for 2024.

“The Government’s decision in last week’s Budget to maintain incentives, such as the Benefit-in-Kind tax rate to boost electric vehicle purchases, provides some relief for the industry. However, some businesses will be hoping for further support to help accelerate sales.

“Based on our calculations, from April 2025 when the new rate of national insurance comes in, a company with a fleet of 100 electric vehicles will expect to see savings of £564,000, compared to a company with a fleet of 100 internal combustion engine vehicles.”

James Garlick, head of EV at British Gas, says that attention must now focus on ensuring the UK’s charging network can withstand the EV demand and ensure that nobody is left behind.

“The Chancellor’s £200m public charging investment is to be welcomed, but bold measures need to be made to tackle the inequality that exists between at-home and public charging,” he added.

“Without facing this challenge head on, we risk excluding a significant number of motorists who rely solely on the public network from accessing affordable at-home charging costs and ease-of-use charging solutions.”

Jon Lawes, managing director at Novuna Vehicle Solutions, says that the Chancellor pulled a rabbit out of the hat last week with welcome measures around fuel duty, the extension of EV incentives in company car tax beyond 2028, and a £2bn boost for the auto industry.

However, said: “The jury’s still out on whether this is enough to sustain growth in the sector and restore consumer confidence.

“With businesses making up the bulk of new vehicle registrations, we’re yet to see the real impact from the avalanche of new operating cost pressures announced in the Budget, which will no doubt weigh on corporate fleet transition plans.”

Philip Nothard, insight director at Cox Automotive, believes that October’s 6% decline in the UK car market highlights “significant industry challenges”.

“Private demand for EVs remains weak despite an array of model choices and heavy, unsustainable discounting from manufacturers,” he said.

“While BEV uptake rose, driven largely by fleet purchases, this growth masks an underlying softness in consumer interest. The gap between ambitious EV targets and actual consumer behaviour is widening, making it clear that broader support is needed for a fast and fair transition.

“With the projection close to two million units by the end of 2024, attention now turns to 2025, when the reliance on aggressive discounts and limited private EV demand may no longer be viable.

“Structural shifts and stronger incentives will be critical to achieving sustainable growth, helping align policy goals with consumer readiness and ensuring the industry’s long-term stability.”

October’s best-selling cars

- Kia Sportage

- Ford Puma

- Mini Cooper

- Volvo XC40

- VW Tiguan

- Ford Kuga

- Toyota Yaris

- Nissan Qashqai

- MG HS

- Peugeot 208

The Kia Sportage was the best-selling new car in October, across all channels, securing more than 4,500 sales during the month.

It outsold the Ford Puma, which is the volume champion YTD, by 1,000 units.

Kia has now sold more than 100,000 cars this year, making it the fourth best-selling brand overall.

Volkswagen remains the largest brand by sales volume, with more than 140,000 cars sold to date.

Seven of the top 10 best-selling new cars in October were SUVs, marking the segment’s continues dominance in the UK market.

Login to comment

Comments

No comments have been made yet.