Oil demand displaced by electric and fuel-cell vehicles globally will more than double from what it is today to almost 4 million barrels per day by 2027, a new report suggests.

With 83 million electric cars, trucks and buses on the road next year, and more than 340 million electric two-and three-wheelers, the reduction is similar to the volume the whole of Japan consumed in 2022.

BloombergNEF’s Long-Term Electric Vehicle Outlook (EVO) shows that electric vehicle (EV) adoption is still growing, despite a mixed near-term outlook.

The new report indicates that rapidly falling battery prices, advancements in next-generation battery technology and improving relative economics of EVs with internal combustion engine (ICE) counterparts continue to underpin long-term EV growth globally.

However, the report indicates that the window to reach global net-zero transport ambitions is now narrower than ever.

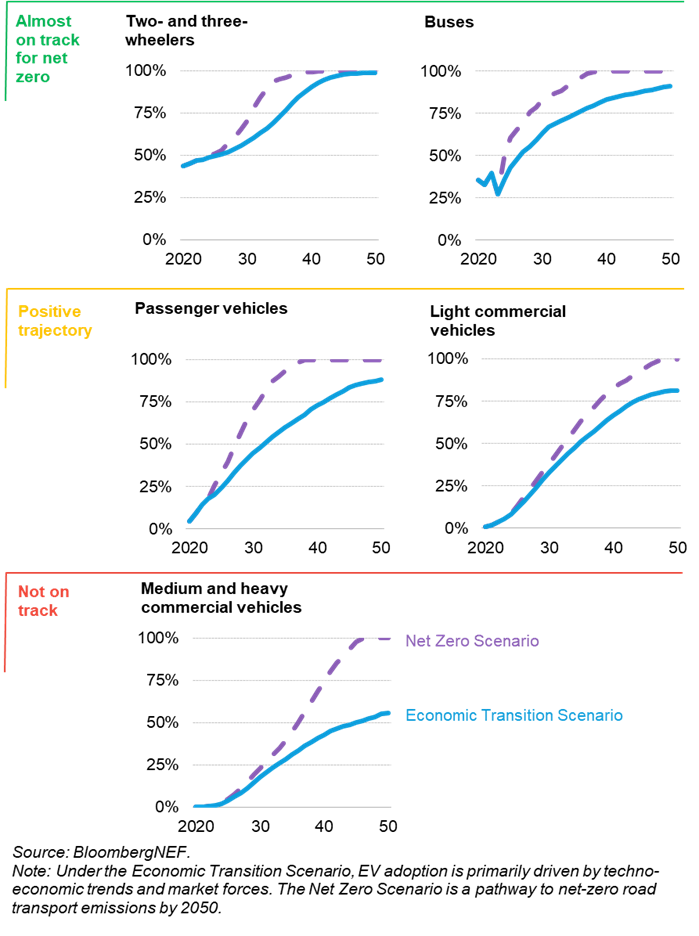

The report presents two updated road transport scenarios: the base case Economic Transition Scenario (ETS) – in which EV adoption is shaped by current techno-economic trends and with no new policy intervention – and the Net Zero Scenario (NZS) – consistent with reaching a global zero-emission fleet by 2050.

In the base case ETS, electric-vehicle sales continue to rise globally, even though growth has slowed in the US and Europe as a result of regulatory and political changes, and some automakers pushing back their EV targets.

The report also shows that EVs are no longer only a wealthy country phenomenon, with countries like Thailand, India and Brazil all experiencing record sales as more low-cost electric models are launched targeting local buyers.

The underlying technology for electrification continues to improve, battery prices continue to fall, and EV adoption moves from being policy-driven to being driven by consumer demand across all markets, says the report.

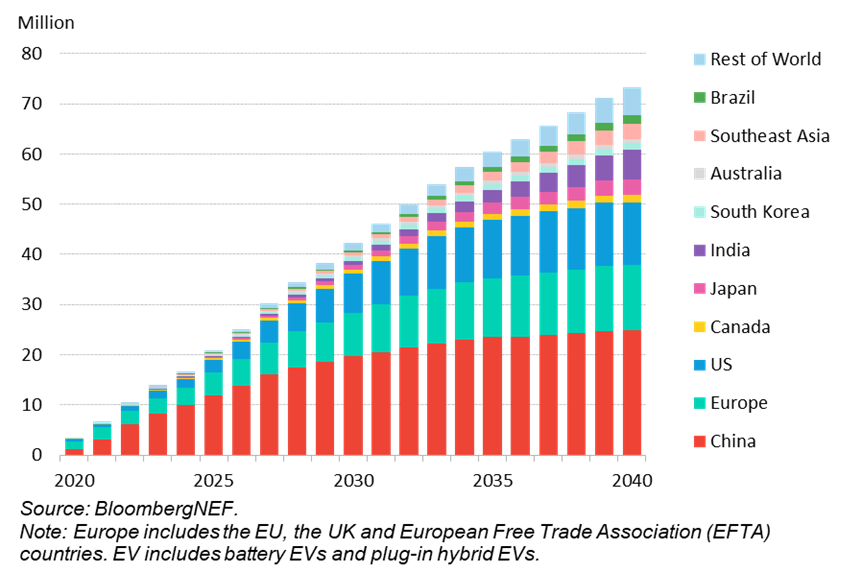

It predicts passenger EV sales are expected to exceed 30 million in 2027 in the ETS and grow to 73 million per year in 2040, contributing 33% and 73% to global car sales in those years, respectively.

Global long-term passenger EV sales by market in BNEF’s Economic Transition Scenario

It also finds that electrification is now spreading quickly to all sectors of road transport. Two- and three-wheeled vehicle sales continue to rise in emerging economies and electric sales are expected to exceed 90% globally by 2040.

The decarbonisation of the commercial vehicle sector – including vans, trucks and buses – has already started and is set to accelerate.

The cumulative value of EV sales across all segments could hit $9 trillion dollars by 2030 and $63 trillion by 2050 in BNEF’s ETS.

At least $35 billion needs to be invested in battery-cell and component plants by the end of the decade, though this is easily exceeded by the $155 billion already planned by companies.

Despite the progress, global road transport is still not on course for a net-zero trajectory. While BNEF’s NZS calls for 100% of the road-going car fleet to be electrified by 2050, the base case ETS only achieves 69% in the same year.

This shows that current techno-economic trends alone are not enough to get the transport sector on track for global climate goals, it says, and that continued strong regulatory support is still very much needed.

Currently, only one segment of road transport – three-wheeled vehicles – is fully on track to reach net zero by mid-century.

Heavy- and medium-duty vehicles are the furthest off course for this goal: electric and hydrogen fuel-cell powertrains account for only 18% of global truck sales by 2030 and 43% by 2040 – and even this represents significant change for the industry.

Nikolas Soulopoulos, head of commercial transport at BloombergNEF (BNEF), said: “Truck manufacturers are about to undergo a rapid technological transformation on the back of strict environmental targets in Europe and the US.

“The speed of that change will be unprecedented for the industry, but meeting a Paris-aligned scenario requires even faster production of zero-emission vehicles.”

Annual global electric road vehicle sales in BNEF's Economic Transition Scenario and Net Zero Scenario

For the world to achieve a zero-emission vehicle fleet by 2050, sales of petrol and diesel vehicles will need to stop around 2038, with leading markets needing to phase out ICE vehicles even sooner, in the early 2030s.

In the Economic Transition Scenario, only the Nordic countries reach a full phase-out of combustion vehicles before 2038.

As more countries implement industrial strategies to capture value from the transition, there is a risk that climate goals fall further out of reach, it says.

Governments will need to carefully weigh up competing priorities and avoid policies that reduce competition or access to affordable EVs.

Aleksandra O’Donovan, head of electric vehicles at BNEF, said: “Governments trying to champion domestic manufacturing at the cost of faster decarbonisation should consider very carefully what they are prioritizing, as reaching net-zero road transport emissions by 2050 is still possible, but much faster progress is needed.”

Other findings of the Long-Term Electric Vehicle Outlook show that plug-in hybrids (PHEVs) are making a comeback, but their full role in the transition is still unclear.

It also suggests that EVs are driven more than their ICE counterparts.

Meta-analysis of EV driving patterns in different countries shows that pure EVs are doing more annual kilometres than comparable gasoline powered vehicles.

There is significant variation by country and the US is a notable outlier with fewer kilometres driven by EVs.

Finally, it argues that electric heavy trucks become economically viable for most use cases by 2030.

In heavier segments, battery electric trucks are mostly used in urban duty cycles initially. But their economics improve even for long-haul routes and around 2030 approach those of diesel powertrains.

Fuel-cell trucks remain a viable option for some duty cycles and in some countries, but their outlook is far less certain.

Login to comment

Comments

No comments have been made yet.