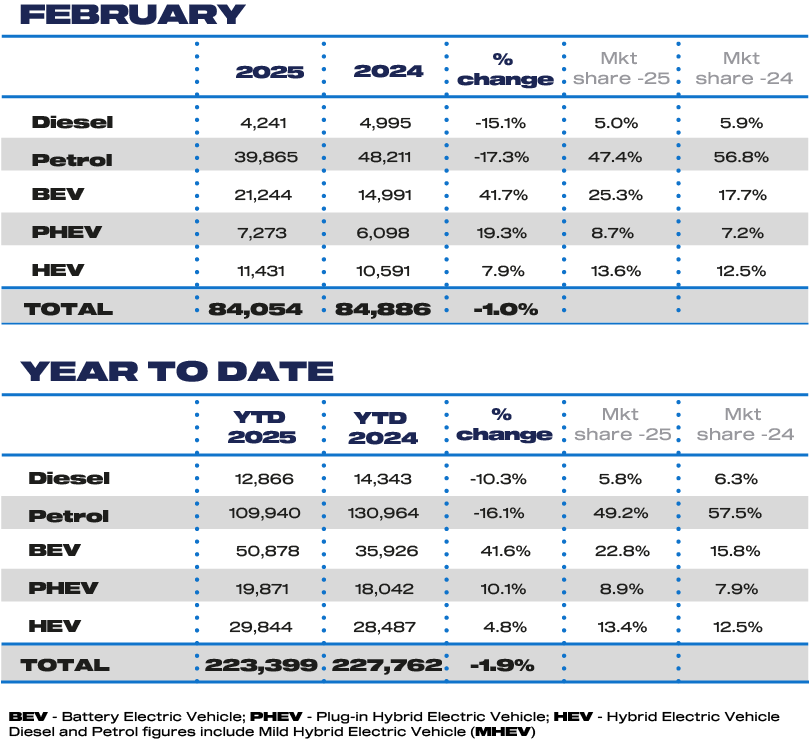

Pure electric powertrains accounted for one-in-four new car registrations in February, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

Battery electric vehicle (BEV) registrations were up by 41.7% to 21,244 units in the month, securing a 25.3% market share compared with 17.7% a year ago.

However, it still falls short of the 28% zero emission vehicle (ZEV) mandate target for 2025 and, given February comes ahead of the March numberplate change, it is always one of the smallest and most volatile months, says the SMMT.

It is predicting a further surge in uptake, as buyers capitalise on the new '25 plate and take their last chance to avoid the vehicle excise duty (VED) expensive car supplement (ECS), which from April 1 will add £2,125 over six years to the cost of BEVs with a list price above £40,000.

Electrified vehicle uptake also continued to grow in the month, with plug-in hybrid vehicles (PHEVs) rising 19.3% and hybrid electric vehicles (HEVs) up 7.9%.

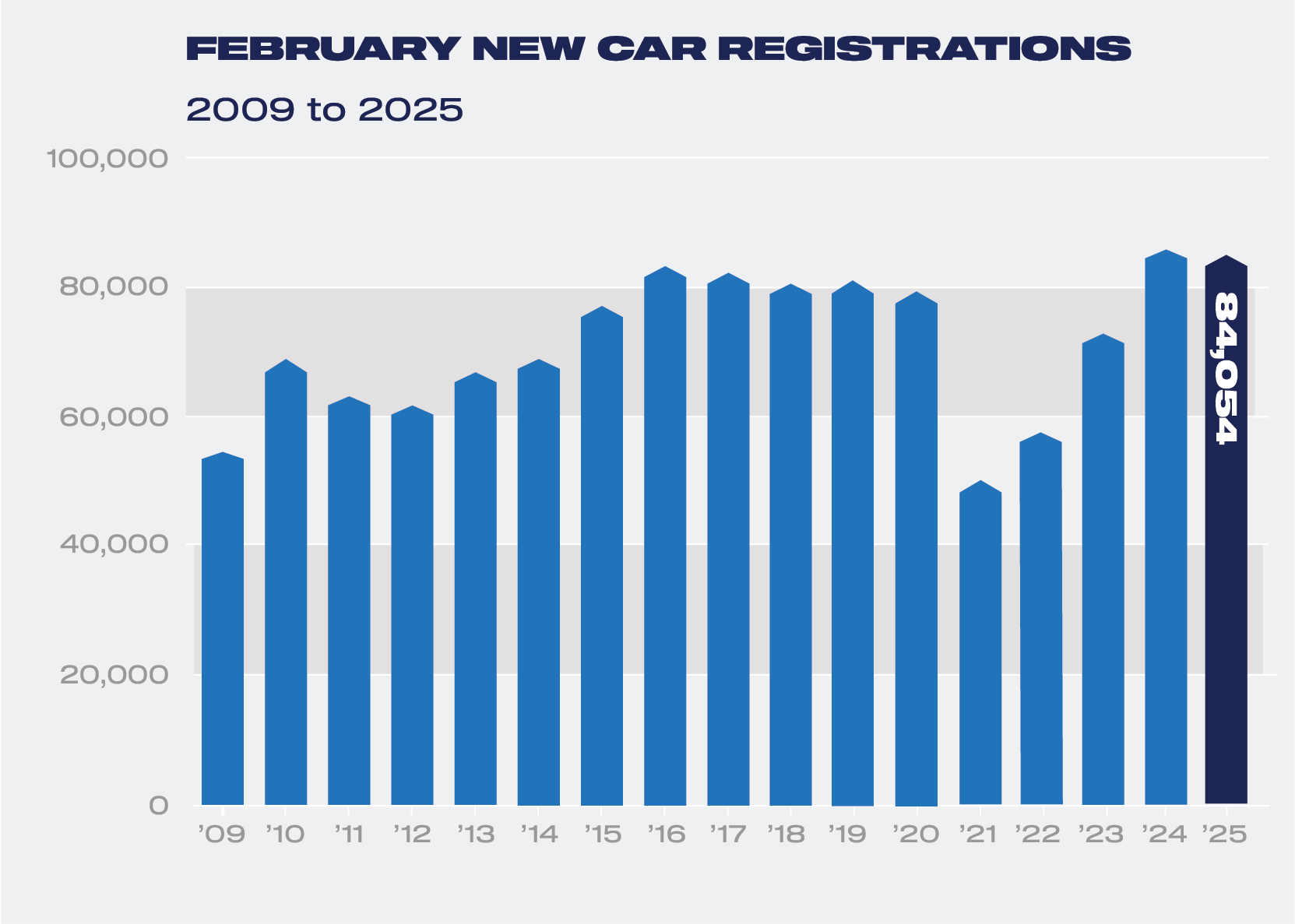

A growing interest in EVs, however, was tempered by a “subdued” new car market in February, with registrations down 1% to 84,054 units.

In what is usually the smallest month of the year – accounting for only around 4% of annual volumes – February was the fifth consecutive month of decline.

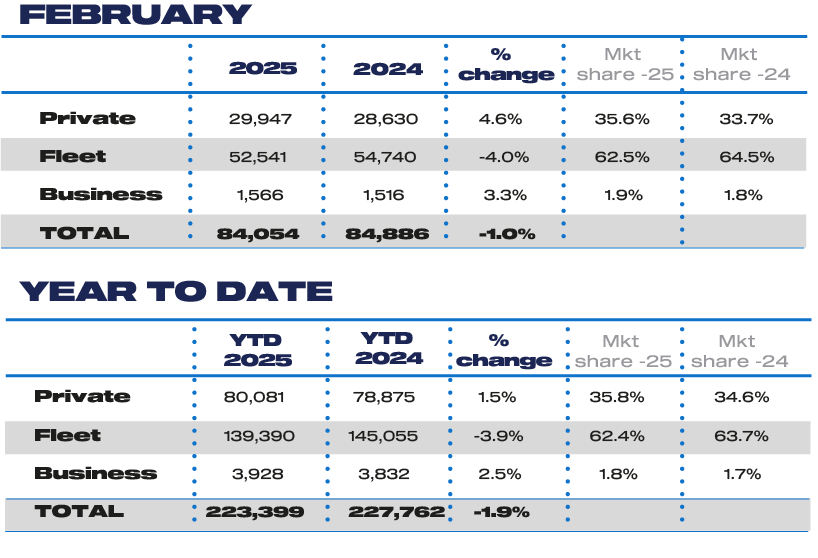

Fleet and business registrations were down 3.8% when compared to February 2024, with 54,107 units registered, equating to a 64.4% market share.

Year-to-date fleet and business registrations are also down. So far this year, 143,318 new company cars have been registered, a 3.7% decline.

Private registrations, meanwhile, rose by 4.6% in the month to slightly increase overall market share to 35.6%.

Mike Hawes, SMMT chief executive, said: “Although February’s figures show a subdued overall market, the good news is that electric car uptake is increasing, albeit at huge cost to manufacturers in terms of market support.

“It is always dangerous, however, to draw conclusions from a single month, especially one as small and volatile as February.

“With the all-important March number plate change now upon us, and tax changes taking effect in April that will, perversely, dissuade EV purchases, we expect significant demand for these new products next month - but, long term, EV consumers need carrots, not ever more sticks.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, believes that pent-up demand for the ’25 plate and ongoing incentives should provide a boost to new car registrations in March, but wider economic pressures could temper expectations.

“There is hope that the Government’s recent consultation on the zero emission vehicle mandate will deliver clarity for the industry,” he added.

“However, successfully navigating the next phase of the mandate and beyond will require a coordinated approach - manufacturers, charging point operators, finance providers, and Government bodies must be enabled to work together in addressing the remaining barriers to EV adoption.

“This will ensure a smooth transition to a cleaner, more sustainable future for the UK automotive sector.”

Despite growing interest in EVs, Jon Lawes, managing director at Novuna Vehicle Solutions, believes the broader outlook remains uncertain.

“From April, EVs will lose their exemption from vehicle excise duty, adding costs that could erode the tax advantages driving corporate adoption—particularly via salary sacrifice schemes,” he said.

“With the 2030 ban on new petrol and diesel cars looming, concerns are mounting over future tax rises, complicating long-term fleet planning.

“Manufacturers, reliant on incentives to meet ZEV mandate targets, now face an unpredictable landscape.

“Combined with geopolitical instability, this could strain supply chains and push prices higher, dampening momentum just as the sector needs acceleration.”

Login to comment

Comments

No comments have been made yet.