With manufacturers facing 25% tariffs on US imports, data from Jato Dynamics reveals that 16.1 million new light vehicles were sold in the US in 2024.

Around 6.3 million were largely imported to the US from Mexico, Canada, the European Union, the UK, Japan, and Korea.

The tariffs on car imports came into effect last week, with a 25% tariff on imported parts to start from May 3.

While the 25% tariff has been applied broadly, carmakers will feel its impact in a variety of different ways.

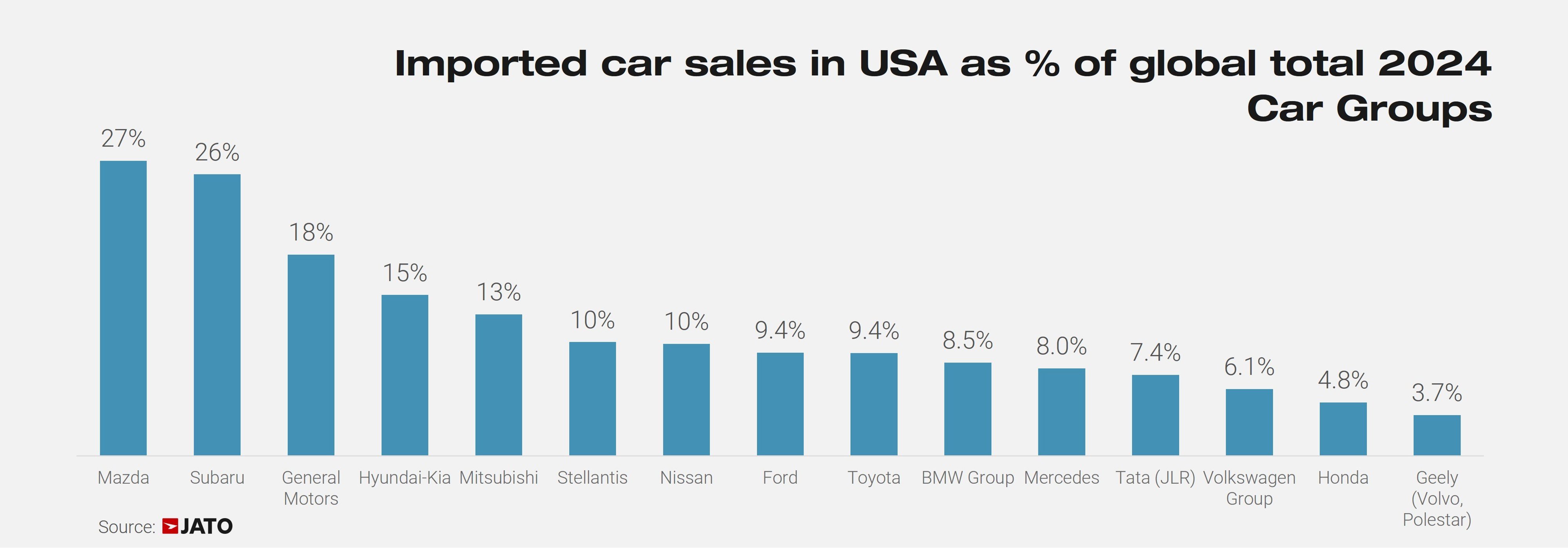

For example, in 2024, Detroit’s ‘big three’ – General Motors, Ford, and Stellantis – sold approximately 1.85 million imported light vehicles in the US, accounting for 13% of their combined global sales.

In comparison, Toyota, Honda, and Nissan – the three largest Japanese brands – sold 17.9 million units globally last year.

Of this total, 1.53 million units were imported and sold within the US market, equating to 9%.

For Germany’s Volkswagen Group, BMW Group, and Mercedes Benz, US demand for their imported cars accounted for 7% of their combined global total.

While the new trade policy is intended to boost domestic carmakers, they too will be impacted negatively, says Jato.

With a smaller global presence than some of their Japanese and European counterparts, US manufacturers rely heavily on domestic sales, meaning that tariffs on cars imported largely from Mexico, Canada, and Korea will be felt keenly.

Other brands will suffer

Few will benefit from the imposed tariffs, but some brands will suffer more than others.

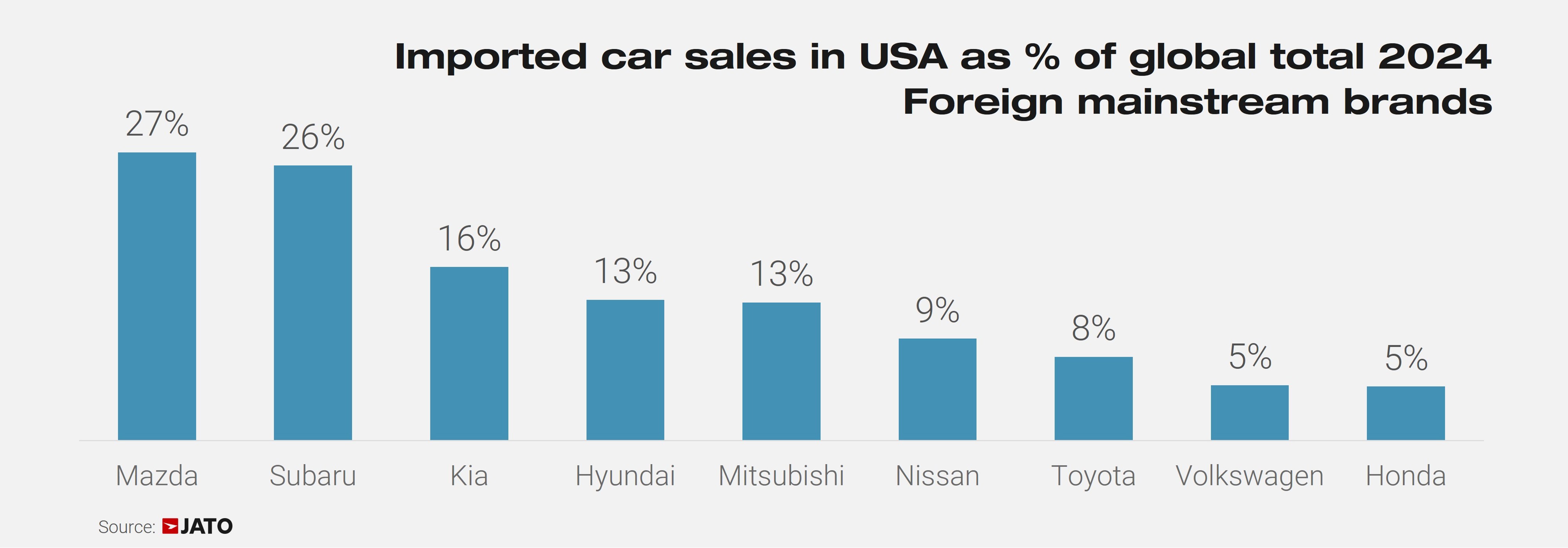

For example, Mazda, Subaru, and General Motors are most reliant on imports into the US.

Mazda sold 1.28 million new cars globally in 2024 – 343,000 of these were vehicles imported and sold in the US.

Meanwhile, the US accounted for 71% of Subaru’s total car sales in 2024. While a large portion of these vehicles were produced at its factory in Indiana, imports into the US still made up 26% of the brand’s total volume globally.

General Motors is highly dependent on the US market, ranking just behind Hyundai-Kia and Toyota in total vehicle imports in 2024, says Jato.

Its global footprint is largely concentrated in North and South America, China, and a few smaller markets.

Notably, sales of imported vehicles in the U.S. made up 18% of GM’s total global sales. That was the highest percentage among the world’s five largest automakers.

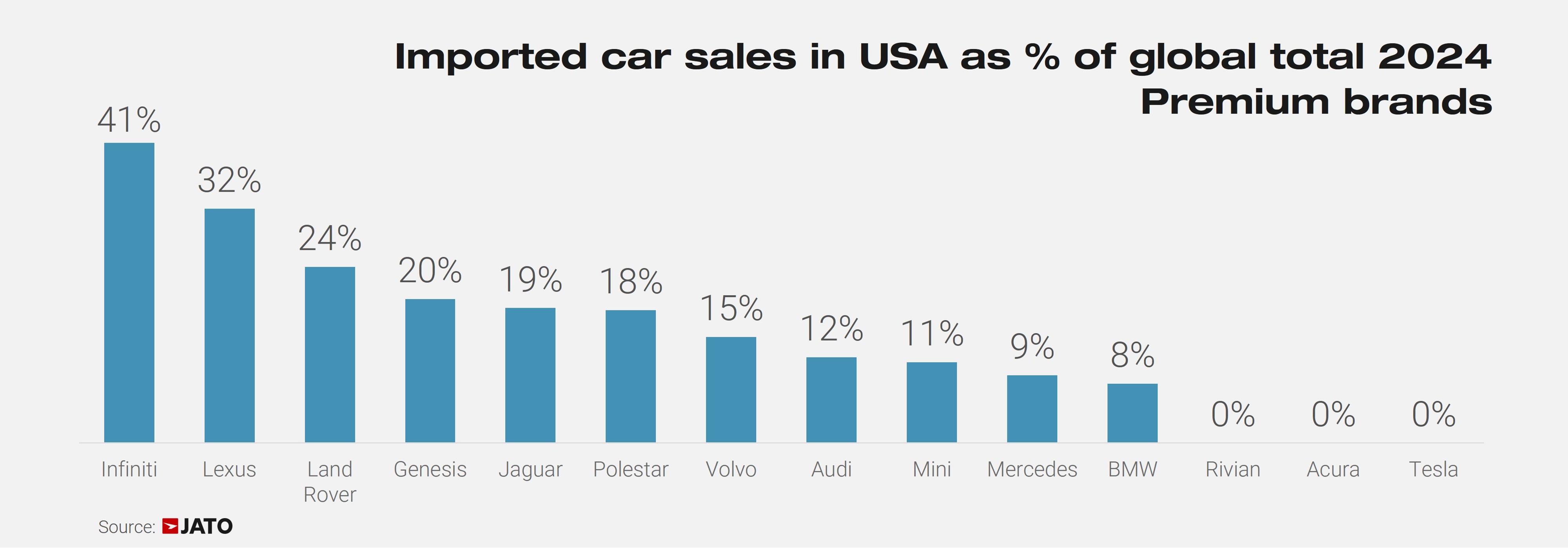

In terms of imported car sales to the US as a percentage of global sales for premium brands in 2024, Jaguar Land Rover’s exposure is evident.

One-in-four Land Rover vehicles (24%) are imported to the US, the third highest after Infiniti (41%) and Lexus (32%). Jaguar were fifth with one-in-five cars (19%) imported to the US.

As a result, Jaguar Land Rover (JLR) has ‘paused’ shipments to the US, as it considers how to address “the new trading terms” of tariffs on UK automotive.

Volkswagen Group to hit roadblocks

In 2024, the US made up less than 10% of Volkswagen Group’s global sales.

As a result, the German manufacturer, alongside Honda, is less exposed than other major carmakers; however, Jato explains that this level of protection will be offset by the fact that vehicles made abroad account for approximately 80% of its sales in the US.

Felipe Munoz, global analyst at Jato Dynamics, said: “The US is a vital market to 14 of the 18 non-Chinese global carmakers.

“For the likes of Volkswagen, the US contributes a relatively small amount of the brand’s total revenue, but it will seek to hold a presence to retain its position as a global brand.

“Alongside Volkswagen, it is likely that Volvo, Hyundai-Kia, Mercedes, BMW, Stellantis, Toyota, Nissan, Subaru, and General Motors will need to increase their production footprint in the US in the near future. The US is a market that they can’t leave.”

Login to comment

Comments

No comments have been made yet.