The profits of Europe’s seven largest leasing companies have increased by 59% over the past five years, from 2018 to 2022, reaching a combined €15.7 billion (£13.7bn) in 2022.

A new report by research firm Profundo, which was commissioned by Transport and Environment (T&E), looks at the profitability of ALD LeasePlan (Ayvens), Alphabet/BMW Financial Services, Arval, Leasys, Mercedes-Benz Mobility/Athlon, Mobilize Financial Services and Volkswagen Financial Services.

The T&E report comes in the wake of research by Fleet News for the FN50 that showed pre-tax profits for the UK’s top 50 leasing companies by risk fleet size have exceeded £2bn for the first time, thanks to record-breaking used car prices driven by the semiconductor shortage.

Collectively, the FN50 reports pre-tax profits of £2.04bn – up £500 million on the £1.5bn achieved last year and more than three times the £625m reported in 2021.

Highlighting how record-breaking residual values (RVs) have driven the 36% rise in profits, revenues for the FN50 have only increased by 4%, year-on-year (YOY).

Meanwhile, the turnover of FN50 companies reached £12bn – a £400m increase on the £11.6bn reported last year.

According to the T&E research, the two leasing companies that recorded the biggest growth in profit since 2018 were Arval (owned by BNP Paribas) and Leasys (the leasing division of Crédit Agricole and Stellantis).

Arval’s profits grew by 192% since 2018, although the number of leased and financed vehicles only rose by 33%. Leasys’s fleet size increased substantially (82%) but its profits nearly doubled that (143%).

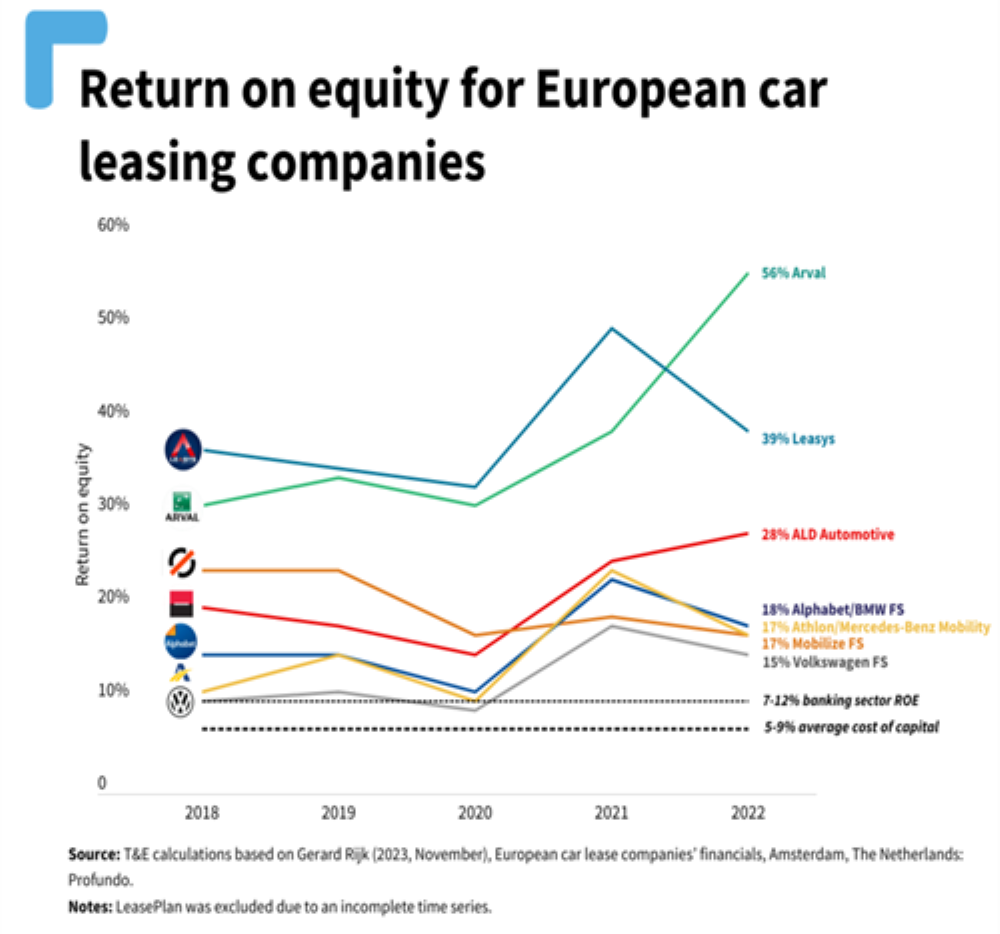

The average return on equity (ROE) for the leasing companies has increased from an already high 21.2% in 2018 to 27.2% in 2022, according to the report.

ROE is the benchmark used by investors to determine the financial health of a company. For comparison, banks - the owners of some of the largest leasing companies and a comparable sector - record a ROE between 7-12%.

T&E thinks that leasing companies should be doing more to drive the switch to electric vehicles (EVs).

Stef Cornelis, director electric fleets programme at T&E, said: “Leasing companies record billions in profit, yet they are not driving the transition to electric.

“This mismatch between the profitability of major leasing companies and their progress on electromobility is becoming almost awkward.

“Their strong financial performance would easily allow them to invest in more electric vehicles - yet it seems they are more preoccupied with profits and cash.”

However, that isn’t reflected in analysis conducted by Fleet News for the FN50 which showed in the UK that leasing companies are driving EV adoption rates.

Full-electric cars now account for almost a quarter (24.3%) of the FN50 fleet, a significant rise on last year’s 17.3%.

More strikingly, 31.6% of FN50 deliveries in the first nine months of 2023 were pure electric, about twice the level of battery electric vehicle (BEV) total national sales (16.4%), which include fleet registrations.

Login to comment

Comments

No comments have been made yet.