Range-extenders could help “bridge the gap” to full electrification for fleet applications where electrification is proving tough – such as pick-ups, off-road 4x4s and larger vans, says FleetCheck.

A range-extender (REx) vehicle operates primarily as an electric vehicle (EV), with the electric motor driving the wheels.

When the battery charge gets low, the internal combustion engine (ICE) ignites to generate electricity, recharging the battery and extending the driving range.

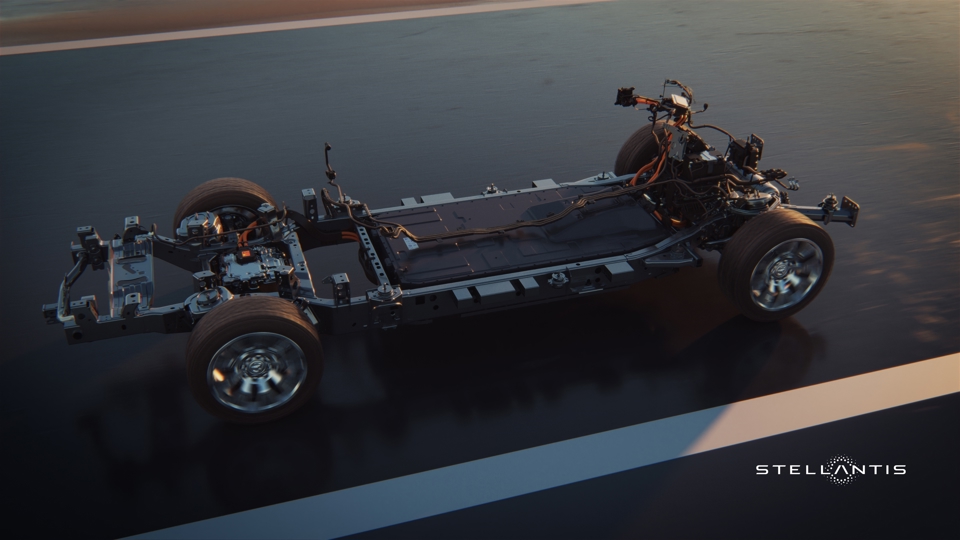

Stellantis is among several manufacturers developing range extender vehicles. In November, it unveiled a new platform to underpin a range of pick-up trucks and large SUVs with electric powertrains.

The STLA Frame platform will initially use fully electric powertrains, with a driving range of up to 500 miles, but there will also be a range extender version that can travel up to 690 miles.

Stellantis says internal combustion, hybrid and hydrogen propulsion systems can also be integrated in future.

Leapmotor aims to offer a petrol range extender option on its vehicles this year. The Chinese carmaker, which is part of Stellantis, has confirmed the powertrain will be available on its flagship C10 model.

The Leapmotor C10 REEV is equipped with a 215PS electric motor and a 1.5-litre internal combustion engine (ICE). The 28.4 kWh battery provides an electric range of 90 miles (WLTP), while the total combined range exceeds 590 miles.

Leapmotor says the engine will achieve 706mpg and emits 10g/km of CO2.

Meanwhile, Ford CEO Jim Farley confirmed that the company is developing both SUV and pick-up platforms designed for range-extender EVs, without giving a date for launch.

Peter Golding, managing director of FleetCheck, said: “In terms of stepping stone models between ICE and electric cars and vans, the motor industry has tended to go down the plug-in hybrid (PHEV) route and in some respects, they’ve not been the best solution.

“The problem with PHEVs, as many fleet managers will attest, is that it’s easy for drivers to never bother to charge them unless they are closely monitored, effectively using them as an ICE vehicle. Leasing companies sometimes receive them back with the charging cable still in its wrapper.”

Golding explains that for some employees, they have been a route to access lower benefit-in-kind (BIK) taxation, while often using more fuel than a petrol or diesel equivalent, because the weight of a little used electric drivetrain is being carried around.

“In contrast, REx vehicles are electric first and make sense where their ICE capacity is designed to offer enough reassurance to offset issues surrounding range,” he said.

“For fleet applications where electrification is proving tough – such as pick-ups, proper offroad 4x4s and larger vans – they could offer a genuine bridge until a time when charging infrastructure, and battery technology and pricing, improves to the point that an electric vehicle becomes practical.”

For there to be a move towards RExs in these categories, Golding argues that some form of Government recognition and support would be needed.

“The new Ford and Stellantis vehicles being engineered appear largely aimed at the US market but no doubt the technology could be adapted for use in Europe if there was sufficient demand,” he added.

“It could potentially make an impact if applied to larger panel vans, which remains probably the most prominent, difficult-to-solve area of electrification.”

He concluded: “We know from measures in the latest Budget that the Government is moving against PHEVs in both benefit in kind and vehicle excise duty terms, and our understanding is that RExs are classified for taxation purposes in the same way, so there would probably have to be some changes to create a situation where manufacturers are encouraged to introduce them.”

Login to comment

Comments

No comments have been made yet.