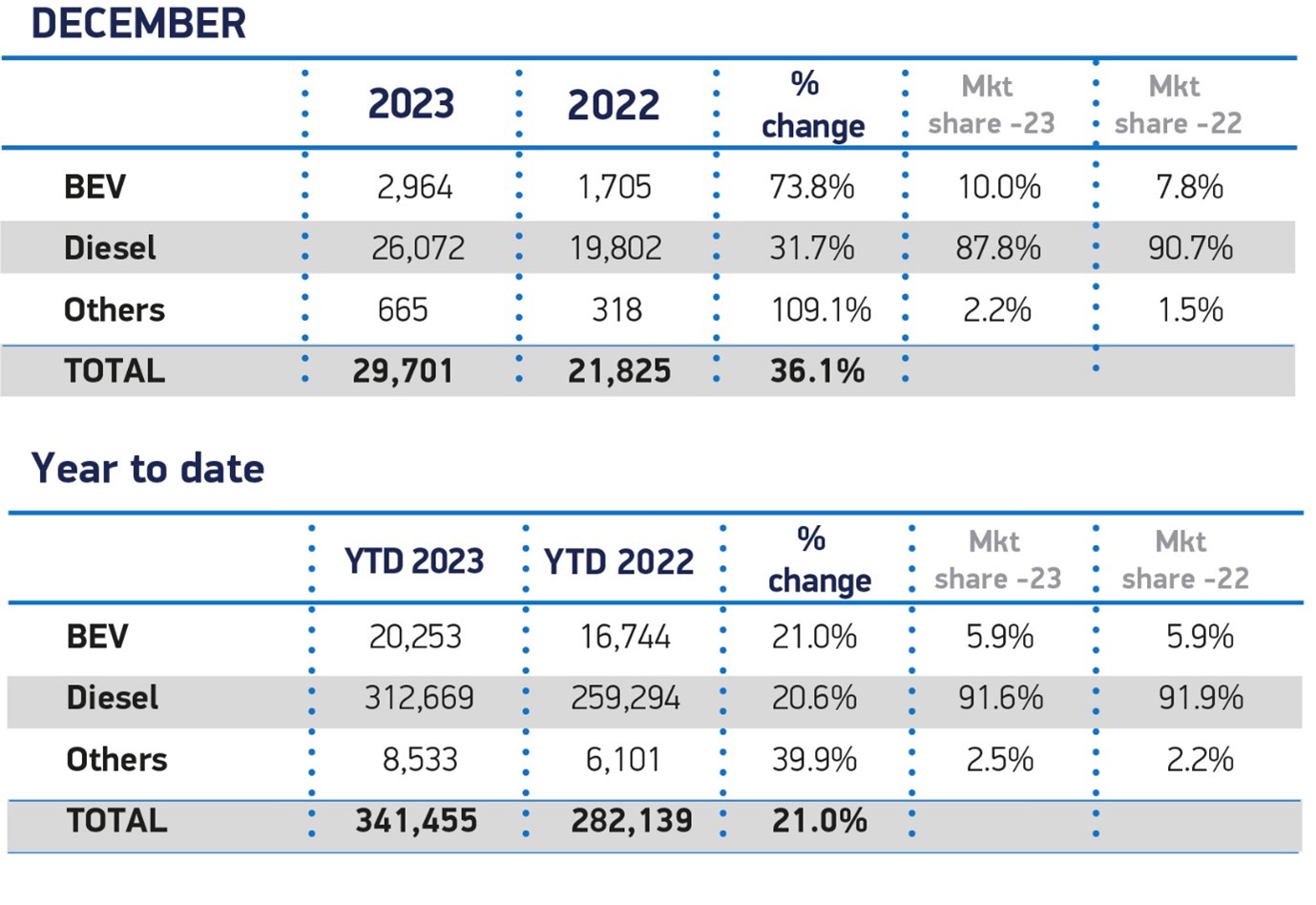

The adoption of new battery electric vans hit record volumes in 2023, increasing by 21% to 20,253 units, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

Some 28 different models were registered during the year, equating to a market share of 5.9%, some way shy of the 10% zero-emission new van sales expected from manufacturers this year, with the zero-emission vehicle (ZEV) mandate coming into force.

SMMT figures, however, do show that battery electric vehicle (BEV) uptake jumped 73.8% to 2,964 units in December, representing 10% of registrations in the month – the second highest ever monthly BEV share.

It means that since 2019, some 58,226 electric vans have been registered, helping make the UK the third largest electric van market in Europe by volume.

However, it remains behind several other European nations by market share, including Germany, France and Spain.

Given the market share of electric vans flatlined last year compared with 2022, ensuring LCV demand matches supply presents a major challenge, according to the SMMT.

Immediate action to reduce existing barriers to BEV uptake is crucial, it argues, with the single biggest obstacle being the insufficient number of van-suitable public chargers – requiring significant infrastructure investment in every UK region.

At the same time, a long-term commitment to the plug-in van grant will be necessary to make the switch accessible and equitable for operators across all sectors and parts of the country, it says.

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK, agrees.

She said: "In 2024, the Government will need to provide more clarity to LCV drivers looking to make the switch to electric."

"The impetus to drive the transition to zero-emissions for LCVs very much depends on the Government appreciating that outside the larger cities and towns, buyers of BEV commercials need the reassurance that there will be sufficient charging infrastructure to use EV vans on longer journeys.”

Highest demand for new vans post-pandemic

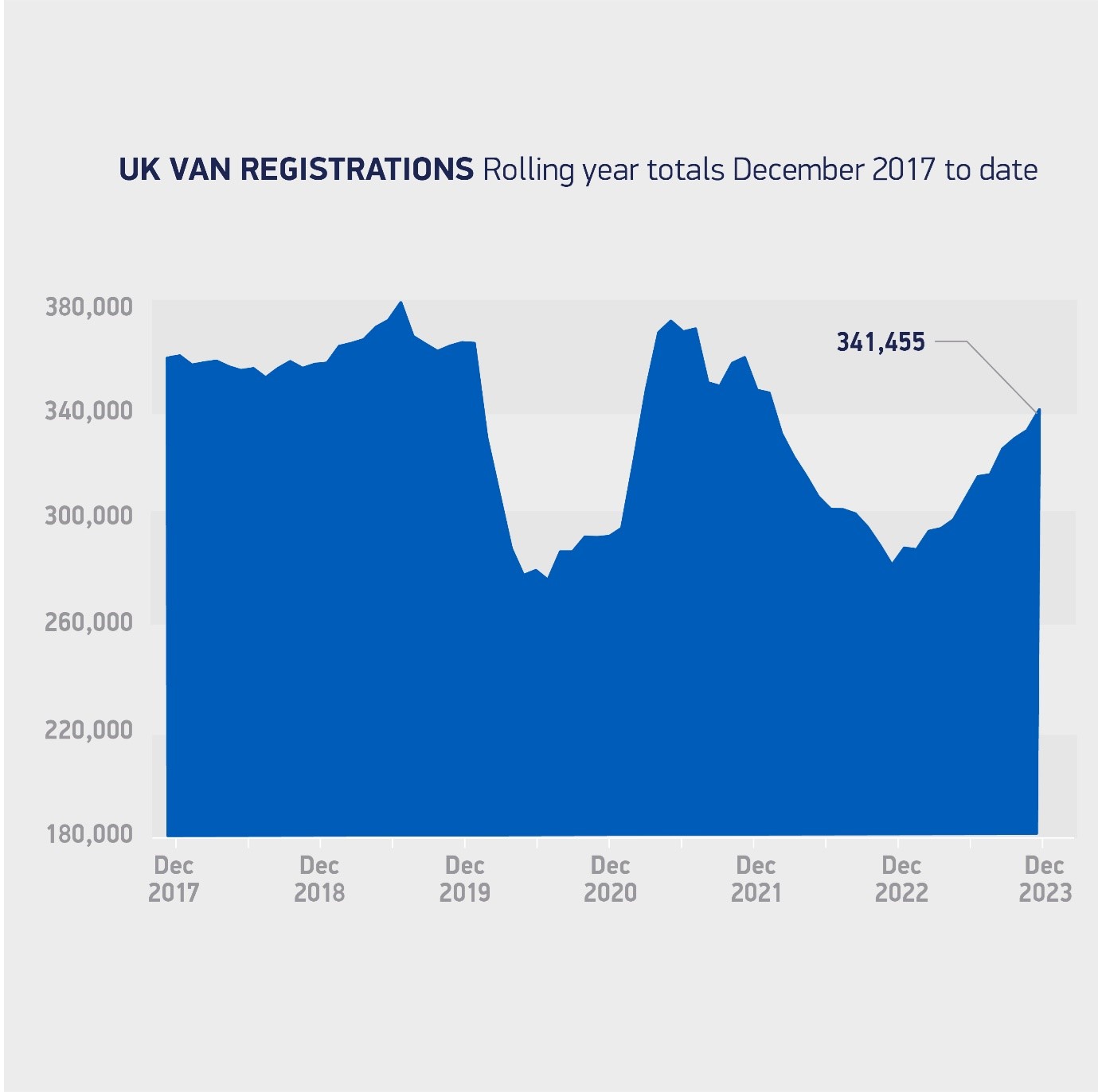

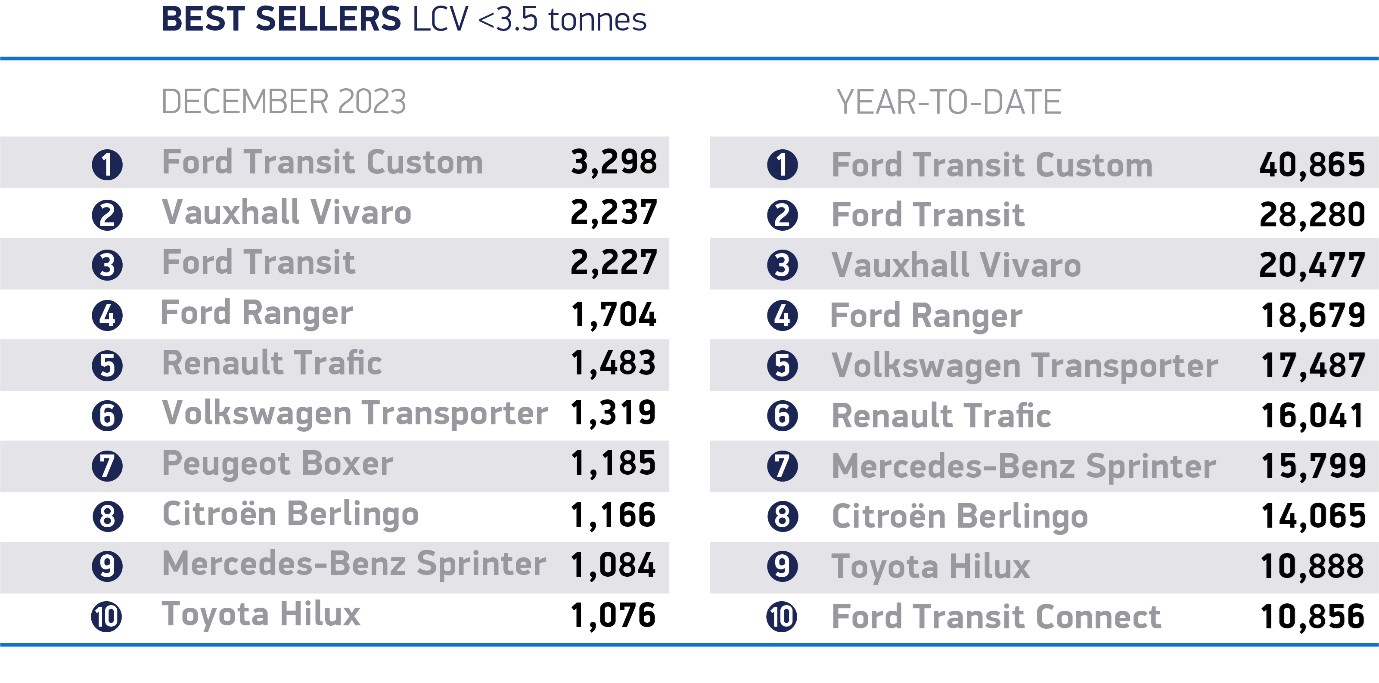

Overall, UK demand for new light commercial vehicles (LCVs) grew by 21% to reach 341,455 units in 2023.

Britain saw an additional 59,316 LCVs of all types and sizes join its roads than in 2022, following an extra £2 billion spend by companies.

December was particularly strong, with demand up 36.1% – the best total for the month since 2015.

As a result of rising vehicle investment across the year, 2023 saw the highest demand for new vans since the sector’s post-pandemic bounceback in 2021, with the market just 6.6% below 2019 levels.

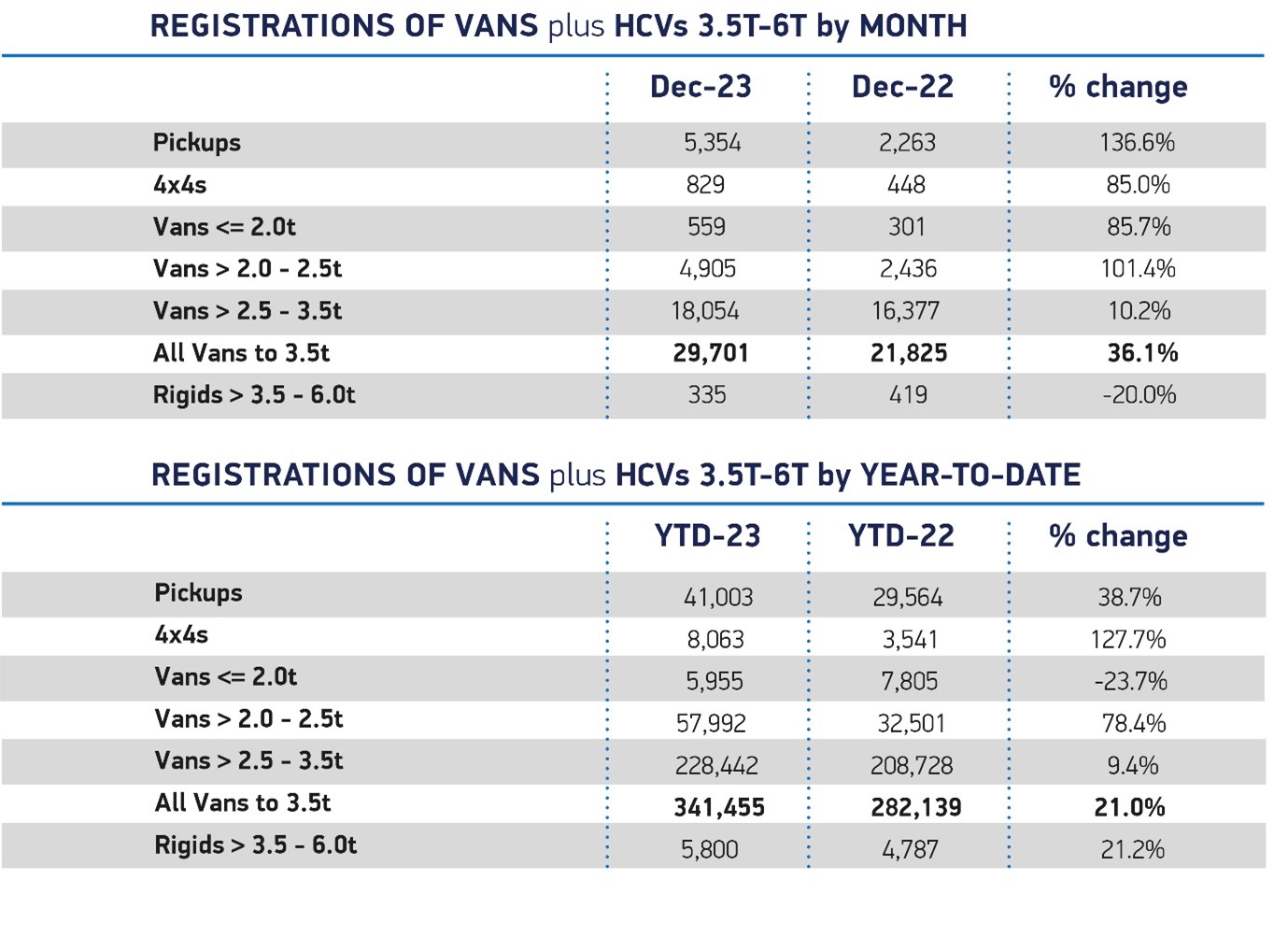

Popular demand for the largest vans (weighing more than 2.5 tonnes to 3.5 tonnes) continued, rising 9.4% to 228,442 registrations – with these models representing 66.9% of all new vans as operators opted for payload efficiencies.

The largest growth in volume was for medium-sized vans (weighing above two tonnes to 2.5 tonnes), surging by 78.4% to 57,992 units, with such vehicles still able to carry heavy loads while at the same time delivering the smaller vehicle size requirements of urban operators.

Demand for pickups and 4x4s also rose, by 38.7% and 127.7% to 41,003 and 8,063 units respectively, while registrations of the smallest vans (weighing equal to or less than two tonnes) declined by 23.7% to 5,955 units.

Mike Hawes, SMMT chief executive, said: “Rising demand for new vans in every month of 2023 – along with record uptake of battery electric vans – is positive news for the UK, given the vital role of these vehicles in keeping businesses and the economy moving.

“Demand for new vans is also essential for decarbonisation and, as the UK’s ambitious mandate for electric van sales comes into effect, every lever must be pulled to make the switch accessible for fleets in every region.

“If 2024 is to be the year of the electric van, investment in charge point infrastructure is mission-critical – bringing with it the successful green transition and economic growth the nation needs.”

Login to comment

Comments

No comments have been made yet.