Demand continues to soar for used battery electric cars (BEVs), according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

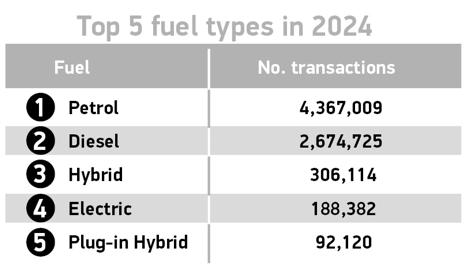

It shows that demand increased 57.4% year-on-year for used BEVs, with a record 188,382 units sold, equating to a new high for market share, at 2.5%, up from 1.7% in 2023 and 13 times larger than back in 2019.

In Q4, BEV share was even higher at 2.7%, matching Q3’s performance.

Sales of used plug-in hybrids (PHEVs) and hybrids (HEVs) also grew, up 32.2% to 92,120 units and 39.3% to 306,114 units, respectively.

Combined, the number of used electrified vehicles sold in 2024 increased by 43.3% year-on-year, with more than half a million of these ultra-low or zero emission cars accounting for a 7.7% share of sales.

This growth, says the SMMT, aligns with the new car market and demonstrates the increasing demand and choice across the sector for new and used electric motors.

Petrol and diesel powered cars accounted for 92.1% of all used car transactions – down slightly from 94.3% last year.

Petrol remained dominant, up 6.8% to represent 57.1% of the market, while diesel transactions dropped by 2.4%, accounting for 35.0% of all transactions.

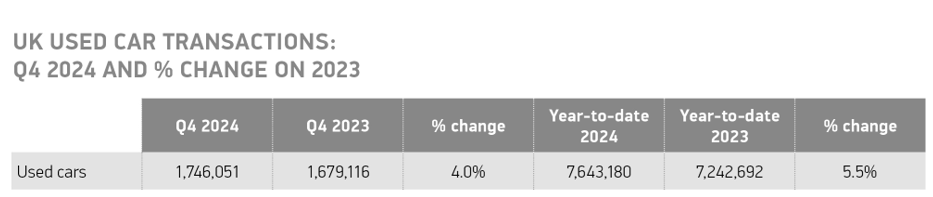

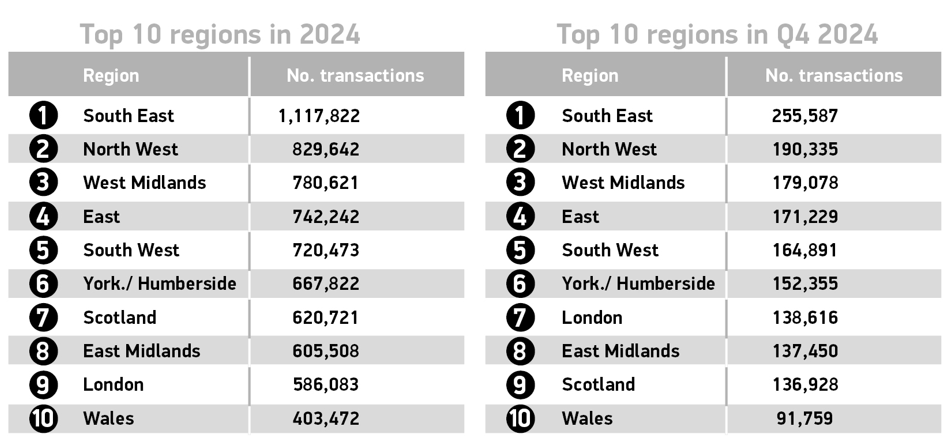

Overall, the UK’s used car market grew by 5.5% to 7,643,180 transactions in 2024.

With eight quarters of continuous growth, the year saw 400,488 more vehicles change hands than in 2023, with transactions rising in every month in 2024, as they did in 2023, with Q4 up 4% to 1,746,051 units.

The top three popular body types remained the same for another year, with superminis taking the top spot, accounting for one in three (32.3%) of all used cars sold in 2024.

Lower medium held second place, with a 27.1% share of the market and dual-purpose vehicles rounded off the podium, making up 15.9% of sales.

Dual purpose recorded the strongest rise in volumes, up 10.7%, reflecting they are now the bestselling segment in the new car market. At the other end of the spectrum, luxury saloons represented just 0.5% of the market.

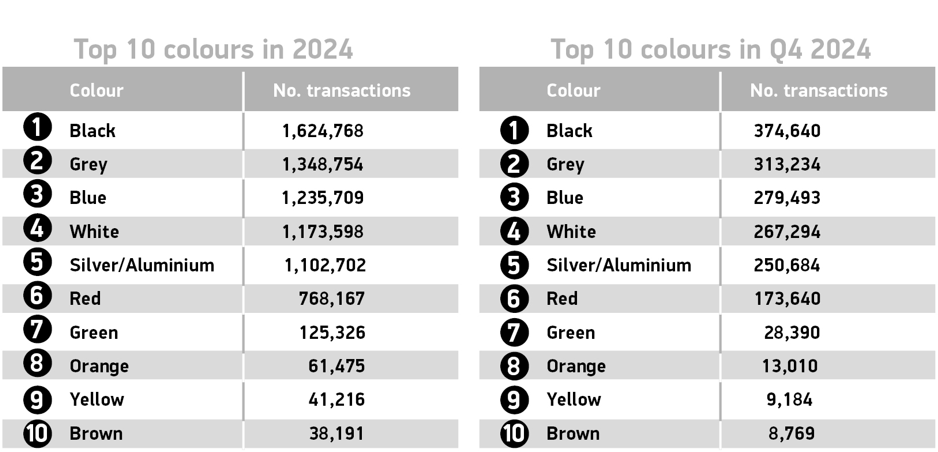

While grey remained most popular in the new car market, black cars were favoured among used car buyers, with more than 1.6 million (21.3%) opting for the colour.

Grey was second, with a 17.6% share and blue third, taking 16.2% of sales.

Combined, the top three hues accounted for more than half (55.1%) of all cars sold.

Meanwhile, 5,171 buyers opted for a pink motor – an increase of 301 vehicles on 2023, while 4,659 maroon cars found new owners, pushing the shade up to displace cream, which saw 4,657 transactions, as the least popular colour.

Turquoise cars saw the largest growth in 2024, up 11.2% to 8,266 cars, while grey saw the largest volume gain – up more than 117,000 units to 1.349 million.

Mike Hawes, SMMT chief executive, said: “The used car sector’s 25-month growth streak is good news for fleet renewal and for consumers benefitting from the greater choice filtering through from the new market.

“Record sales of second hand EVs also demonstrates strong appetite for these cutting-edge cars at lower price points.

“Ensuring ongoing growth, however, means maintaining that affordability, along with supply, which requires meaningful fiscal incentives to stimulate consumer demand for new EVs and removing the VED expensive car tax disincentive that risks dragging down used EV affordability for years to come.”

James Hosking, managing director of AA Cars, believes that the used car market is on a “roll”.

“Access to used EVs relies on a strong new car market, which supplies a steady stream of models at diverse price points,” he said.

“The more new EVs hitting the road today, the greater the affordability and variety for future second-hand buyers.

“To maintain this balance, stronger incentives are needed to encourage new EV adoption, ensuring a sustainable and accessible used market in the years ahead.”

Matas Buzelis, car expert at vehicle history checking service carVertical, added: “Many drivers remain hesitant to make the switch to electric, but increased supply is bringing average prices down and this is tempting more people into buying EVs and hybrids.

“The network of public charging points is also expanding quickly, providing reassurance to drivers that won’t run out of power while on the road.”

Philip Nothard, insight director at Cox Automotive, concluded: “The 2024 used car transaction results show 5.5% year-on-year growth and, more notably, a 3.6% increase above the pre-pandemic 2001–19 average, a positive sign of steady recovery for the UK’s used car market.

“This growth inspires optimism amid ongoing challenges in the wider automotive sector.

“With supply constraints and consumer confidence pressures still looming in 2025, any further gains will serve as a testament to the resilience of the second-hand market.”

Login to comment

Comments

No comments have been made yet.