A rush to hit Government zero-emission vehicle targets will create an unrealistic and unnatural market, with potentially far-reaching consequences over the long-term, Cox Automotive is warning.

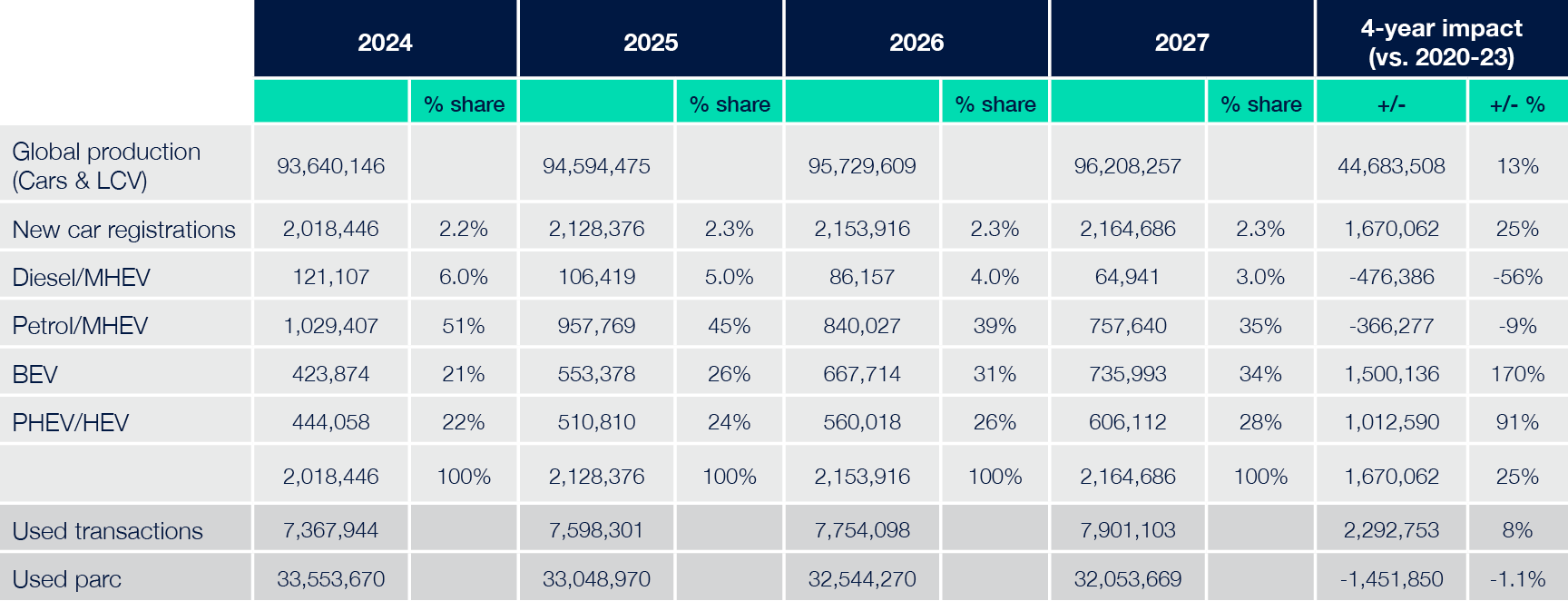

The zero emission vehicle (ZEV) mandate, which came into force this year, requires more than a fifth (22%) of cars and 10% of vans sold by manufacturers to be fully electric.

The targets for manufacturers increase each year, requiring 80% of new cars and 70% of new vans sold in Great Britain to be zero emission by 2030, increasing to 100% by 2035.

Fines of £15,000 will apply to each car sold outside of the target.

As a result, Cox Automotive is warning that the new car market in Q4 will be an extremely challenging period for the sector, potentially surpassing the pressure experienced during the economic crash of 2008 and the pandemic in 2020.

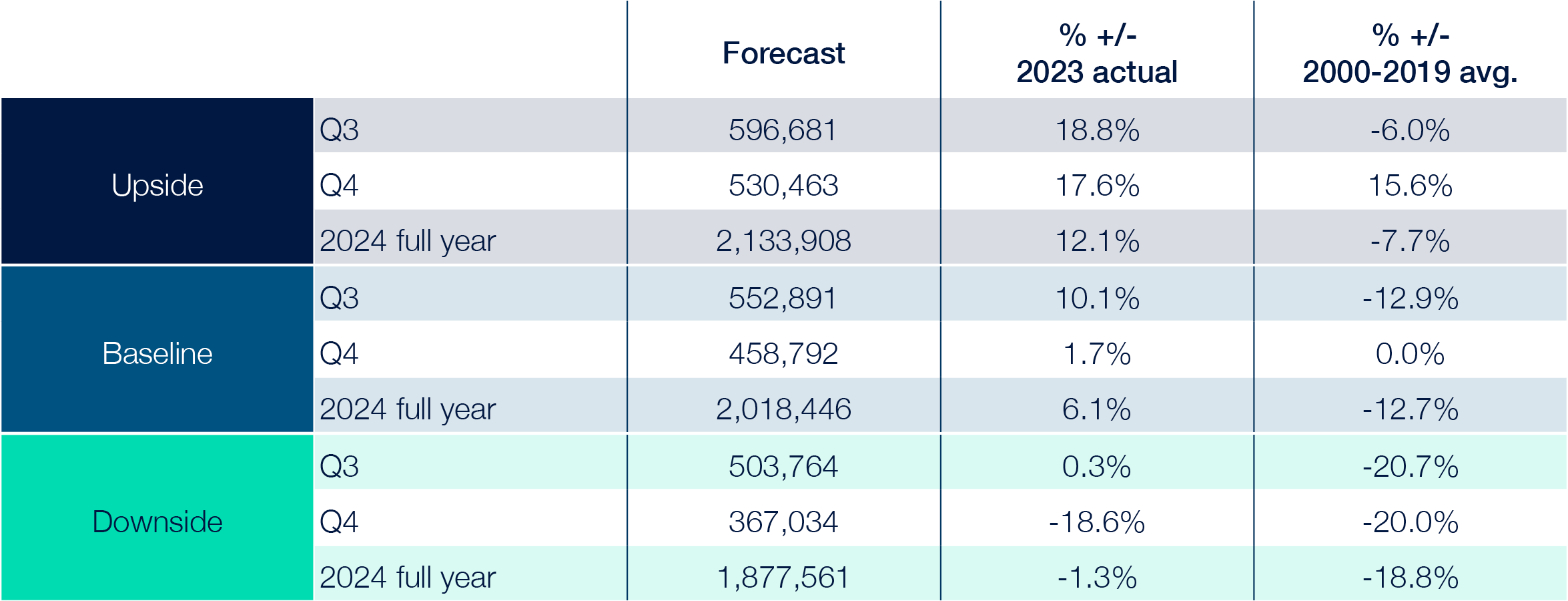

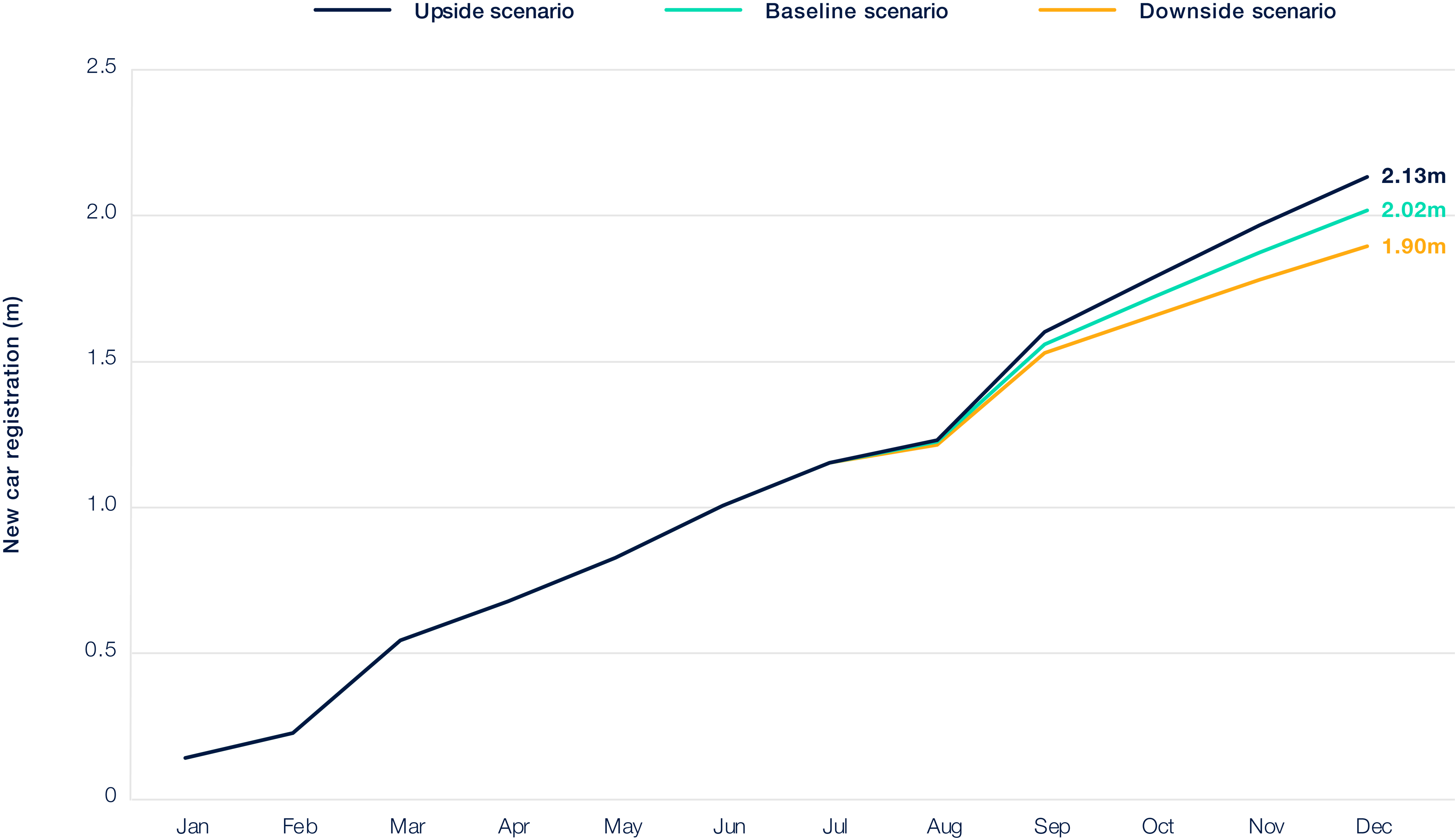

Publishing its revised 2024 new car forecast, it is predicting 2,018,446 registrations will be achieved by the end of the year.

This is a marginal 2% decrease on Cox Automotive’s previous baseline forecast and reflects the new car market the first two quarters and the volatility expected in Q4 as the ZEV mandate influences strategic and tactical activity on the part of many manufacturers.

Cox Automotive’s baseline forecast anticipates 552,891 registrations in Q3 and 458,792 in Q4.

The year will end 6.1% up on 2023’s full-year volume, which is 12.7% down on the 2000-2019 average.

Cox Automotive’s insight director, Philip Nothard, explains that, while the headline numbers are positive, how they will be achieved could have painful ramifications across the sector.

“There’s no doubt, the performance we’ve seen during the first half of this year, with over one million registrations for the first time this decade and 24 consecutive months of growth, is a good news story for the new car market,” he said.

“We've also seen major OEMs, including BMW, Mercedes, Renault and Peugeot, returning to form from a volume perspective. The net result is that registrations are tracking ahead of our baseline forecast at this point, and we remain confident that our forecast of two million registrations for the full year is realistic.”

However, how this number will be achieved is a cause for concern, he warns.

“Several prominent manufacturers have made it clear that non-compliance with the ZEV mandate is not an option and that they have no intention of paying penalties,” he explained. “But with EV sales falling well short of where they need to be, this leaves them with just a handful of options if they are to meet this pledge.

“They will either prioritise pushing EV stock into the market through aggressive fleet and retail price strategies or restrict the availability of ICE (internal combustion engine) and PHEV (plug-in hybrid electric vehicle) derivatives to force EV sales. Some may do both.”

Nothard warns that this will create an unrealistic and unnatural market, with potentially far-reaching consequences over the long-term.

He cites manufacturer and dealer profitability, consumer choice and residual values as likely casualties.

“Manufacturers are caught between a rock and a hard place,” he continued. “They’re under impossible financial pressure, facing increasing competition, and carrying the responsibility to fast-track the transition to zero-emission motoring.

“They have little choice but to push hard to make their EV products appealing to buyers, be that through financial incentives or by limiting the alternatives.

“Dealers will inevitably take on some of this burden, as will fleets and private buyers, in the form of unpredictable residual values when these heavily discounted EVs start to flood the used market in 12-36 months' time.”

With no Government concession on the ZEV timetable or any support mechanisms in sight, Nothard said: “The risk of significant challenge, unlike anything seen in over a decade, in Q4 is genuine.”

Read how credits will be key to carmakers achieving ZEV mandate targets this year.

Login to comment

Comments

No comments have been made yet.