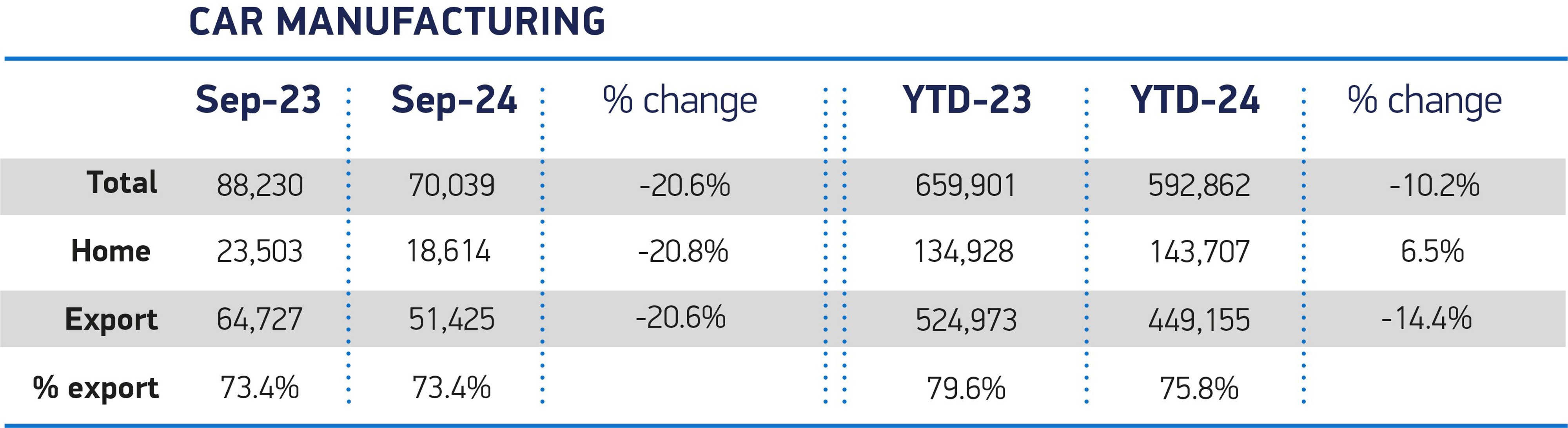

UK car production declined by a fifth (20.6%) in September, with just 70,039 units produced, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

The trade body says that the scale of the decline is, in part, exacerbated by comparison with a strong September 2023, which saw the best result for the month since 2020.

Factories have also been winding down production of current models and retooling lines for all-new zero emission vehicles.

Some 21,309 electrified models were made in September, representing almost a third (30.4%) of all cars produced despite an overall volume decline of 37% against the same month last year.

Output for domestic and export markets saw almost identical rates of decline, down 20.8% to 18,614 units and 20.6% to 51,425 units, respectively.

Continuing the trend as Britain’s leading market for finished vehicles, the EU took more than half (52.2%) of exports at 26,825 units, although volumes fell by 28.6%.

Exports to China, one of the top three export destinations, fell too, down 23.1% to 3,673 units and taking 7.1% export share, while those to the US rose 24.6% to 8,210 units and representing 16% of September’s exports.

In the year to date, a 6.5% rise in output for the UK was not enough to offset a 14.4% fall in overseas shipments, given the export-led nature of the sector, meaning overall UK car production is down -10.2% to 592,862 units, since January.

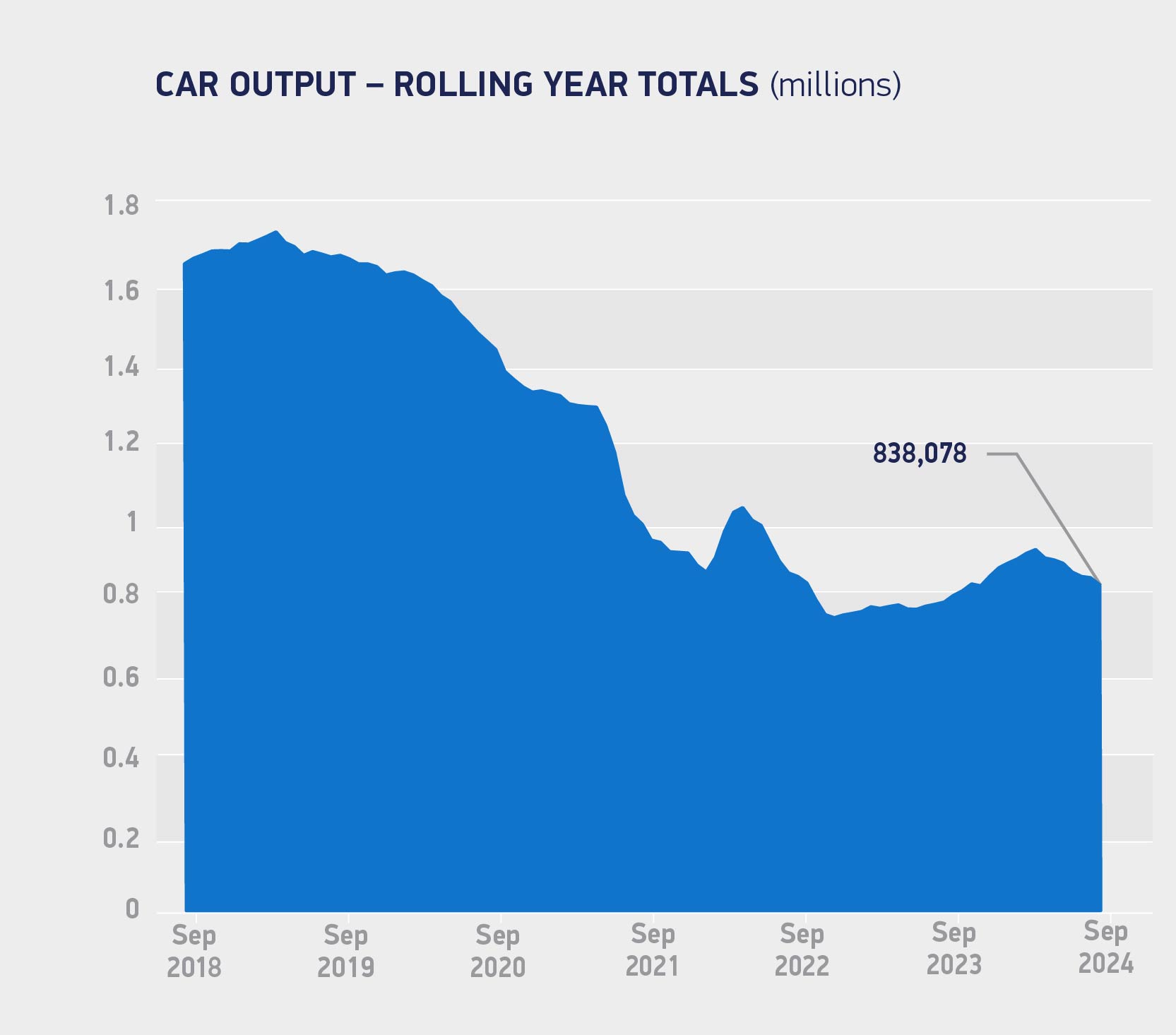

Growth is expected to return once new models come on stream, says the SMMT, with car and light van production forecast to head back above one million units in 2027 and with the potential to surpass 1.3 million by 2030.

Mike Hawes, the SMMT’s chief executive, said: “As UK Automotive undergoes its most radical transformation in more than a century, short term production declines were always anticipated, and they represent a temporary adjustment in exchange for long term growth.”

Despite a drop in car production this year, the sector remains Britain’s largest exporter of manufactured products, increasing its share of these exports to 13.9% in the first half of 2024.

The value of these exports has remained consistently high, driven by global demand for premium UK-made electrified vehicles, which are worth roughly one and a half times more than ICE models. Moreover, in the 12 months to June, the sector was worth £114 billion in total trade, encompassing £46.8bn in exports and £67.2bn in imports.

Hawes continued: “Following record investment announcements last year, the sector is ready to build on its position as the UK’s largest exporter of manufactured products.

“To do so, we need the necessary industrial and market conditions, and the forthcoming Budget and Industrial Strategy must put in place ambitious measures to bolster business confidence, attract investment and secure competitiveness.”

To ensure the industry’s hugely important contribution to UK economic growth can continue, and grow, SMMT is calling for the Autumn Budget to include the incentivisation of private consumer demand for battery electric vehicles (BEVS), which would accelerate market transition and stimulate industrial growth.

In addition, the funding secured within last year’s Advanced Manufacturing Plan should be reaffirmed; access to competitively priced low carbon energy secured; and measures introduced to encourage investment, especially in the zero-emission powertrain supply chain and skills, it says.

Login to comment

Comments

No comments have been made yet.