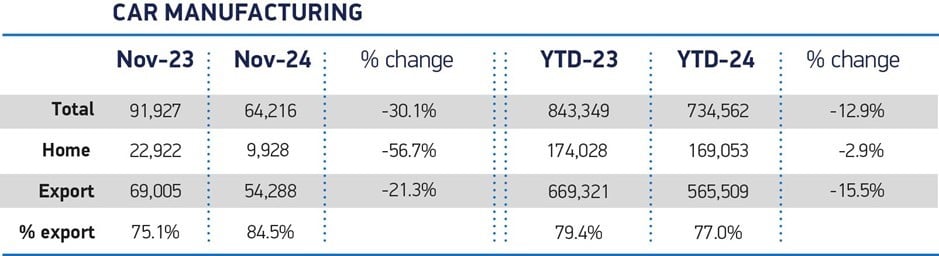

In what was the ninth consecutive month of decline, UK car production fell by almost a third (30.1%) in November.

New figures, published by the Society of Motor Manufacturers and Traders (SMMT), show that 64,216 cars rolled off factory lines, 27,711 fewer than in November last year.

The SMMT says that this was due to a combination of factors, including strategic product decisions, weakness in key global markets, ‘calendarisation’ and the fact that production grew significantly in November 2023 as Covid-related supply chain challenges faded.

All major manufacturers experienced declines, representing the worst performance for the month since 1980.

Output for both domestic and export markets fell sharply, down by more than half (56.7%) and a fifth (21.3%) respectively, with more than eight-in-10 cars shipped overseas and more than half of these (52.3%) heading into the EU.

Some 19,165 battery electric, plug-in hybrid and hybrid electric cars were made in the month, representing almost a third (29.8%) of output, despite volumes declining by 45.5%.

From January to November, UK carmakers have produced more than a quarter of a million electrified vehicles, down 19.7% on the same period in 2023 due primarily to model switchovers taking place at major plants.

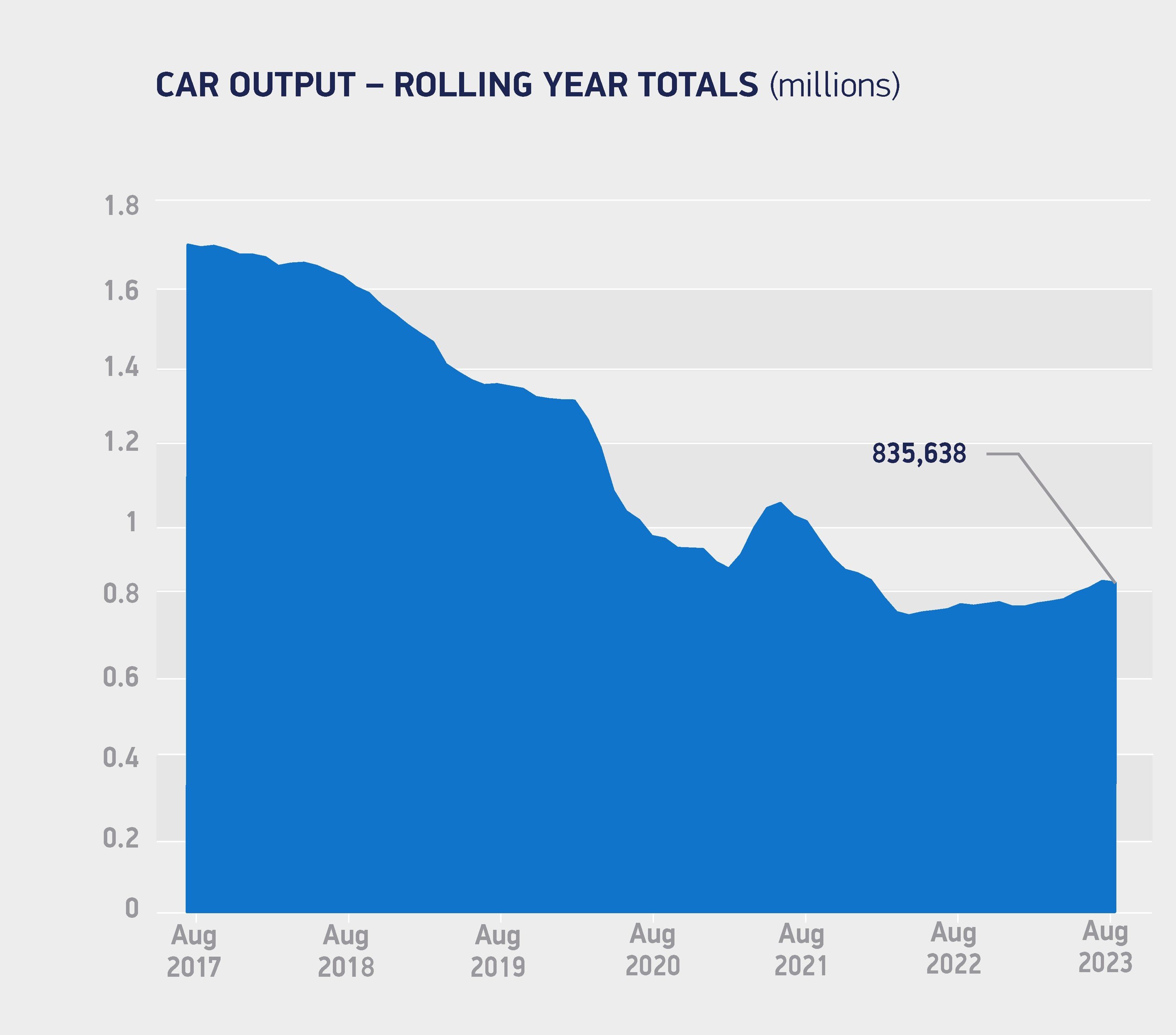

In the year to date, UK car output has now fallen by 12.9% to 734,562 units – 108,787 fewer than the same period in 2023 and almost half a million short of 2019 volumes.

Given the restructuring that is taking place across the global automotive industry which has seen plant closures, including the UK over this period, and the changes underway as companies transition from ICE to EV production, a decline was expected, says the SMMT.

Mike Hawes, chief executive of the automotive trade body, said: “These figures offer little Christmas cheer for the sector.

“While a decline was to be expected given the extensive changes underway at many plants, manufacturing is under pressure at home and abroad, with billions of pounds committed to new technologies, new models and new production tooling.

“Government can help by supporting consumers in the transition, fast tracking its Industrial Strategy for advanced manufacturing and, most urgently, reviewing the market regulation which is putting enormous strain on the sector.”

The SMMT says that the UK government must act quickly by introducing incentives for private consumers, boosting infrastructure rollout and fast tracking an industrial and trade strategy that delivers competitive conditions including cheaper low carbon energy, new skills and measures to attract further investment.

Most urgently, however, it says that it must publish its consultation on the changes to the ZEV mandate regulation, as the link between a vibrant local market and healthy local production is a critical one.

Last month, the Government will launch a 'fast track' consultation on electric vehicle (EV) sales targets in the zero emission vehicle (ZEV) mandate after mounting pressure from the auto industry.

Business secretary Jonathan Reynolds confirmed that a consultation would be launched in the coming weeks at the SMMT’s annual dinner on November 27.

However, he stressed that the Government is still committed to the 2030 phase out date for petrol and diesel vehicles, but said it is clear there is a need for more support to make the transition to electric a success.

The ‘fast-track’ consultation is yet to be launched by the Department for Transport (DfT).

Johnathan Dudley, head of manufacturing at tax, audit, advisory and consulting firm Crowe UK, said: “Output is clearly linked to falling demand and there is little doubt the current economic outlook and mounting job uncertainty is affecting this situation.

“It's further frustrated by the effects of EV quota penalties which are now "under review", but this could be too late for the Luton van plant.

“The effect on the supply chain is huge: vehicle manufacturers work on "just in time" and therefore any reduction in component orders will immediately be passed down to businesses in the supply chain.

“Many of these suppliers are funded using receivables finance and so any sales downturn will suck cashflow out of their business - it's highly likely intervention through Government support will be needed over the coming months to prop up the supply chain.”

He added: “The Government’s recent green paper on the industrial strategy sets out a roadmap for growth. However, to achieve this, supply chain security and retention of skills is vital.

“In a world striving for growth, the business secretary needs closely monitor market movements and be ready and willing to respond in a way that is both bold and pragmatic. Otherwise, people's livelihoods, and the success of the industrial strategy, could be on the line.”

Login to comment

Comments

No comments have been made yet.