UK car production volumes rose by 21% to 82,997 units in January, making it the fifth straight month of growth as global demand for British-built brands continued to grow.

The figures, from the Society of Motor Manufacturers and Traders (SMMT), show that the bulk of production was for export (75.8%), with overseas shipments up 11.6% to 62,938 units – a rise of 6,559.

However, output for the domestic market commanded the biggest volume growth, up by an additional 7,863 units (64.5%).

The EU was the largest global market for British-built cars, taking more than half (53.2%) of exports, followed by the US (15.0%), China (10.5%), Japan (2.8%) and Australia (2.3%).

Shipments to the EU, US and China all rose, by 5.0%, 81.1% and 33.2% respectively.

UK production of battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) vehicles rose again by a combined 4.5% to 29,590 units to account for 35.7% of overall output.

In line with overall figures, the majority of these models were exported.

Mike Hawes, the SMMT’s chief executive, said: “A positive start to the year for UK car production bodes well for the industry and the many thousands of livelihoods on which it depends.

“There can be no room for complacency, however, given economic headwinds and geopolitical tensions. There must be a relentless commitment to competitiveness, building on the significant recent investments into the sector.

“The forthcoming Budget is a chance for Government to do just that by introducing measures to boost UK automotive manufacturing, focused on energy, investment competitiveness and market demand.”

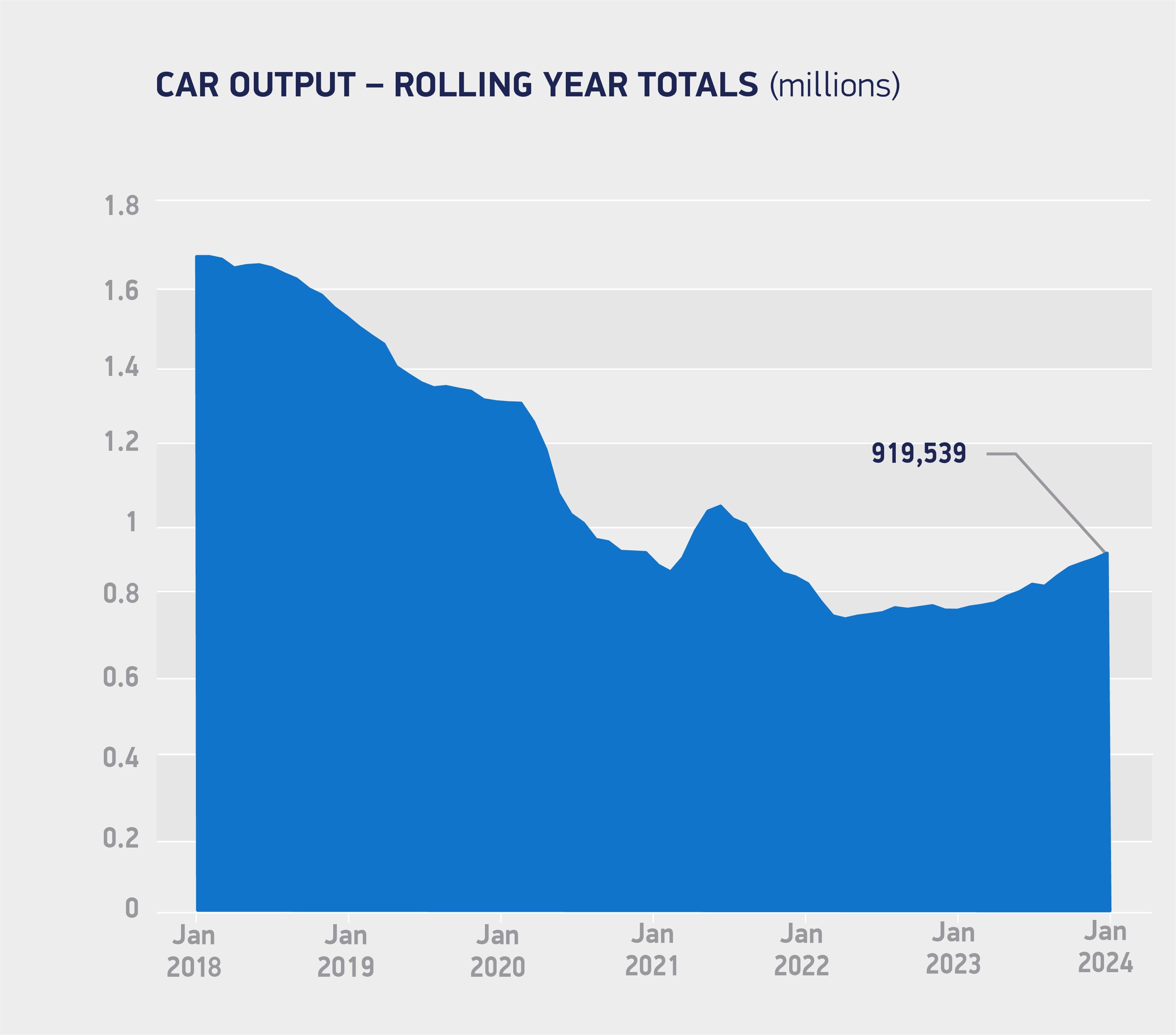

While the scale of any impacts on UK car manufacturing arising from attacks on shipping in the Red Sea has yet to be seen, the latest independent outlook, made in November, foresees UK car and light van production rising by some 3% in 2024 to 1.04 million units.

Richard Peberdy, UK head of automotive for KPMG, said: “UK car manufacturing continues to scale-up its output, fuelled by production line investments for the development of hybrid and electric vehicles, as well as in new models of all fuel types.

“Electric vehicle demand is largely being driven by low benefit-in-kind tax and write-down allowances for businesses, including company car and salary sacrifice schemes for employees. But growing private sales of new EVs is proving challenging.

“The UK automotive industry is hoping that the Budget contains measures to incentivise consumer EV purchasing, whilst also hoping for further measures to attract inward investment and boost the UK car industry's competitiveness."

Login to comment

Comments

No comments have been made yet.