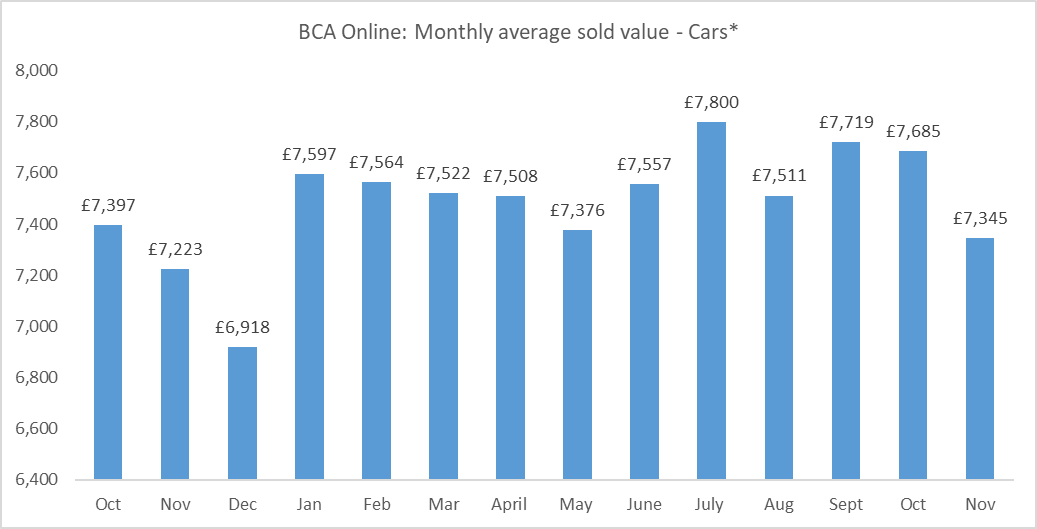

Used car values averaged £7,345 across the board at BCA in November 2024, with supply and demand well balanced and reflecting typical seasonal.

While the move from the October position of £7,685 was driven by a shifting stock mix and a very seasonal monthly guide price move, the general market strength saw average values remain ahead year-on-year.

Sold volumes continued to be significantly ahead of the same period last year and, with more than 10,000 different buyers purchasing during the month, the strong engagement levels seen throughout much of 2024 continued.

Stuart Pearson, BCA chief operating officer, said: “The used market remained positive in November, with good levels of demand from professional buyers and a steady price performance that reflected the typical seasonal pressures at this time of the year.

“The overall feeling is that the market is well balanced as the year draws to a close and the anticipation is that 2025 is going to get off to a good start.”

He continued: “Since the pricing realignment experienced in the final quarter of 2023, the used car market has remained positive throughout most of this year, bringing confidence to professional buyers and a level of optimism perhaps not seen for a few years.

“Prices have been generally stable and the inventory disciplines that have been adopted leave most businesses in good shape to take advantage of the spike in demand that is eagerly anticipated into the New Year.”

Pure EV models drive rise in AFV margins

Separate data from Dealer Auction’s EV Performance Review shows that the average gross margin for alternatively fuelled vehicles (AFVs) in November jumped by just under a third on October’s data, rising 31.4% from £2,819 to £3,664.

The average sold price on the trade-to-trade platform also rose – 7% month-on-month.

Last month signalled a major shift in the used AFV profile, with models dropping in age and mileage. This trend continued in November: the age profile dropped 3.4% to 3.4 years.

While mileage was a much more negligible drop than last month’s 15% (November saw it drop just 0.4% to 32,612 miles), models are still carrying significantly fewer miles than at the start of the year, which will no doubt appeal to buyers.

While ad views on electric vehicles more than doubled from 2,819 to 7,419, a drop in hybrid views put the overall ad views in the negative for November, with 16.4% fewer views.

Dealer Auction’s marketplace director, Kieran TeeBoon, said: “The £800-plus rise in average retail margins is significant.

“Consumer awareness of EVs is obviously crucial to making a profit, but that’s only part of the picture. Profit also comes from acquiring the right stock quickly to meet demand.”

Star performers included the Volkswagen ID.3, which was the highest-placing EV by volume sold and also placed 5th in the top margin chart – it was also one of the speediest sellers, selling in 25 days on average.

On the hybrid side, the Toyota Auris topped the chart for CAP performance (180.8%), while the Hyundai Tucson topped the volume chart.

In the margin top 10, the big hitter from June, August and October, the Lexus RX hybrid, just managed to stay in the top 10, with the Audi e-tron taking the top spot with an average gross margin of £6,551.

TeeBoon continued: “November marked a pivotal moment in the EV Performance Review, as electric vehicles surged ahead in key performance metrics.

“While hybrids have long reigned supreme, the latest data could signal a turning tide. As we head towards 2025, it’s clear that electrification is no longer a future ambition but fast becoming a present reality.”

UK is currently the most stable retail used BEV market in Europe

The retail used battery electric vehicle (BEV) sector in the UK remains the most stable of the 13 major European countries, according to Indicata’s monthly Market Watch report.

The report shows used BEV sales taking a 4.8% share of the UK market while zero emission cars accounted for 5.1% of used car stock sitting on dealer forecourts, which shows retail supply and demand are currently well matched.

While this supply figure does not consider BEVs sitting in the UK wholesale market it bodes well for a healthier used EV market moving into 2025 than experienced over the past two years.

Only Denmark comes close to this level of stability with BEVs taking a 38.2% share of sales whilst boasting a 31.5% share of dealer stock whereas most European countries are faced with a major overstocking of used BEVs.

Meanwhile, UK retail BEV prices rose again between October and November by 0.7% according to Indicate data, and by 1.4% between August and November. This is the first real sign of used BEV price stability in 2024.

This price consistency in no way makes up for a 43% reduction in UK BEV retail prices and the subsequent residual value losses experienced since January 2023, but it does provide a glimmer of hope for those underwriting future residual values.

“Residual value setters who shape attractive leasing rates will play a major part in helping OEMs reach next year’s ZEV mandate target where 28% of new cars must be battery electric,” said Dean Merritt, Indicate UK head of sales.

“While they will not want to be too optimistic with residual values, new BEV discounts are likely to contribute to more affordable rates for all BEVs.

“The ZEV mandate will continue to have a significant influence on the used car market over the coming years and will push more BEVs into the used car market as new sales increase. If the blend of supply and demand continues in its current vein, we can see the used BEV market providing more stability during 2025,” he added.

Login to comment

Comments

No comments have been made yet.