A flat year for the used car market is being predicted by Cox Automotive, with 7.6 million used car transactions expected by the end of 2025.

It reports that vehicle prices show early signs of stabilisation, especially across electric vehicle (EV) models, which it says is a positive development given the used EV parc is set on a significant growth trajectory over the next four years.

Following a sluggish start to the year, trade values and first-time conversion rates are firming and overall performance against Cap Clean is increasing, especially in the lower price bandings, it added.

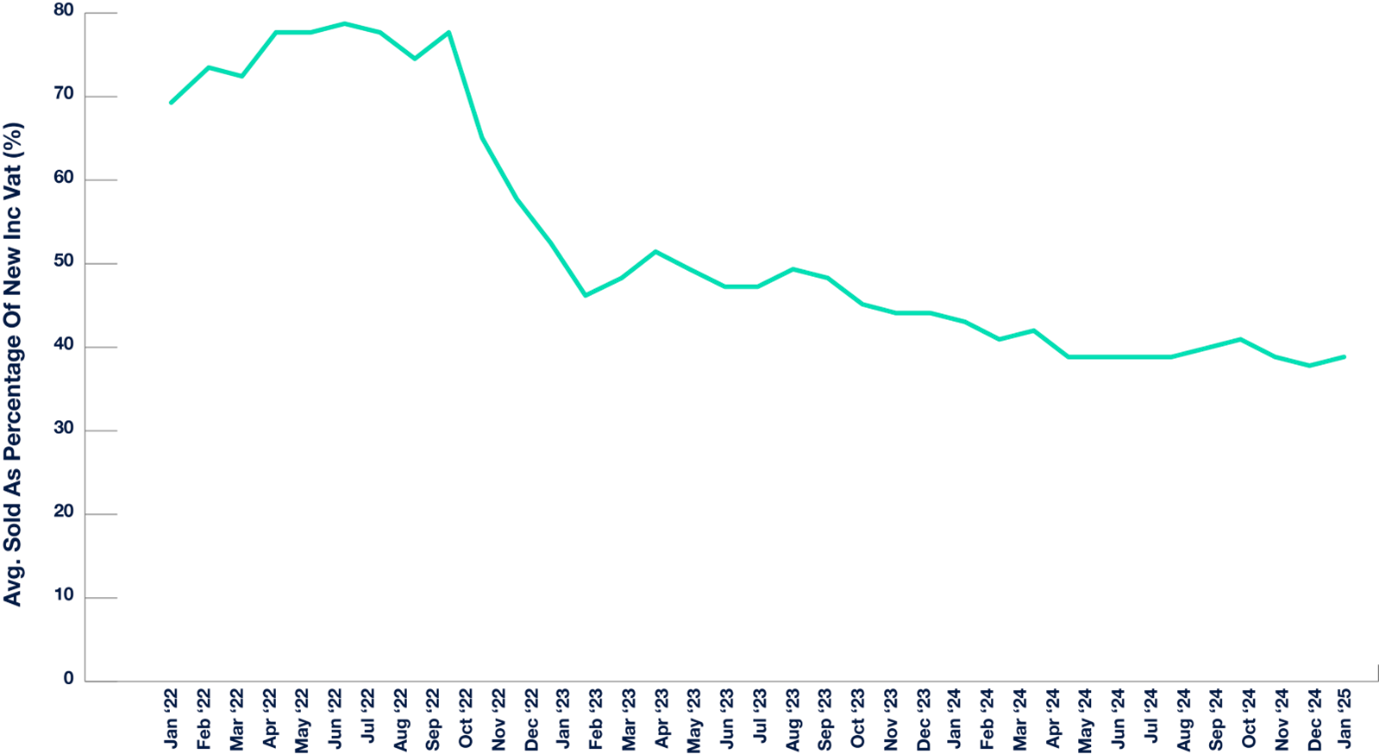

Electric Vehicles - Sold Price as a Percentage of New Car Price

Source: Manheim Auction Services

Cox Automotive is predicting values to stay strong due to a supply gap from recent years of low registrations in the first half of 2025.

They will likely continue until prices return to standard depreciation patterns in the third quarter.

As interest rates and inflation hopefully stabilise further this year, Cox Automotive believes consumer demand is also likely to increase.

EVs and hybrids are expected to see substantial growth in their share of the car parc by 2028.

Both plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs) are projected to increase their share by 87.37% while EVs will increase by 177.45%.

Meanwhile, petrol cars will see a minor decrease in the same time period by approximately 5.97%.

Although petrol ownership is projected to remain relatively stable, the same cannot be said for diesel.

The share of diesel in the car parc is projected to decrease significantly by 2028, driven largely by stricter emissions regulations, changes in production volumes, supply chain efficiencies and shifting consumer preferences.

Looking back at 2024, as little as 123,000 new diesel vehicles were registered compared to 1,065,879 in 2017, says Cox Automotive.

This trend will filter through into the used market, limiting the supply of newer diesel models but also declining consumer interest in this vehicle type.

However, despite progress in building the UK’s EV car parc, challenges remain.

The used market for EVs is expected to remain fragmented as they are generally priced lower than their internal combustion engine (ICE) counterparts, posing challenges when it comes to retaining their value.

This combined with regulatory pressures, including VAT charges on charging, the changes to benefit-in-kind (BIK) tax rules for PHEVs (which could drive up the rate for certain models from 8% to 24%), Vehicle Excise Duty and the prospect of road pricing means that an air of uncertainty lingers around the used electric market, it says.

Used values show ‘modest’ increase

In separate analysis from Cap HPI, used car values in February saw a modest increase of 0.4%, equivalent to £40, at the three-year, 60,000-mile benchmark.

The data was driven by a resilient retail market that has continued to support the wholesale sector, leading to largely positive trading conditions.

Conversion rates stayed strong from January into February, consistently averaging between 70% and 80%.

In some instances, sales exceeded these levels, with certain vendors, particularly in fleet sales, regularly achieving 100% conversions.

Dealer and part-exchange sales also performed well, report Cap HPI, reinforcing the high level of engagement from buyers.

Car supermarkets, independent retailers, and franchise dealers remained highly active, a positive indicator for this time of year.

Chris Plumb, head of current car valuation at Solera Cap HPI, said: “With ongoing uncertainty in the new car market, particularly as private registrations remain subdued, some franchised retailers are placing greater emphasis on expanding their used car operations and strengthening their aftersales business to mitigate potential revenue pressures, which in turn increases competition for vehicles through wholesale channels.

“The result has been upward pressure on values in recent weeks, marginally above the seasonal norms.

“The value movements reinforce a continued market focus on price-sensitive stock - vehicles that offer an attractive upfront cost or lower monthly finance payments.”

February saw the first upward movement of the year, with the average seasonal movement being a small increase of 0.3%.

Since the introduction of Cap Live in 2012, there have been only three instances where average values dropped marginally (2017, 2021, and 2022).

When analysing by price band, the most significant gains in percentage terms were seen in vehicles priced up to £5,000, which increased by 1.8% (£60), followed by a 1.3% (£90) rise for those between £5,000 and £10,000, and a 0.7% (£85) increase for models in the £10,000 to £15,000 range.

All other price bands recorded increases, except for vehicles priced between £30,000 and £50,000, which declined by 0.1% (£60), and those over £50,000, which saw a slight drop of -0.2% (£160). At one year old, values edged up slightly by 0.1%.

Used BEV volumes increase

Used battery electric vehicle (BEV) wholesale volumes continue to grow, with record month-on-month and year-on-year increases.

However, rising supply puts pressure on specific models, and attractive new car offers further influence the market, making new BEVs more appealing than their nearly new counterparts.

In many cases, the monthly PCP payment on a brand-new BEV remains lower than that of a used model, limiting the demand for younger second-hand examples.

Used BEV values have declined across all the age and mileage profiles.

At one year and 10,000 miles, values dropped by 1.6% (£540), while at three years and 60,000 miles, the decline was also 1.6% (£350). Five-year-old BEVs saw the steepest drop at 2.2% (£400).

Plumb concluded: “With the arrival of the new ‘25’ plate from the 1 March, we anticipate increased volumes within the used car market as fleet returns and part-exchanges filter through.

“At the same time, manufacturers are offering competitive new car deals, particularly on BEVs, as they push for market share and work towards their VETS targets.

“However, any impact on used values is unlikely to be felt until April at the earliest, and even then, any downward pressure is expected to be moderate.”

Login to comment

Comments

No comments have been made yet.