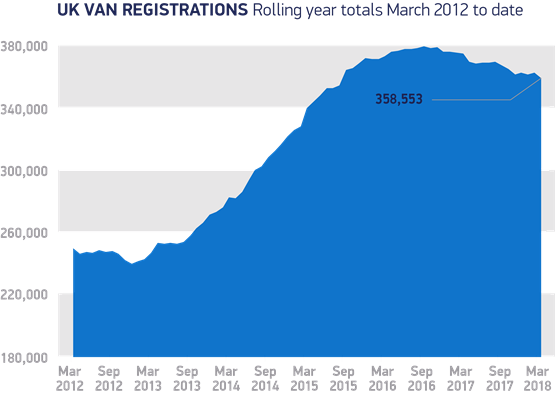

Light commercial vehicle (LCVs) registrations declined in March, according to figures released by the Society of Motor Manufacturers and Traders (SMMT).

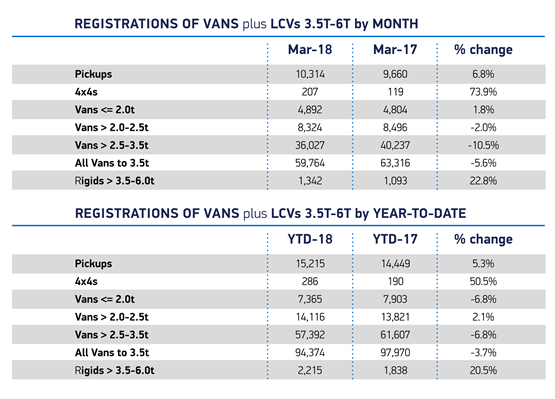

Just under 60,000 new vans hit UK roads last month, representing a 5.6% decline on March the previous year.

Vans weighing less than 2 tonnes, pickups and 4x4s all saw demand increase in the month, up 1.8%, 6.8% and 73.9% respectively. However, this failed to offset a decline for medium and heavier vans, with registrations of vehicles weighing 2-2.5 tonnes down by 2% and vehicles 2.5-3.5 tonnes falling by 10.5%.

Mike Hawes, SMMT chief executive, said: “A decline in the important plate change month of March is a concern and we need the right economic conditions to restore market stability and encourage buyers to invest in new commercial vehicles. The new van market is a key barometer of business confidence and while uncertainty remains, a degree of fluctuation in demand is to be expected this year.”

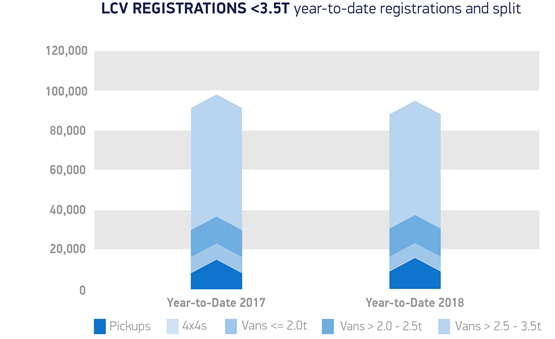

Year-to-date, 94,374 new LCVs have been registered on UK roads, a drop of 3.7% on the first quarter in 2017, with the bulk of the decline in the market for vans weighing 2.5-3.5 tonnes.

Russell Adams, commercial vehicle manager at Lex Autolease, said: “As we’d expect, March was a good month for van registrations as businesses look to take advantage of the new number plates. However, in a year that’s been fairly flat for the market, it’s not surprising that overall sales were down year-on-year.

“A big factor in the slowdown is that businesses are taking a lot more time over their purchasing decisions. Political uncertainty and looming tax and regulatory change has undoubtedly encouraged businesses to pause for thought, but the increasing amount of choice available in the market is just as much a factor.

“Understandably, it takes more time to consider the increasing range of options available – smaller panel vans, for example, that can take on job roles traditionally performed by heavier vehicles. There is also the potential for new driving technology and fuel types to explore.

“Across the board, we’re seeing enquiries focus far more on whole-life cost, which in turn, is causing businesses to consider when and how ULEVs could play a role for them as well."

Login to comment

Comments

No comments have been made yet.