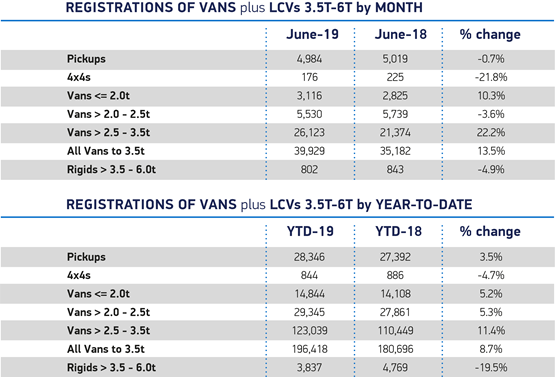

New van registrations rose by 13.5% in June, the sixth consecutive month of growth and a record first six months of the year, according to the Society of Motor Manufacturers and Traders (SMMT).

Demand for smaller vans weighing less than 2 tonnes rose 10.3%, while registrations of larger vans weighing 2.5-3.5 tonnes rose 22.2% in June.

However, growth in demand for pickups and 4x4s slowed again, with registrations down 0.7% and 21.8% respectively, and the market for medium sized vans weighing 2.0-2.5 tonnes also posted a fall, declining 3.6%.

In the first six months of 2019 the LCV market was up 8.7% and ahead of expectations, says the SMMT.

There were 196,418 new vans registered – 15,722 more than in the same period last year. Except for 4x4s, sales volumes of which are relatively small, all segments posted healthy rises with the strongest growth seen in demand for larger vans weighing 2.5 to 3.5-tonnes.

Mike Hawes, SMMT chief executive, said: “With many light commercial vehicles playing a crucial role in urban areas, getting more of the latest, cleanest and most fuel efficient models on to our roads is essential to help improve air quality – so it’s good news to see the UK van market performing so well.

“However, it’s important to remember that purchasing patterns are cyclical and for this trend to continue we need business confidence to improve and political uncertainty to end with a good Brexit deal.”

Nigel Base, SMMT’s commercial vehicle manager, says that the SMMT’s recent van report highlighted the structural change in transport and logistics that has been taking place across the UK over the past 10 years.

“The all-time record van registration figures released today send a clear message that this change continues,” he said. “Numbers for the first half of this year are more than 4,000 units higher than the previous record in 2016 and confirm the long-term shift towards heavy vans.

“But perhaps even more startling is that registrations of Alternatively Fuelled Vehicles (AFVs) are over 200% up on the same month last year.

“Granted this is from a low base but nonetheless it’s the beginning of what is likely to be a long-term shift in the market as manufacturers introduce new products.

“The UK is clearly moving towards a more efficient logistics and service delivery model. However, all of this success could be undermined by the current political uncertainty and the risk of a no-deal Brexit. Such a scenario needs to be taken off the table and a sustainable compromise put in its place.”

Login to comment

Comments

No comments have been made yet.