A shift in stock mix is heavily influencing the used van market compared to earlier in the year, according to BCA.

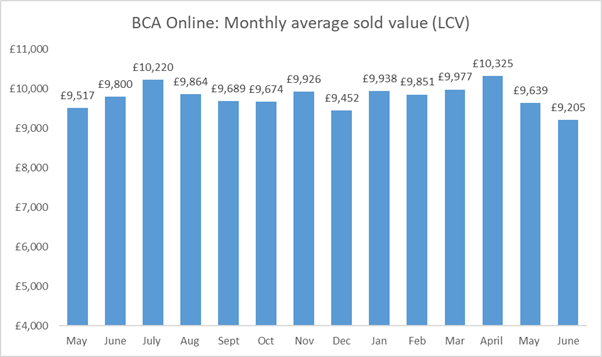

Used light commercial vehicle (LCV) values averaged £9,205 across June, down by £434 (4.5%) compared to May, representing the lowest monthly average value recorded in over two years.

Sold volumes of light commercials remained positive across BCA’s daily programme of online LCV sales as buyers and vendors remained reasonably aligned on pricing expectations. Buyer numbers continued to rise month-on-month, as they have for most of this year.

However, performance against price guides fell to 97.5% (from 98.9% in May), underlining the widening disparity between values paid for the very best condition LCVs and those realised by more poorly presented vehicles.

Stuart Pearson, BCA’s chief operating officer, said: “The two-tier market developing in the LCV sector is typically seen when volumes rise with an influx of poorer quality stock affecting the mix.

“Vendors are increasingly aware that vehicles in poorer condition have to be valued realistically to generate attention from buyers.

“This is exacerbated when corporate volumes of similarly specified, base colour and often poor condition vans are added to the mix – these have to be carefully managed to avoid depressing overall values.”

However, in contrast, interest for well presented, better grade vehicles that can purchased and retailed from the forecourt quickly remains as high as it has all year.

“We continue to see some exceptional values generated for LCVs with a strong retail specification and in a good colour, particularly for vehicles with a relatively low mileage and on a recent registration plate,” he added.

“Whatever the market conditions, valuing stock in line with market expectations is critical to successful remarketing.

“Supply and demand will always influence values, with the best quality stock continuing to attract premium prices and sellers needing to pay close attention to the condition of older stock.”

Aston Barclay reports buyers becoming more selective

Dealers paid strong money for used LCVs in good condition in Q2, according to Aston Barclay’s market insights report.

Prices rose in Q2 by a healthy 17.2% (£1,442) from Q1 helped by a fall in average mileage from 102,933 to 94,000 miles and a consistent average age of 61.3 months.

Auction conversion rates were running consistently high at 75% despite signs that used volumes were increasing on the back of improved new vehicle production.

Dealers, however, were being more selective about bidding on vehicles with damage and what they were prepared to pay, said Aston Barclay.

With more used volumes gradually entering the market it has become imperative that vendor reserves reflect the change in market conditions, particularly on damaged vehicles.

The used value guides are yet to reflect the changing market conditions which makes setting reserves on individual vehicles important to keep conversion rates high.

Q2 also saw the effect of higher interest rates on some smaller businesses who became more cautious when buying replacement or additional used LCVs to protect their cashflow.

This has helped increase demand for used stock with full-service histories and in good condition as SMEs planned to keep their vehicle ownership costs under control, it said.

Geoff Flood, Aston Barclay’s national LCV manager, explained: “We are starting to see a market correction based on used volumes improving and demand slowing down as we enter the summer period.

"Add to that used value guides being out of sync with the market then everyone is having to work harder to keep the market moving. Importantly the market remains stable.”

Login to comment

Comments

No comments have been made yet.