Fleet operators are investing in new zero emission trucks, with electric and hydrogen registrations up by 265.6% to 234 units in 2023, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

However, these vehicles accounted for just 0.5% of the market, despite the end of the sale of new, non-zero emission trucks under 26 tonnes coming in 2035.

The SMMT says that operators need certainty that making the switch will be commercially viable against tight margins.

The benefits are clear, including a reduced carbon footprint and more efficient operations, but there are acute concerns over the lack of public charge point infrastructure.

The SMMT is calling for a national charge point strategy that includes support for HGVs.

Mike Hawes, chief executive of the SMMT, said, “Two years of growing demand for the very latest, fuel efficient trucks amid testing times reflects these vehicles’ importance to the British economy – and with some HGVs facing the same 2035 end of sale date as cars and vans, the sector is also critical to our green goals.

“Increasing availability of electric and hydrogen models – and record demand for them – is encouraging market growth but operators need cast-iron confidence to switch.

“More than ever, Government must compel truck infrastructure rollout and provide a signal that the time to invest is now.”

Overall HGV demand up

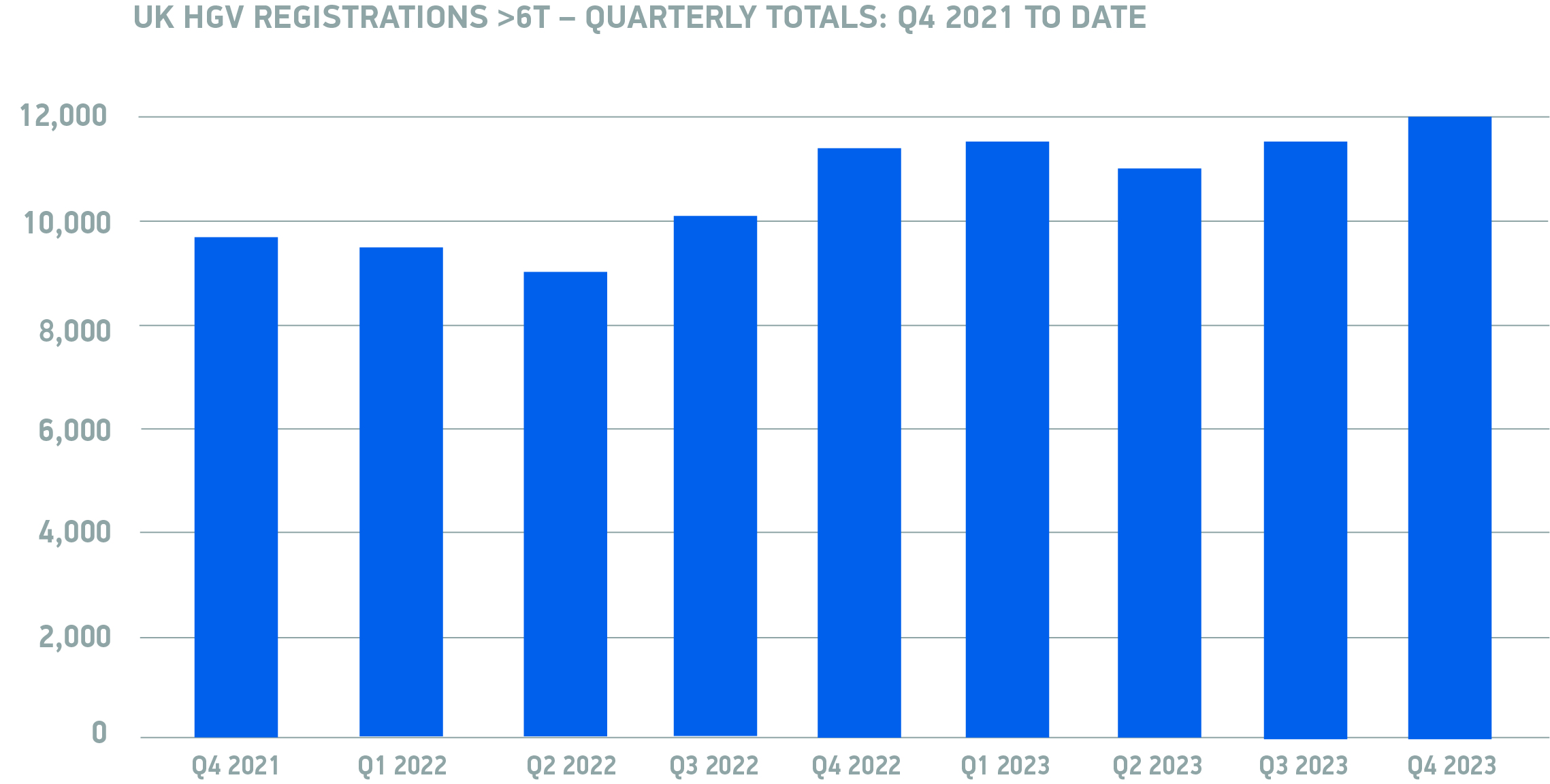

Overall, the SMMT figures show that demand for new heavy goods vehicles (HGVs) grew for the second year running with UK registrations up 13.5% in 2023.

There were 46,227 new trucks of all types and sizes registered last year, representing the best annual total since 2019, as more businesses invested in their fleets.

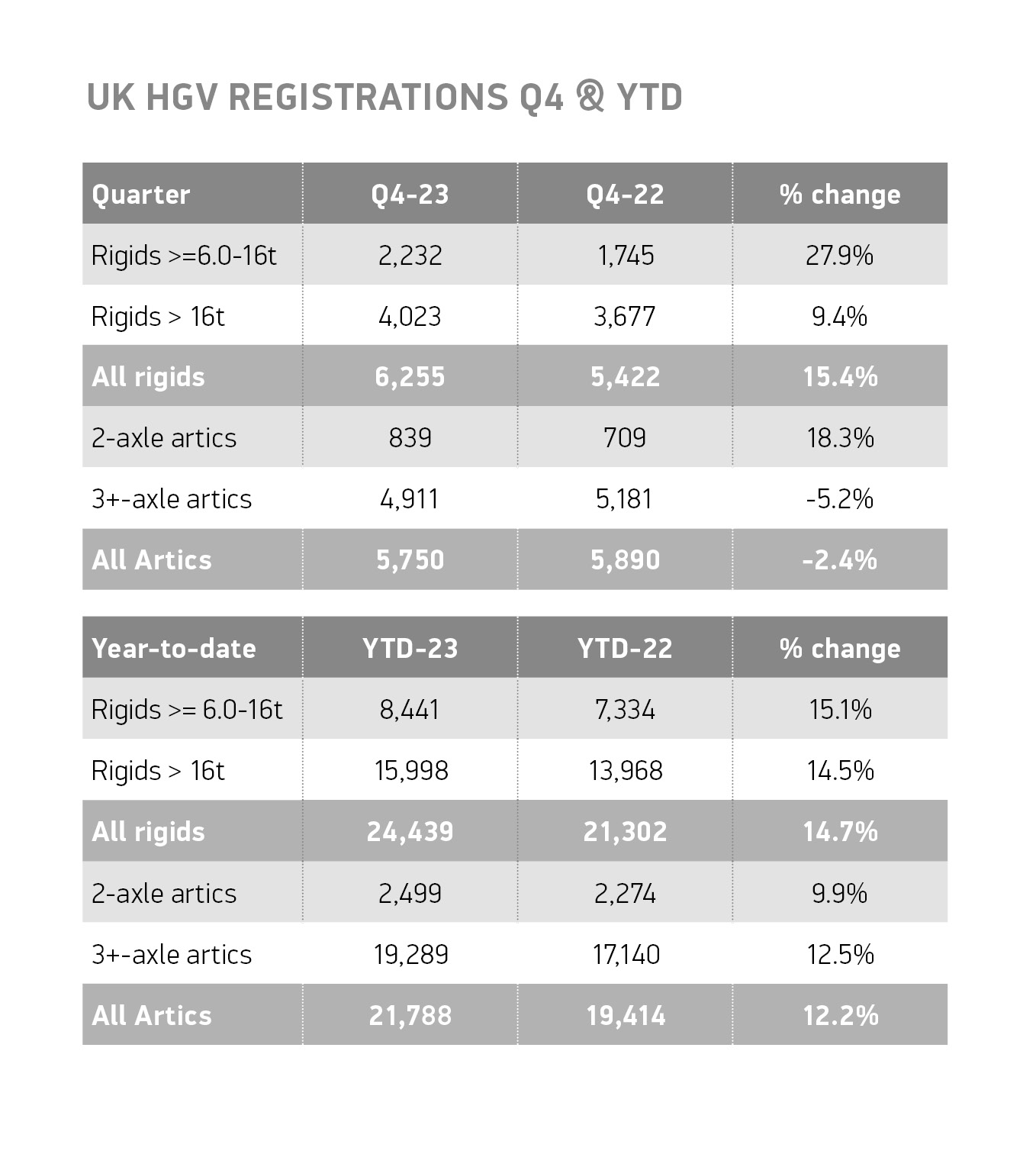

The bulk of new HGVs were rigid trucks, up 14.7% to 24,439 units – more than half (52.9%) of the market – while demand for articulated trucks was also strong, rising 12.2% to 21,788 units.

More specifically, the most popular truck body type continues to be tractors, typically used for the largest delivery trucks, up 12.4% to represent some 46.4% of the market.

Demand for box vans – typically used for chilled and fragile goods distribution in urban areas – rose 19.2%, while uptake of curtain-sided trucks and refuse vehicles increased by 37.4% and 14.4% respectively.

Tipper registrations declined, however, down 9.2% compared with a strong 2022.

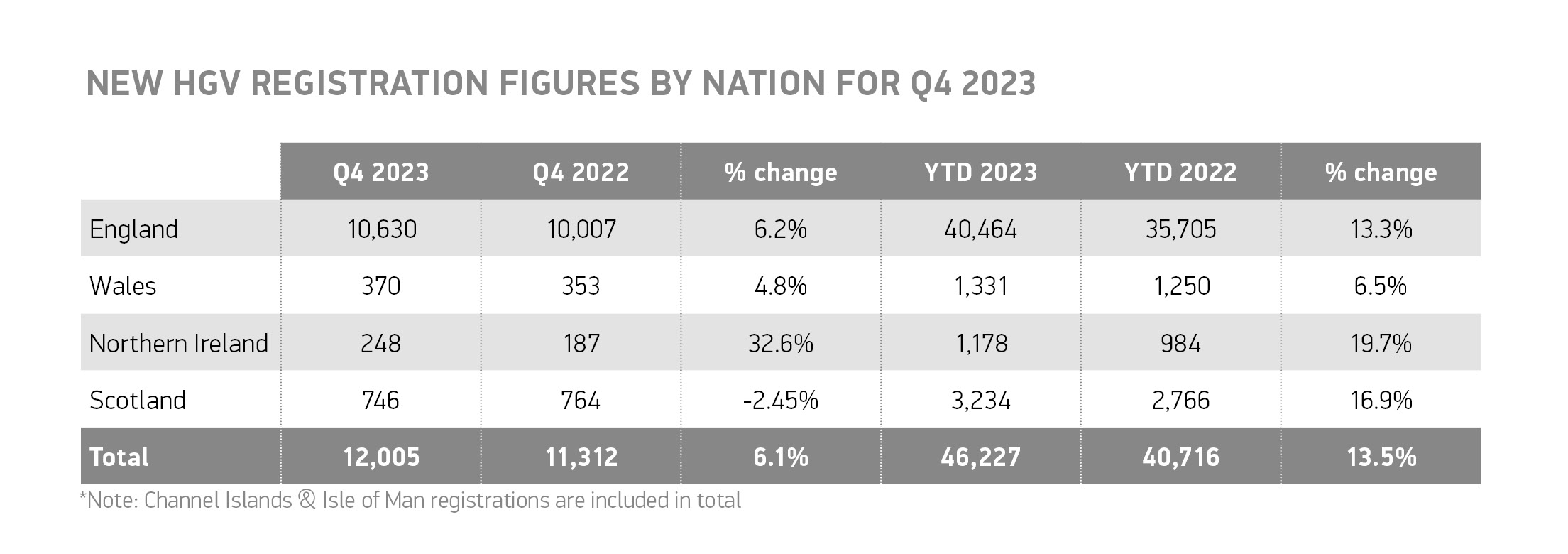

Truck operators in every UK nation made more vehicle investments, with the vast majority (87.5%) in England, rising by 13.3%.

Fleet renewal in Scotland and Wales also grew, by 16.9% and 6.5% respectively, while Northern Ireland saw the biggest percentage growth, up 19.7% – albeit with small volumes that are naturally subject to volatility.

Britain’s biggest region for truck demand continues to be South East England, the location of several large ports, accounting for more than one in five (20.8%) of all registrations.

North West England and the West Midlands, meanwhile, made up 14.4% and 12.1% of all UK demand respectively.

Robust demand nationwide means that UK uptake is now just 4.8% or 2,308 units below pre-pandemic 2019 levels.

Login to comment

Comments

No comments have been made yet.