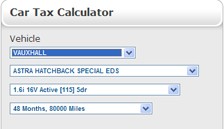

The Fleet News company car tax calculator helps you put the real running costs of fleet vehicles in perspective.

The car tax calculator provides detailed insight into the running costs of every fleet vehicle in the UK using a range of different replacement cycles, and includes the taxes paid by employees and employers.

Fleet managers can simply choose a vehicle from the drop down list and also opt for a replacement cycle (eg. three years/30,000 miles), and the figures showing the vehicle’s wholelife costs are calculated for you.

The figures are split into Employer costs and Employee costs and provide a breakdown of company car tax bills for 20% and 40% taxpayers.

The service also includes information that is normally ‘hidden’ within the business, such as Class 1A National Insurance Contributions.

The company car tax calculator also lets you compare two vehicles side by side, to see which model offer better efficiency.

If you have any comments on this service from Fleet News, please email fleetnews@bauermedia.co.uk.

Login to comment

Comments

No comments have been made yet.