Registrations of new electric vans failed to hit Government targets in 2024, with sales figures from the Society of Motor Manufacturers and Traders (SMMT) showing a marginal increase.

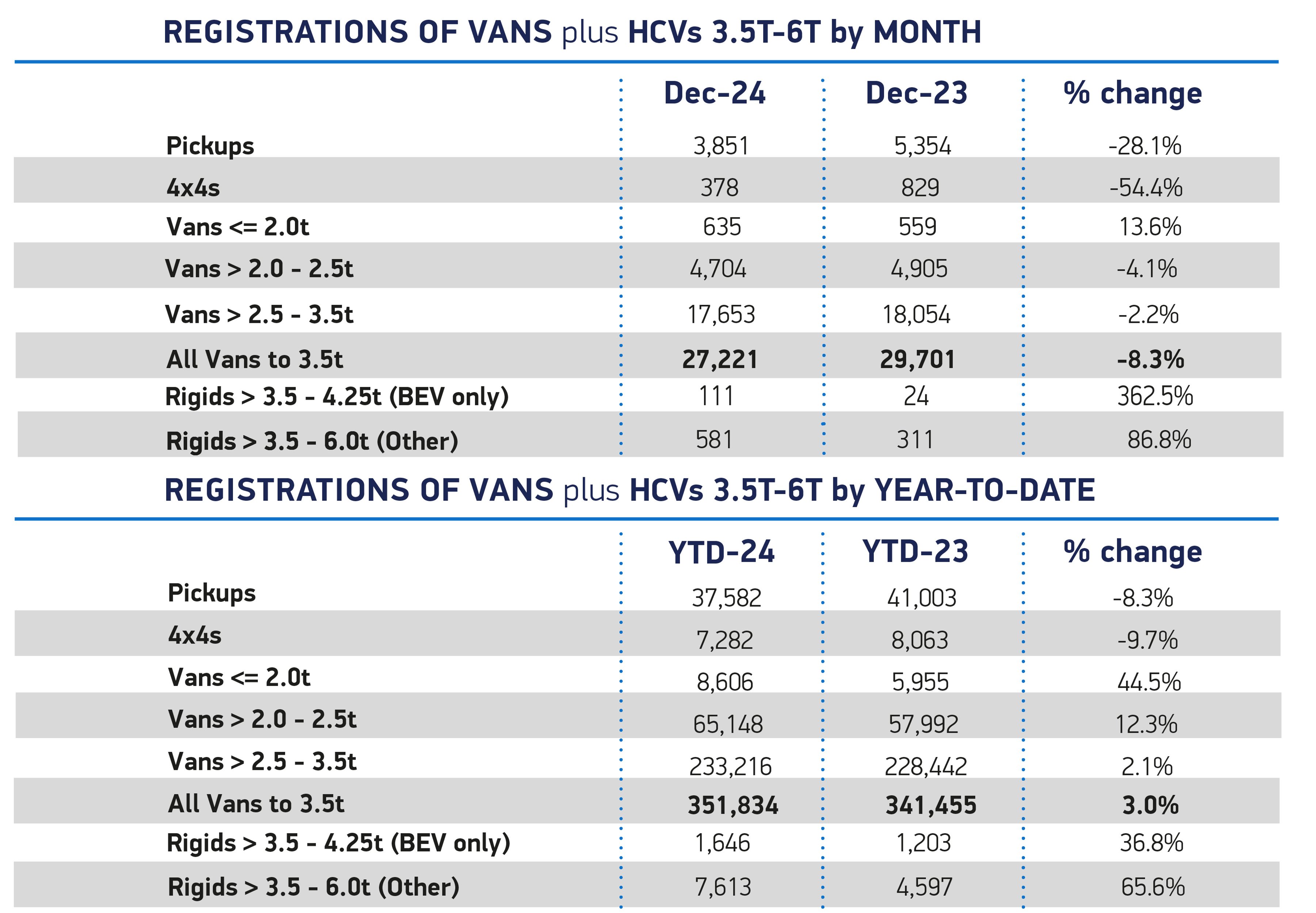

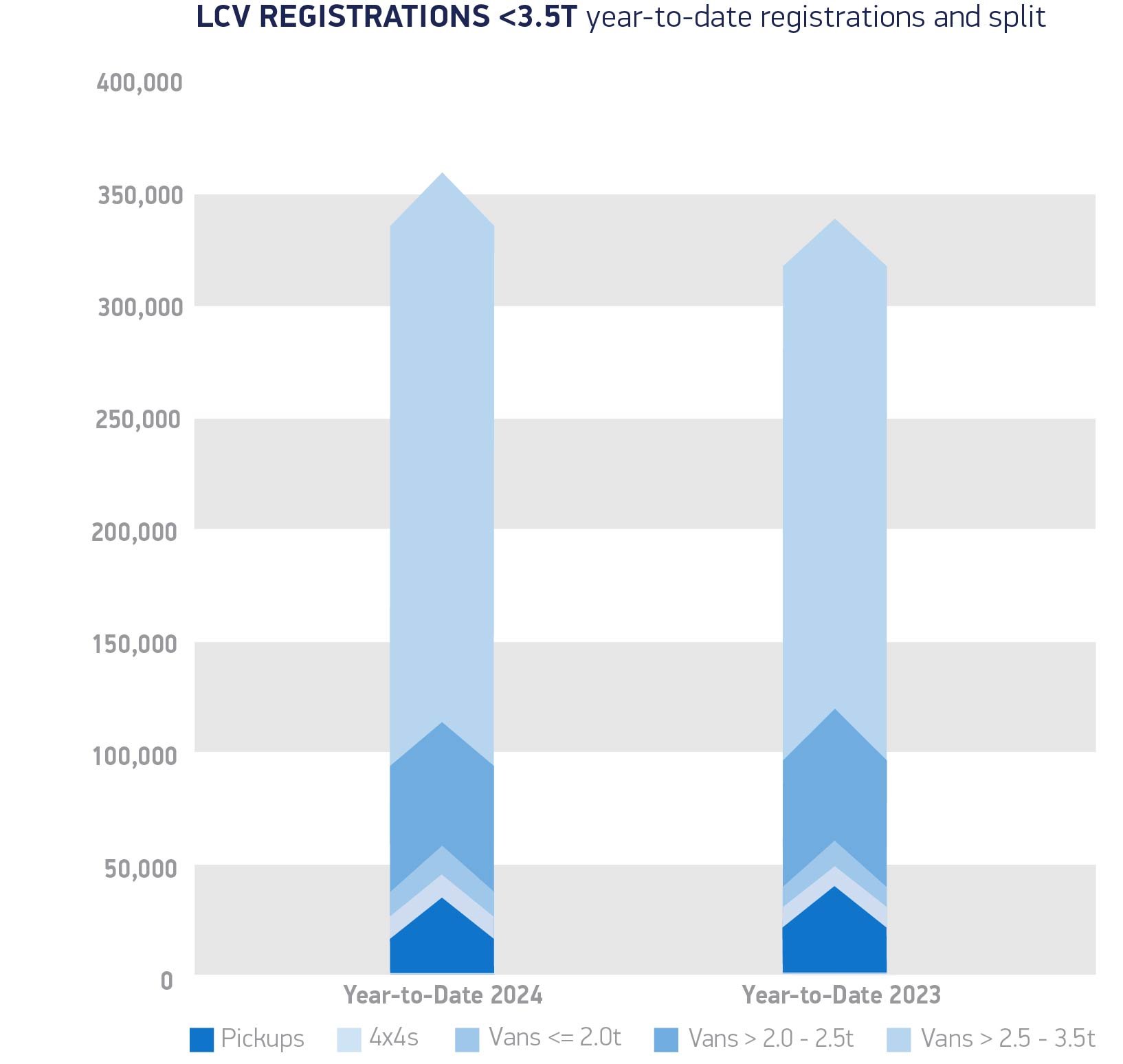

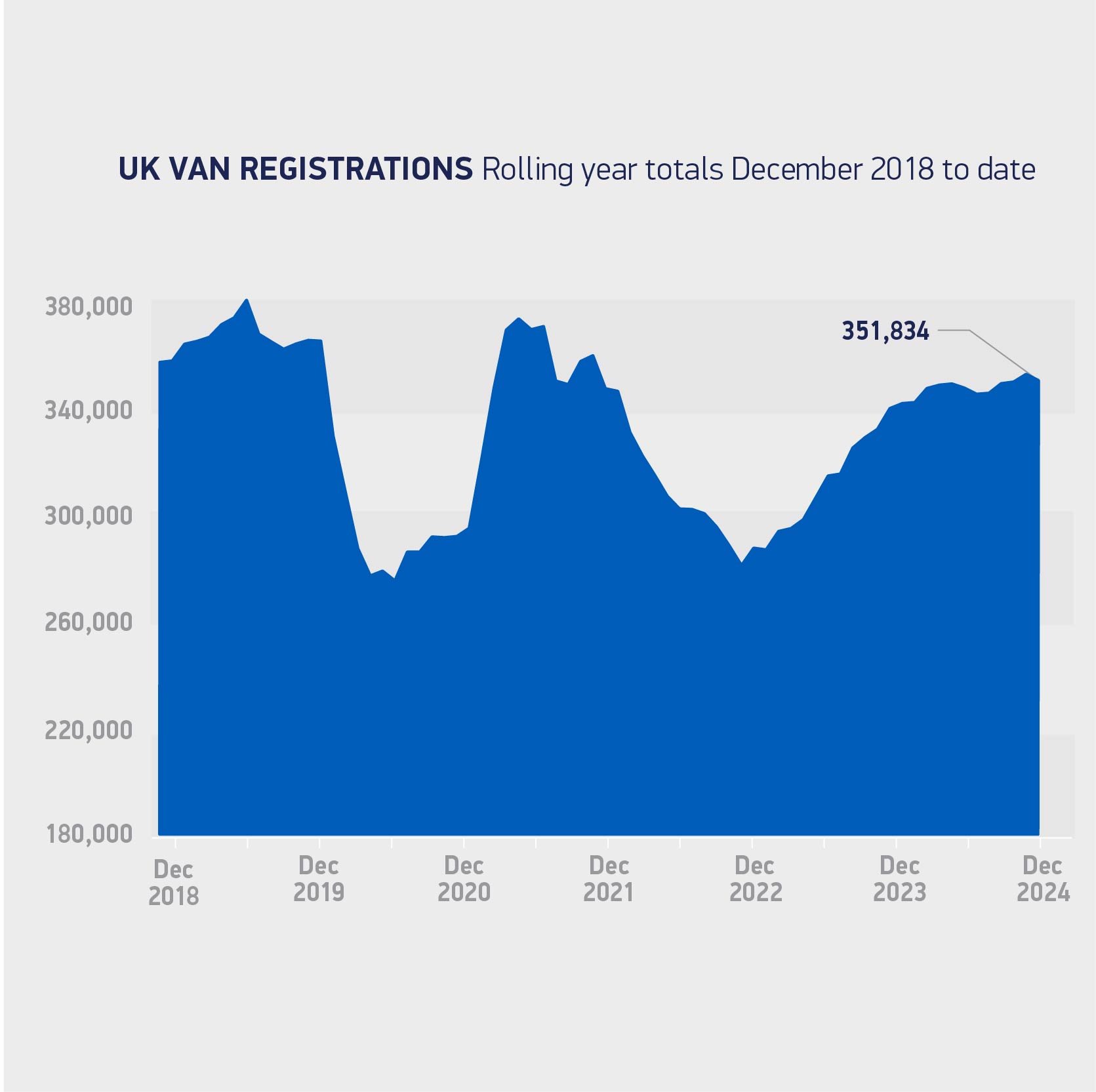

Overall, the UK’s new light commercial vehicle (LCV) market rose by 3% to surpass 350,000 registrations in 2024.

With some 27,221 new LCVs registered in December, it meant that a total of 351,834 new vans, pick-ups and 4x4s were registered across the year – making 2024 the best year of fleet renewal since 2021.

Demand grew in every van weight class last year, with uptake of the largest vans up 2.1% to represent 66.3% of the market.

New registrations of medium and small sized vans also grew, up 12.3% and 44.5% to 65,148 units and 8,606 units respectively.

Deliveries of new 4x4s, meanwhile, declined by 9.7% to 7,282 units in comparison with a strong 2023 performance, with volumes naturally fluctuating in smaller volume sectors.

There was also an 8.3% drop in new pick-up registrations to 37,582 units – a volume which could fall significantly further in 2025, following Government’s decision to tax double-cabs as cars for benefit in kind and capital allowances purposes from April this year, says the SMMT.

Key businesses which depend on these vehicles, from farming and construction to utilities and sole traders, will face considerable additional costs and could hold off investing as a result, keeping more polluting vehicles on the road and, counterproductively, reducing tax revenues, it claims.

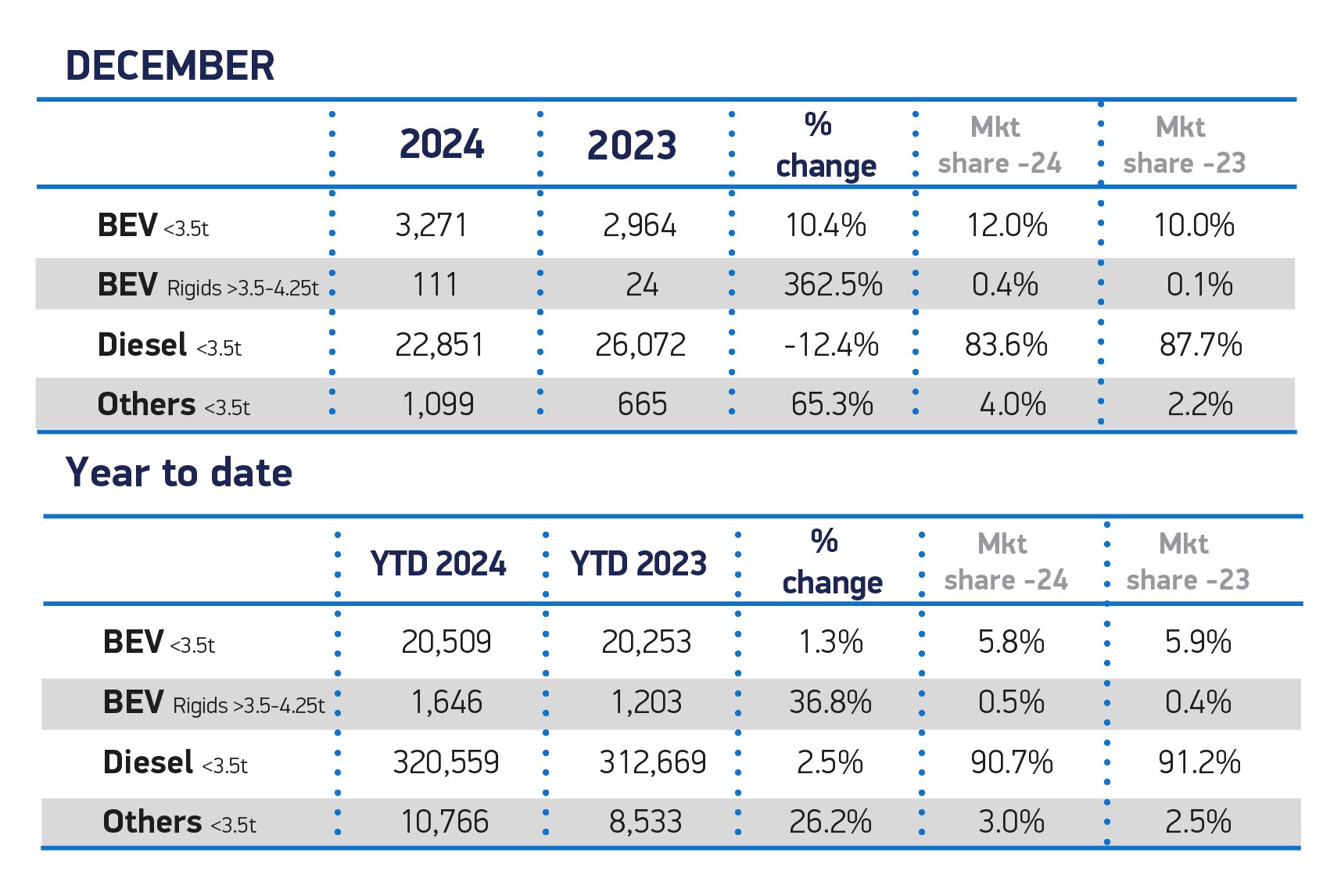

New battery electric van registration volumes rose by 3.3% to 22,155 units, equating to a 6.3% market share – the same as in 2023.

The Government’s zero emission vehicle (ZEV) mandate required 22% of all new car sales and 10% of all new vans registered in 2024 to be zero emission. This year, that increases to 28% of all new car sales and 16% of all new vans.

Such incremental growth in uptake in the first year of the UK’s targets reflects the immense challenge ahead to accelerate the decarbonisation of light commercial vehicles, according to the SMMT.

UK fleet operators had 33 different zero emission van models to choose from last year, more than half (52.4%) of all new models available.

However, the SMMT says that the breadth of choice is in stark contrast with the paucity of van-dedicated public charge points, which is undermining fleet confidence in the commercial viability of going electric.

With uptake remaining significantly short of the 10% target for 2024 set by Government’s ZEV mandate, even if, as industry expects, demand rises by more than 85% in 2025, the UK’s BEV share would reach just 10.6% – a significant distance off the 16% required this year.

With market demand for BEVs far below expectations when the mandate was designed, the SMMT is urging the Government to fast-track the ZEV mandate review and ensure the regulation reflects market realities, barriers and the support necessary to drive such growth.

Indeed, ambitious regulation must come with equally ambitious incentives and infrastructure rollout – else investment, model choice, growth and decarbonisation will be compromised, says the SMMT.

“Vans, 4x4s and pick-ups keep businesses everywhere on the move, making this sector a barometer of the UK economy,” explained Mike Hawes, SMMT chief executive.

“The best overall volume in three years, therefore, is good news with van makers striving to deliver abundant and competitive EV choice.

“Buyer confidence, however, will inevitably be undermined when charging infrastructure does not meet the needs of fleet operations.

“A review of EV regulation is crucial, therefore, to reflect current market realities and ensure ambitions are deliverable, without any negative and costly consequences.”

“December marked a disappointing conclusion to the year for new LCV registrations, as dealers and manufacturers worked to close the gap and meet the ZEV target for 2024” said Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK.

“In 2024, all model and weight sectors have shown growth, except for pickups and 4x4s. The removal of the user benefit-in-kind commercial dispensation by the Government, from April 2025, is beginning to affect demand in this sector, with an 8.3% year-on-year decline and a significant 28.1% drop in December.

“Notably, BEVs accounted for a total market share of 6.3%, well below the 10% target set by the ZEV mandate. This is particularly concerning as fines for non-compliant vans are set to double from £9,000 to £18,000 in 2025, alongside the mandate percentage increasing to 16%.

“On a positive note, sales of light weight vans up to 2.0t have grown steadily throughout the year, showing a year-to-date increase of 44.5%. These vehicles, commonly used as service vans, may signal growing confidence in this sector of the economy.

“NFDA welcomes the inclusion of a section for vans in the Government's consultation launched last month, which seeks views on proposals to support the UK's transition to zero-emission vehicles. The needs of van operators differ significantly from those of car users and greater attention must be given to on-street charging infrastructure, as many van drivers lack access to home charging facilities.”

Login to comment

Comments

No comments have been made yet.