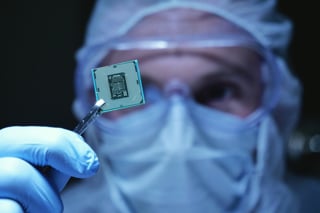

Just one-quarter (26%) of UK fleets have been affected by the global semiconductor shortage that has impacted vehicle supply, according to research by the Arval Mobility Observatory.

The organisation’s 2022 Barometer report says 16% of respondents report having been impacted when acquiring petrol, diesel and electric vehicles, 5% on EVs only, and 5% on petrol and diesel vehicles only.

Out of those who have been affected, the top three measures adopted in response include extending the lifecycle of current vehicles (83%), speeding up the implementation of EVs (35%) and considering adding other vehicle manufacturers to their policy (11%).

However, it is worth noting that the research was carried out between November 2021 and January 2022, since when the supply issues caused by the semicondudctor issues have deepened.

Shaun Sadlier, head of Arval Mobility Observatory in the UK, said: “It is perhaps surprising that as many as three out of four fleets report that there has been no impact on their operations."

He believes that the same question asked today on would get a very different response in terms of the level of impact.

“This is, in our view, is quite a high figure (even for the research period). The most likely explanation is that it is largely accounted for by either fleets planning further ahead in their vehicle replacement process, or by the contract extensions that were widely undertaken by many businesses during the pandemic when mileage fell dramatically.

“These particular fleets have been unaffected by delayed orders either because they have not been trying to replace vehicles, or have not yet really felt the full impact of the extended lead times.

“That line of thinking is backed by the research, which shows that among the 26% of fleets who say they have encountered problems, by far the most common response has been to extend vehicle life cycles.

“This is a finding consistent with the experience of Arval in the UK – and a sensible and accessible way of managing the situation for most organisations.”

Sadlier said it was notable that around one-third (35%) of respondents believe the shortage will speed up electrification.

He added: “Presumably, in having to wait for vehicle delivery, they have decided to accelerate movement towards their corporate social responsibility (CSR) targets by leapfrogging a replacement cycle where they would probably have chosen an ICE or PHEV and have instead opted to go straight to an EV, which often have shorter lead times as manufacturers appear to be diverting more of their production to zero-emission vehicles.”

He is seeing companies take dramatic steps to open up their choice lists to a much wider range of manufacturers in a bid to get new vehicles onto their fleets (much greater than the 9% shown in the survey). But there is a mix of reactions.

“We are seeing some fleets opening up for EVs, while remaining restricted for internal combustion engines (ICEs); others are opening up for everything,” he says.

The research also found 11% of respondents have considered opening up their choice lists, 9% have opted for used vehicles to meet their needs and 3% have examined the possibility of mobility solutions as an alternative.

The Arval Mobility Observatory 2022 Barometer talked to fleet decision-makers in 26 countries.

Full insight into the report was first published in the April issue of Fleet News.

Login to comment

Comments

No comments have been made yet.