The green credentials of a renewable diesel, which is being increasingly adopted by fleets, are being investigated by the Department for Transport (DfT).

Hydrotreated vegetable oil (HVO) has grown in popularity with businesses wanting to curb the emissions of their transport operations.

Government figures suggest use of the fuel in the UK has increased from 8 million litres in 2019 to about 699 million litres in 2024.

Producers of the drop-in biofuel say it say it can cut carbon emissions by up to 90% as it can be made from waste materials like used cooking oil.

However, a key ingredient for the ‘renewable diesel’ sold in Europe is likely fraudulent, a new Transport and Environment (T&E) study shows.

Its green credentials rely, in the main, on it being made from waste sources, particularly used cooking oil or the waste sludge from palm oil production, known as palm oil mill effluent (POME).

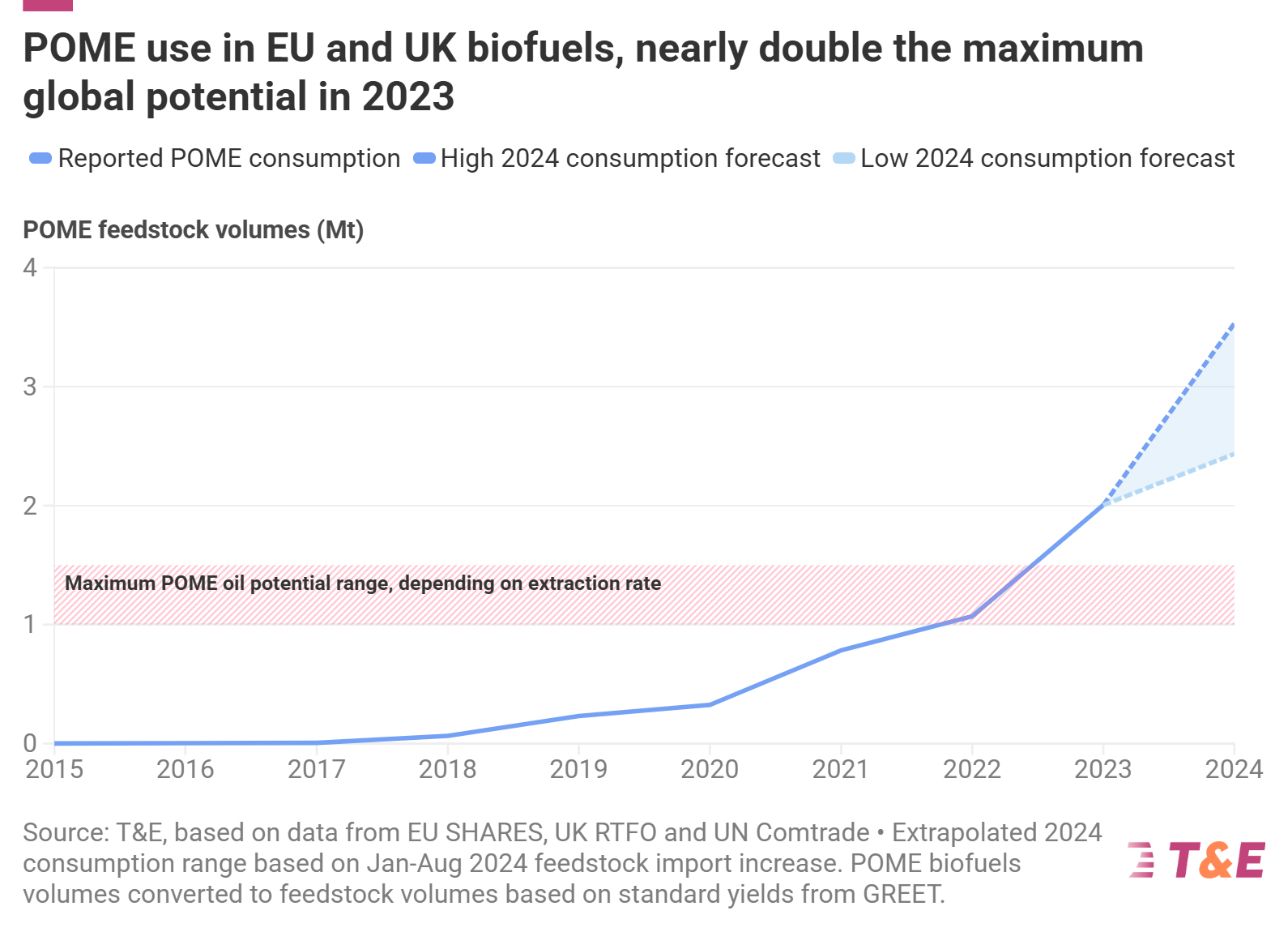

The T&E study found that almost twice as much of the waste sludge from palm oil production is being blended into European biofuels than is available globally.

Officially, more than two million tonnes of POME oil were consumed in European biofuels in 2023, which is way above the one million tonnes that is estimated to be available globally.

Industry whistleblowers say they believe large amounts of these materials are not waste but instead are virgin palm oil, which is being fraudulently relabelled.

Conventional palm oil use in biofuels peaked at around three million tonnes in 2019 before falling 80% by the end of 2023.

This was in large part due to the EU’s decision to phase-out palm oil biofuels from renewable targets by 2030.

Meanwhile, waste-based alternatives like used cooking oil, animal fats and residues such as POME have taken its place, now making up 40% of EU biofuels. There is concern that palm oil is simply entering Europe under a different name, warns T&E.

Cian Delaney, biofuels campaigner at T&E, said: “It appears a lot of POME could be just palm oil in disguise. This raises serious concerns as to whether this renewable diesel or HVO is as green as oil majors say it is.

“We need to remove the policy incentives that enable dodgy biofuels feedstocks making their way into Europe as supposedly sustainable fuels.”

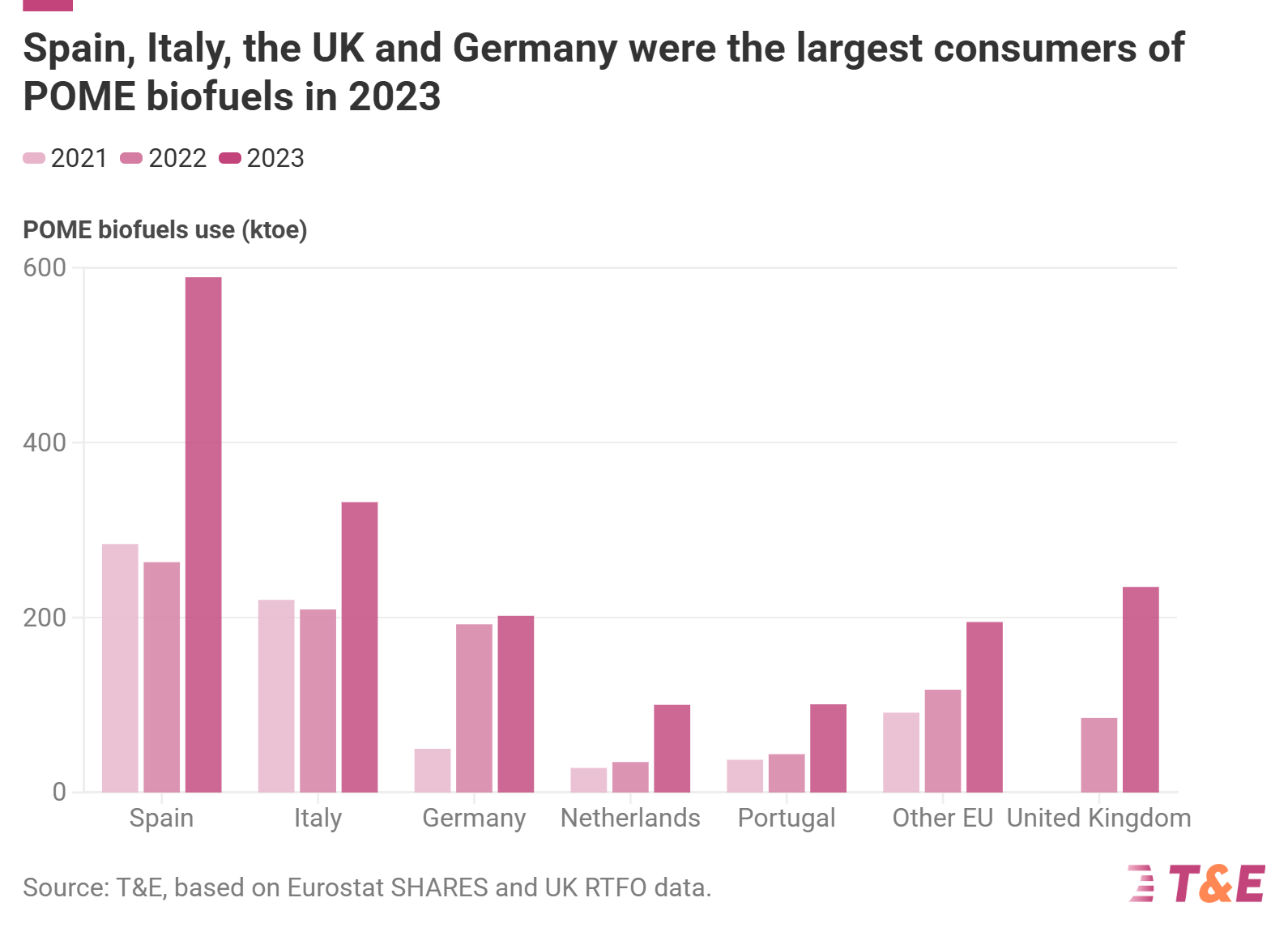

Spain, Italy, the UK and Germany were Europe’s biggest consumers of POME in 2023.

A third of Spanish biofuels came from POME, while Italy relied on it for nearly 20%.

Germany’s POME consumption quadrupled between 2021 and 2022 but stayed steady in 2023, despite rising imports and falling biofuel prices.

The rapid increase in POME biofuels use in the EU has led to POME prices reaching nearly 90% of palm oil prices by mid-2024, suggesting that a reclassification of POME from residue to by-product may be needed if its value continues to rise, says T&E. €2bn was spent by European oil majors on POME in 2023.

In January this year, the Indonesian government published data showing that exports of POME in 2023 and 2024 far exceeded the Indonesian government's estimate of total capacity.

DfT said that they “take the concerns raised seriously and are working with stakeholders and international partners to gather further information”.

Login to comment

Comments

No comments have been made yet.