FN50 leasing companies are lining up to exploit an emerging market sector which will change the shape of the leasing industry – personal contract hire (PCH).

As the company car sector faces continued uncertainty due to a combination of macro and micro economic and political influences, contract hire companies are turning to alternative opportunities to sustain their growth aspirations.

The private customer is seen as a major target. These can be an employee within a fleet customer who does not have access to the company scheme, an employee who has taken cash, or simply any member of the public considering leasing a car.

Over the past year, Arval, Inchcape, LeasePlan and Pendragon have all announced plans to target private car owners with PCH products; other leasing companies are readying or trialling their own schemes. Zenith has gone a step further with the launch of a new business branded ZenAuto.

Zenith CEO Tim Buchan says: “There are 900,000 potential retail customers – it’s so significant we have to focus on it.”

PCH business has yet to alter the balance of the FN50; fleet accounts for 87% of funded cars, up slightly on 2017’s 85% but the same as 2016. However, expect the proportion of retail cars to grow in the coming years.

Arval chairman and CEO Philippe Bismut told Fleet News earlier this year: “Corporates have more employees than company car drivers that have a need for a car.

"So, our new ambition will be to address the wider population. We are pioneering full service, long-term rental, medium-term rental and new propositions for flexible, sustainable, efficient renting solutions for individuals and corporate companies of all sizes.”

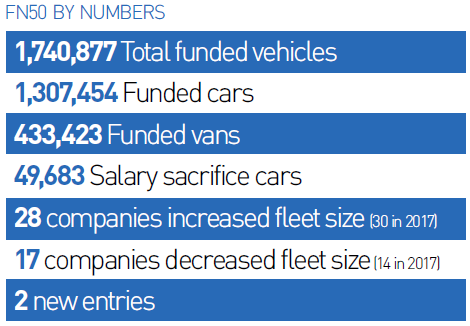

The overall size of the FN50 has risen by 3.1% year-on-year to 1,740,877 vehicles.

The UK’s 50 largest leasing providers are responsible for funding 1,307,454 cars and 433,423 vans.

Vans have increased the most year-on-year, up 6.7% compared to cars, up 2.1%. This reflects the broader macro-economic influences, such as the widespread uncertainty in the company car market caused by a combination of the new fuel testing regime, with its impact on CO2 emissions, and rising benefit-in-kind tax thresholds.

It is persuading some employees, particularly higher rate taxpayers to switch to cash, where leasing companies await with their PCH offerings.

This trend is reported by several leasing companies, while research from Sewells suggests the proportion of perk car drivers switching to cash is set to increase from 29% to 39%.

“We are seeing increasing evidence of employers switching from company car provision to employee allowances,” said Alphabet chief executive officer Nick Brownrigg.

“Employer duty of care responsibilities require greater oversight and transparency in this area than we’ve seen from these employee allowance schemes in the past. The increased interest and demand for these types of arrangement is evident to us.”

The FN50 picture is generally upbeat, with 29 companies reporting increases in their funded fleet sizes.

However, 17 are funding fewer vehicles than a year ago (plus three new entries and one unchanged).

For the first time in a decade, there has been a change in the top two.

Lex Autolease remains the biggest, but LeasePlan has been leapfrogged by a rapidly growing Volkswagen Financial Services (VWFS).

In 2014, VWFS had a fleet size of 92,601 vehicles; a year later, with a move into a new corporate head office in Milton Keynes, the company was talking about aspirations to hit 150,000 vehicles by 2018. It achieved those ambitious growth plans a year early and has continued to accelerate, bringing larger fleets into its traditional customer base of SMEs. Growth has been entirely with cars; VWFS actually funds fewer vans today (22,971) than in 2014 (33,243).

Its 2018 funded fleet size of 194,599 vehicles is up 16.9% on last year, outpacing LeasePlan on 169,695.

As well as structuring the business to appeal to corporates, VWFS also benefits from considerable local business and retail funding via the Volkswagen, Audi, Škoda and Seat franchised networks.

Consequently, it has one of the higher retail-to-fleet ratios of any FN50 company – 46% of its car business is with private customers.

That proportion is matched only by ALD, which has a number of white-label contracts with manufacturers that do not have captive funding houses, as well as Leasys, Fiat’s leasing operation, RCI, the Renault-Nissan division, and Wheels4Sure whose business model is to target only local business and private customers.

VWFS is one of 13 companies reporting double-digit growth. The others range from large to small, specialist to mass market funders; there is no clear blueprint for success.

Notable are Leasys, which continues to be one of the fastest growing FN50 companies, this time rising by almost 30% to 13,150, and Marshall Leasing, free of the shackles of its franchised dealer parent and now able to concentrate fully on its core market, up 13.3% to 7,332.

VWFS and Leasys underline the importance of the funding sector to manufacturers – or most accurately, the importance of direct relationships with end users.

The changing market place, with consumers and companies being seduced by subscriptions services, the promise of cheaper, cleaner, safety mobility alternatives, and user-ship instead of ownership models, means they are keen to get closer to the end user and funding offers the perfect opportunity.

It explains Vauxhall’s re-emergence in the market, and the strategies from the likes of Free2Move, the Peugeot-Citroën business, which is evolving into a provider of mobility services, not just corporate funding (all its business is with fleets).

"While we know from our research that very few businesses are replacing company vehicles with mobility solutions, a growing number of our customers are looking for flexible options to meet their fleet needs." Miguel Cabaça, Arval UK

Mobility and flexible funding to meet customers’ changing expectations are top of many leasing companies’ agendas, even if the market is yet to embrace technology-led solutions.

Arval UK managing director Miguel Cabaça said: “While we know from our research that very few businesses are replacing company vehicles with mobility solutions, a growing number of our customers are looking for flexible options to meet their fleet needs.

“Whether they need a vehicle for a few hours, days, months or years they want us to provide cost-effective vehicle choices which means seamlessly combining products like car sharing, short- and mid-term rental alongside more traditional contract hire.”

He added: “We are also being asked more often to provide solutions for the customer’s entire employee-base, including those who are not entitled to a company car. This is where we provide products like salary exchange, personal contract hire, pool cars and car sharing.”

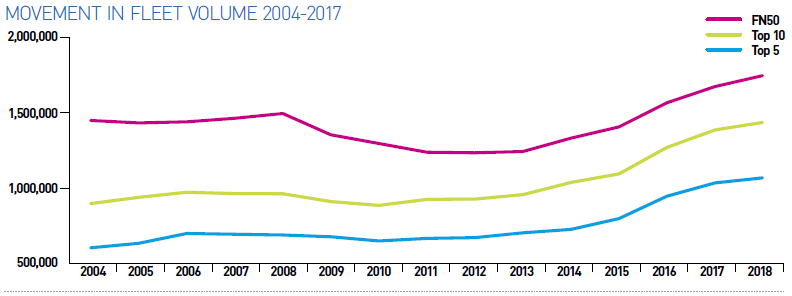

Despite growth from eight of the top 10 leasing companies, their dominance of the FN50 is largely unchanged year-on-year. They account for 81% of the total, compared to 82% last year and 81% in 2016.

Likewise, the top five accounts for the same proportion, 61%, as last year and is just one percentage point higher than two years ago.

One explanation – in contrast to industry forecasts of consolidation, with the big getting bigger – is a pause on acquisition activity by the largest funders. No one is making noises, publicly or privately about seeking to buy (or, for that matter, sell), although this could be the quiet before the storm.

Certainly, there appears to be no sector gaining strength or facing weakness, with most content to focus on organic strategies.

Of the nine manufacturer-owned leasing companies, four have grown, five have contracted. Likewise, five of the 13 dealer-owned providers have grown, seven are smaller (one, Agnew, is unchanged). Both sectors are advantaged by their closeness to the end users via their franchised dealer networks.

The nine bank/financial-owned leasing companies are possibly in the strongest position, typically able to access cheaper funds, with seven growing, although some by just a few vehicles.

The remainder are primarily a mix of independent and venture capitalist, with niches in vans, public sector, SME, or HGVs (hence a smaller presence in the FN50), and their fortunes have been similarly mixed over the past 12 months.

That said, seven of the bottom 10 increased their fleet size last year, showing that specialisms can be an effective business strategy.

NOTE: FN50 survey data was collated by Sewells and analysed by the Fleet News' editorial team

Login to comment

Comments

No comments have been made yet.