Fleet and business car registrations were down by almost 50,000 units in the first five months of 2018, compared to the same period last year.

The latest figures, from the Society of Motor Manufacturers and Traders (SMMT), reveal that there were 586,479 cars registered to fleet and business, from January to May. That compares to 636,013 units in the first five months of 2017 – a 7.7% decline.

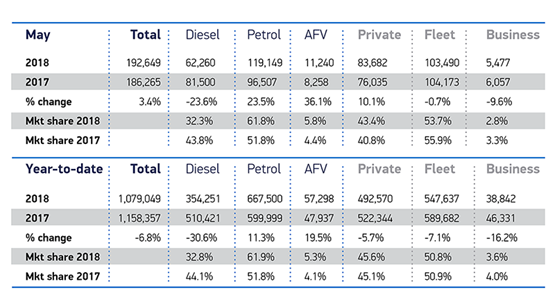

Including private sales, there were 1,079,049 registrations up to May compared to 1,158,357 last year.

Looking at May, fleet and business registrations stood at 108,967, a 1.2% decline on the 110,230 registered in May 2017.

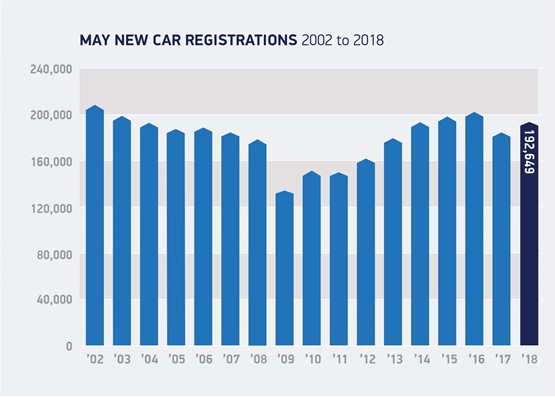

Including private registrations however, the UK new car market grew by 3.4% in May, with 192,649 new units registered, compared to 186,265 in the same month last year.

The growth follows a substantial 8.5% decline in the previous May when demand was impacted by the dual effects of VED pull forward and buyer hesitancy ahead of June 2017’s general election.

Mike Hawes, SMMT chief executive, said: “May’s growth, albeit on the back of large declines last year, is encouraging and suggests the market is now starting to return to a more natural running rate.

“To ensure long-term stability, we need to avoid any further disruption to the market, and this will require sustainable policies that give consumers and businesses the confidence to invest in the new cars that best suit their needs.

“Fleet renewal is the fastest way to improve air quality and reduce CO2, and this applies to hybrid and plug-in technologies as well as the latest low emission petrol and diesels which, for many drivers, remain the right choice economically and environmentally.”

DIESEL DECLINE

In terms of fuel choice, diesel’s decline continues, with the fuel type holding 32.8% market share so far this year compared to 44.1% from January to May 2017.

Petrol market share has increased from 51.8% to 61.9% as has alternative fuel vehicles (AFVs), from 4.1% to 5.3%.

Demand for hybrid and plug-in cars grew by 36.1% in May to 11,240 units, accounting for a record 5.8% of the market. Plug-in hybrid cars were the biggest driver of growth, up 72.7%, while hybrids rose 22.6% and zero emission battery electrics grew 18.7%.

Ashley Barnett, head of consultancy at Lex Autolease, said: “The increase in new car registrations in May shouldn’t be taken out of context – May is traditionally stronger than April, but consumers and businesses are still hesitant when it comes to replacing their cars.

“Continued confusion around new emissions testing (WLTP) and the impact on availability of vehicles, specifically plug-in hybrids, combined with the lack guidance on policy beyond 2021, means many consumers and businesses are holding off replacing their cars.

“Clarity is needed from Government to help people make informed purchasing decisions that will contribute positively to targets around emissions and take older, more polluting vehicles off the road.”

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, said: “While rising interest in alternative fueled vehicles has not yet offset declines in diesel sales, a 36.1% percent rise in motorists buying hybrid or electric cars marks continued traction for the sector and suggests that consumer awareness of alternative fueled vehicles is gaining pace. This is particularly pertinent, given May’s record rises in petrol prices at the pump.

“Our own research found that 73% of fleet owners think the Government can do more to support the move to AFVs. With today’s data showing that overall market confidence among business and fleet buyers is lagging, providing greater infrastructure for AFVs could go a long way towards restoring confidence.”

Login to comment

Comments

No comments have been made yet.