There were 1.14 million vehicles registered in the European car market in February – the sixth consecutive month of decline.

Analysis from Jato Dynamics shows this was largely down to uncertainty for many of the bigger European markets, such as Spain, where registrations fell by 10% amongst political turmoil, and the Netherlands, where a change in tax on pure electric vehicles contributed to the 15% drop in overall registrations.

The Swedish and Finnish markets also saw declines of 15% and 11%, respectively, as the two countries continued to struggle to come to grips with the introduction of WLTP.

Conversely, registrations were up by a huge 36% in Romania, due to the Government’s scrappage scheme in the last quarter of 2018, which led to an increase in vehicle deliveries in the first quarter of this year.

Denmark also recorded a strong result in February, with volume up by 8% due to an increase in its EV and PHEV registrations. This was mirrored in Norway, where nearly twice as many zero-emission cars were sold than in February 2018, and the Tesla Model 3 and VW e-Golf were the two best-selling cars.

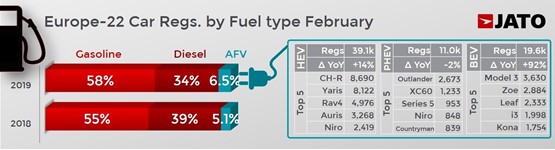

The most notable result from February was the strong performance of pure electric vehicles (BEVs). Although their market share remained marginal at 1.9%, their volume increased by a huge 92% to 20,000 registrations.

BEVs continued to gain traction in markets like Norway, where they counted for 40% of overall registrations, and the Netherlands, where they counted for 7%. Demand also increased by 81% in Germany, which was the largest market for BEVs in February.

This increase can be explained by the introduction of new models, most notably the Tesla Model 3, says Jato Dynamics.

The hotly anticipated car excelled during its first full month on the European market and became the best-selling BEV.

The Model 3 quickly outsold other big players like the Nissan Leaf and Renault Zoe, despite being more expensive and only available for a short amount of time.

Felipe Munoz, JATO’s global analyst, called the performance of the Model 3 “remarkable”, given it usually takes four or five months after a new car has hit the road to achieve this kind of traction in the market.

It is also notable that most of the Model 3’s volume in February came from private registrations, which breaks the usual trend of a new vehicle’s volume consisting of business/fleet registrations.

Furthermore, the Tesla Model 3 achieved another record in February, as it became the top-selling premium mid-size saloon in Europe – outperforming the popular Mercedes C-Class, Audi A4 and BMW 3-Series.

Munoz said: “As we’re seeing in the US, Tesla is also shaking up the European market. Its long-lasting impact will depend on how quickly the German premium makers, Volvo and JLR react to the arrival of the Model 3 to Europe and how quickly they can bring in their own midsize electric cars.”

Meanwhile, diesel registrations fell once again in February, although their market share did stabilise at 34%. This was due to an 8% increase in registrations in Germany, which helped to offset double-digit falls in Italy, France, Spain and the UK. SUVs, vans and sports cars were the only segments to grow during the month, as compact and midsize cars, and MPVs recorded large drops.

Registrations of SUVs were up by 10% to 421,500 units, as they posted a market share of almost 37%. Small SUVs recorded 167,000 registrations, as demand increased by 13%, while compact SUVs saw 178,000 registrations and a 10% increase in demand.

Volkswagen led the model rankings with the Golf, which saw a decline in its gasoline registrations (-18%), but an increase in its diesel registrations (+8%).

Meanwhile, the Volkswagen T-Roc climbed the rankings to become the best-selling SUV in Europe, outselling the Tiguan and Qashqai. It was the best performing SUV in Austria, Luxembourg and the Netherlands, and the second best in Germany, Croatia, Denmark and Italy.

February was also a good month for the new generations of the Volkswagen Polo, which was Europe’s third best-selling car, and the Ford Focus, which was sixth. Elsewhere, the Opel Corsa hit the top 10 as its volume increased by 13%, despite its aging model.

Among the latest arrivals, there were 3,810 registrations of the Citroen C5 Aircross; 3,657 of the Tesla Model 3; 3,190 of the Peugeot Rifter; 2,110 of the DS 7 Crossback; 1,684 of the VW Touareg; 1,458 of the Audi Q8; 1,368 of the Seat Tarraco; 951 of the Mercedes CLS; 891 of the Jaguar I-Pace; 712 of the Jeep Wrangler; and 431 of the Kia Proceed.

Login to comment

Comments

No comments have been made yet.