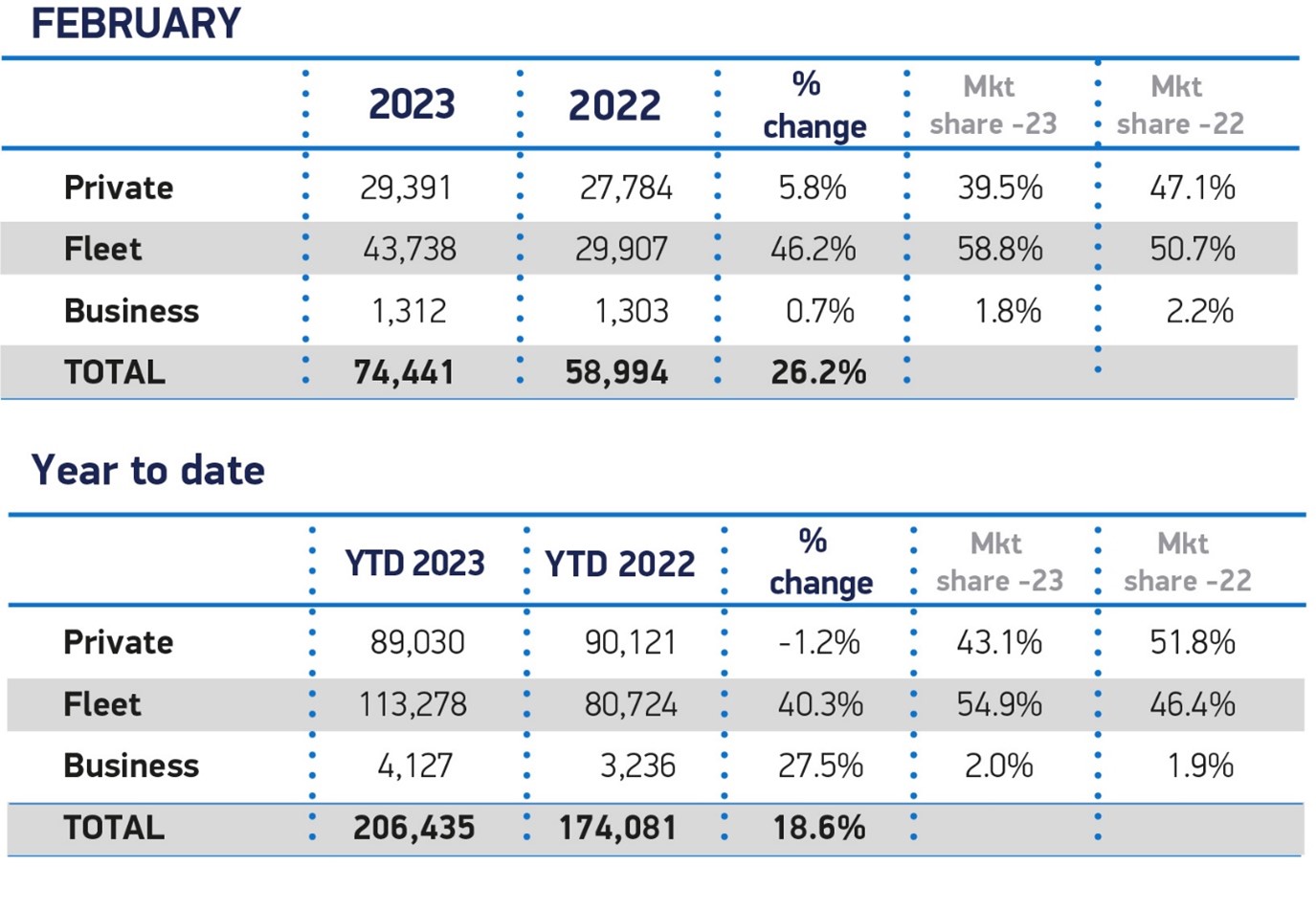

Fleet and business new car registrations increased by almost 29% in February as supply chain issues eased, according to the Society of Motor Manufacturers and Traders (SMMT).

There were 45,050 new company cars registered to fleet and business in the month, compared to 31,210 units in February 2022.

Year-to-date, fleet and business registrations stand at 117,405 units, a 40% uplift on the 83,960 new company cars registered in the first two months of last year.

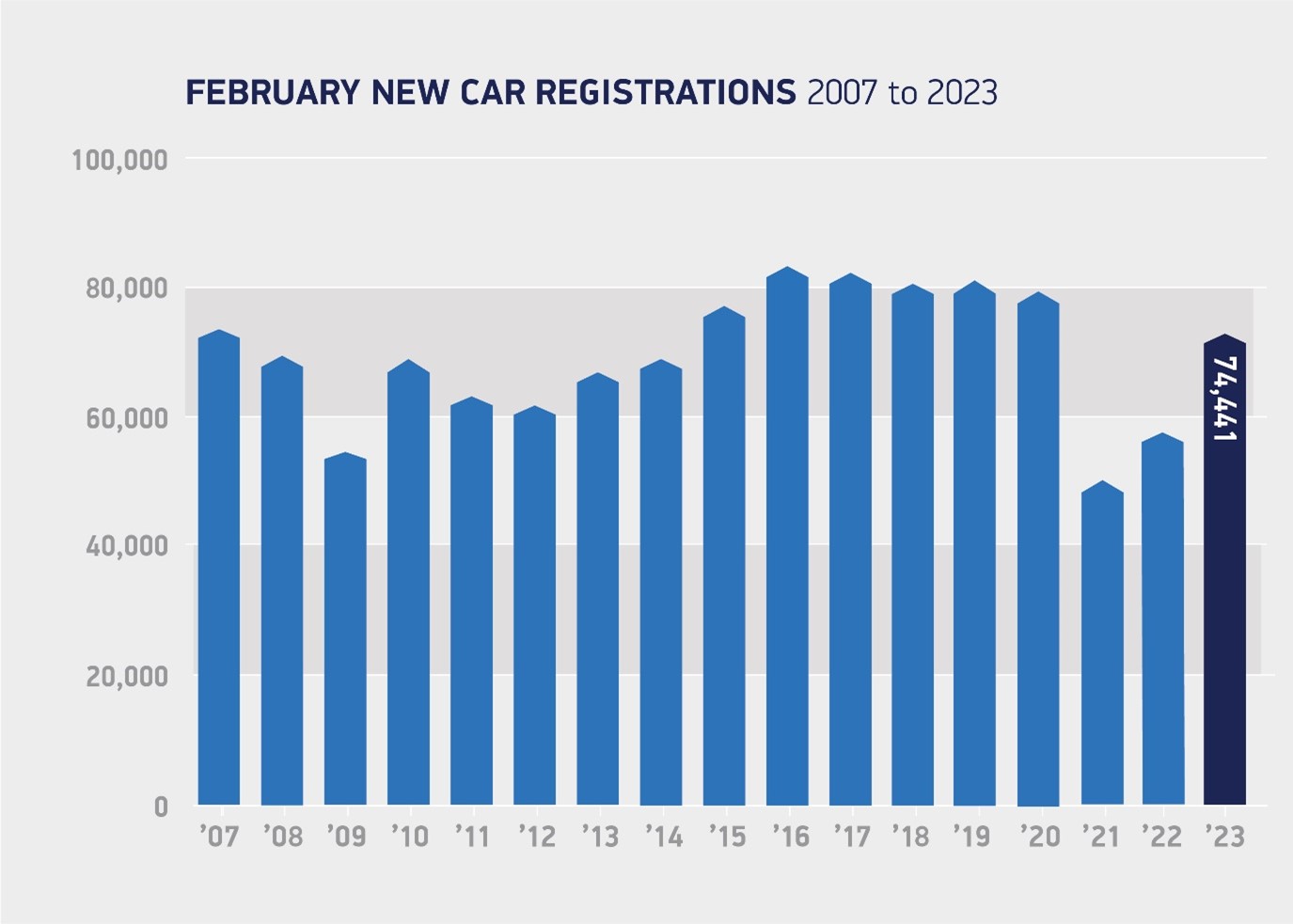

Overall, new car registrations, including private sales, grew by 26% in February, with 74,441 new cars registered, marking the seventh month of consecutive growth as the market closer to pre-pandemic levels, down just 6.5% on the same month in 2020.

Mike Hawes, SMMT chief executive, said: “After seven months of growth, it is no surprise that the UK automotive sector is facing the future with growing confidence.

“It is vital, however, that government takes every opportunity to back the market, which plays a significant role in Britain’s economy and net zero ambition.

“As we move into ‘new plate month’ in March, with more of the latest high-tech cars available, the upcoming Budget must deliver measures that drive this transition, increasing affordability and ease of charging for all.”

There was growth in all but two segments, with only registrations of executive and luxury saloon cars falling, by 15.4% and 6.3% respectively.

Minis (up 66.1%), multipurpose vehicles (41.9%) and superminis (37.7%) posted the largest percentage uplifts, with superminis remaining the most popular, accounting for a third (33.1%) of all deliveries.

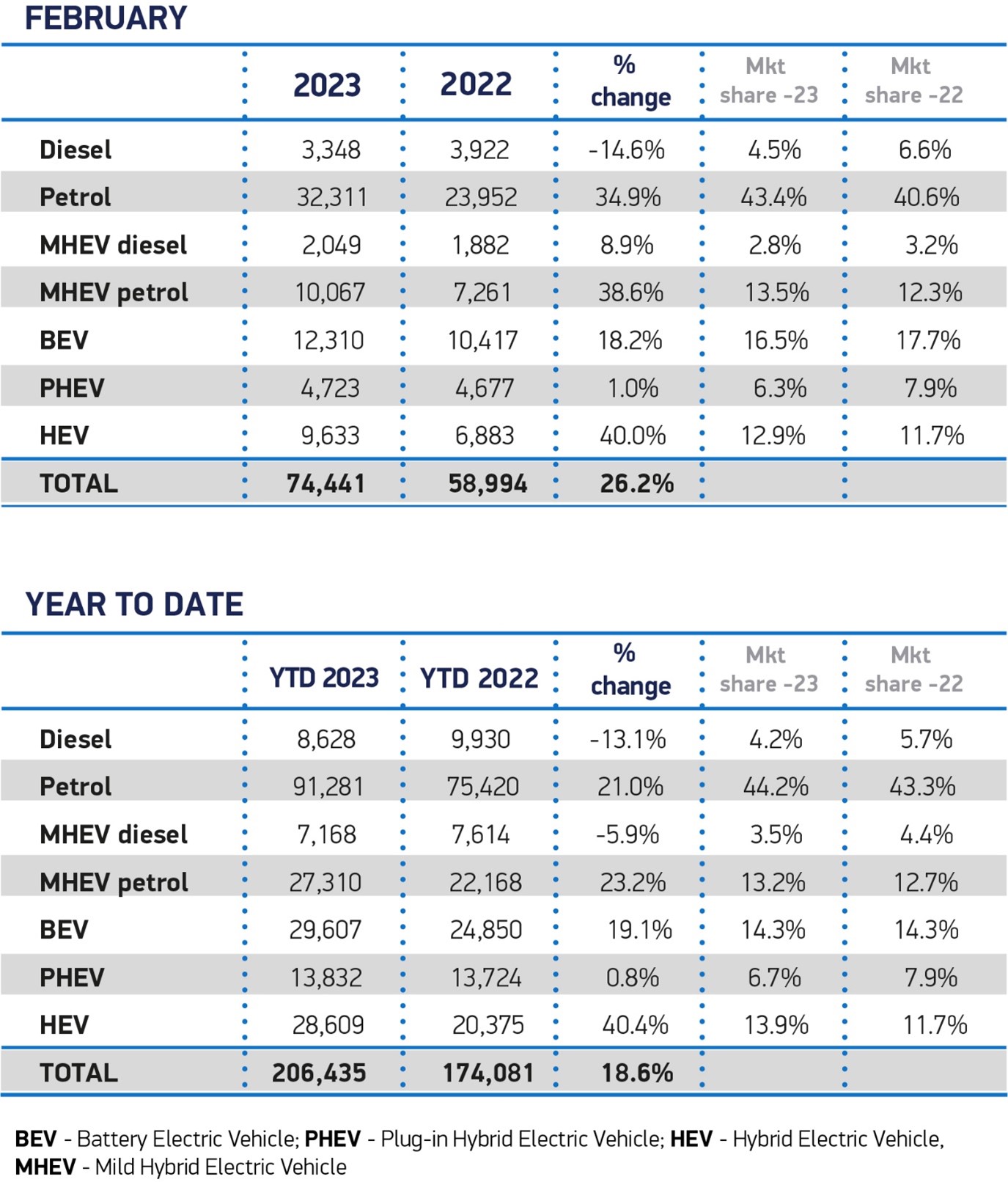

Hybrid electric vehicles (HEVs) recorded the most significant growth of all fuel types, up 40%, followed by petrol, up 35.8% with a 56.9% market share, while diesel registrations fell by 7%.

Zero emission capable vehicles, meanwhile, continued their upward trend, with plug-in hybrids (PHEVs) rising 1% and battery electric vehicles (BEVs) posting another strong month, up 18.2% to account for one in six new UK car registrations.

Combined, plug-ins accounted for almost a quarter (22.8%) of all deliveries in the month, with further growth anticipated.

SMMT expects almost half a million (488,000) PHEVs and BEVs to join Britain’s roads in 2023, as manufacturers bring more than 40 new plug-in electric models to the market.

Jon Lawes, managing director of Novuna Vehicle Solutions, said: “While electric vehicle registrations continue to rise at a steady rate, the UK risks falling behind other leading European countries in the transition to EVs and green transportation.

"Failure to intervene to adequately support the industry, notably to build a more robust supply of battery technology has stymied the UK's progress to date.

"With the budget fast approaching, it is clear that the Government needs to significantly pledge to ramp up investment in the UK automotive supply chain to meet industry demand or risk compromising its 2030 targets.”

Nick Williams, transport managing director at Lloyds Banking Group, believes that there needs to be “significant expansion” to adequately service the growing number of EVs.

“With the new Chancellor due to deliver his spring statement this month, drivers will be looking to the Treasury to confirm investment that will support the UK’s charging network,” he added.

“Similarly, individuals and businesses will be hoping to see continued incentives for choosing a zero emissions vehicle over a higher carbon alternative, with policies put in place that take a fair, emissions-based approach.

“By supporting the UK’s infrastructure, industry and drivers, the Chancellor can help maintain the momentum the country is rapidly building on its electrification journey.”

Login to comment

Comments

No comments have been made yet.