Fleet and business new car registrations increased by 36% in June, with almost 100,000 company cars sold, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

There were 97,468 new cars registered to fleet and business in the month, some 25,995 units more than the 71,000-plus vehicles sold in June 2022, equating to a 55% market share.

Overall, the new car market grew by 25.8% in June, with 177,266 vehicles registered - the 11th consecutive month of growth.

With waiting times easing and pent-up demand being met, the sector is a rare bright spot in a gloomy economic landscape even though overall market volumes remain below pre-pandemic levels, said the SMMT.

Year-to-date, more than half-a-million (514,395) new cars have been registered to fleet and business – 54% of the overall market.

That is a 37% increase on the 374,013 new cars registered with the sector in the first six months of 2022.

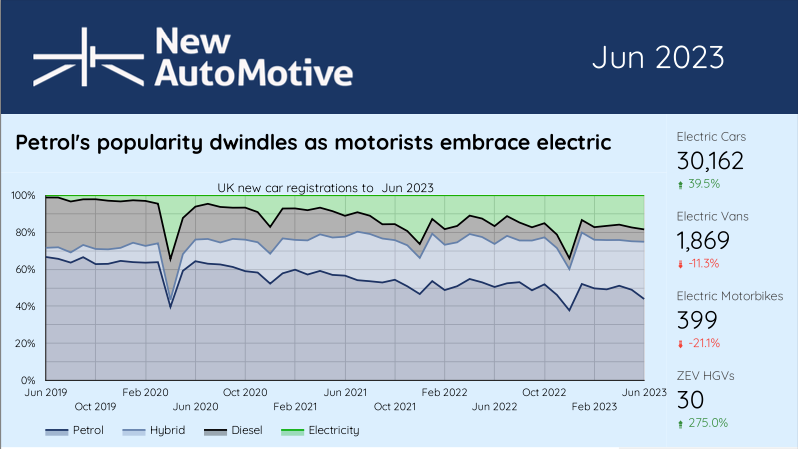

Deliveries of petrol cars increased 22.7%, to remain the most popular powertrain, while those of hybrids (HEVs) and plug-in hybrids (PHEVs) also rose, by 40.1% and 65.5% respectively.

Diesel registrations were down by 13.5%.

Battery electric vehicle (BEV) registrations, meanwhile, grew again, with the segment up 39.4% as 31,700 buyers chose to get behind the wheel of a zero-emission car – 17.9% of the total market.

Nick Williams, managing director of Lex Autolease, said: “As we reach the mid-point of the year, the number of EVs registered so far in 2023 is already up 32.7% compared to this time last year.

“These impressive figures pre-empt another record-breaking year for EV uptake on UK roads, as we see more and more people making the switch ahead of the 2030 ban on new diesel and petrol cars.”

Fleets drive growth in new electric vehicle sales

It is fleets, rather than private buyers, that continue to drive the growth in EVs, thanks to low benefit-in-kind (BIK) tax rates.

Although manufacturers are offering a range of BEV deals for private buyers, including flexible subscription models and attractive finance rates, more could be done by other stakeholders to make purchasing even more compelling, argues the SMMT.

“The new car market is growing back and growing green, as the attractions of electric cars become apparent to more drivers,” said SMMT chief executive, Mike Hawes. “But meeting our climate goals means we have to move even faster.

“Most electric vehicle owners enjoy the convenience and cost saving of charging at home but those that do not have a driveway or designated parking space must pay four times as much in tax for the same amount of energy.

“This is unfair and risks delaying greater uptake, so cutting VAT on public EV charging will help make owning an EV fairer and attractive to even more people.”

Almost a million (949,720) new cars joined UK roads in the first six months of 2023, with total registrations up 18.4% and BEV uptake at record levels with 152,968 deliveries so far this year – some 13 times greater than the same period in 2019.

BEV market share for 2023 is now 16.1% but, with a zero-emission vehicle (ZEV) mandate requiring 22% BEV registrations per manufacturer due to come into force in less than six months’ time, more needs to be done to accelerate the transition, says the SMMT.

Given that recharging an EV at home can offer a 60-70% cost per mile saving compared with refueling a petrol or diesel vehicle, the industry is calling for a cut in VAT on public charging to help quicken uptake.

Drivers able to charge at home pay just 5% VAT to power up their EV, compared with 20% for those without access to a driveway or designated private parking space who are reliant on the public network.

VAT equity would make switching to an electric vehicle feasible for more people regardless of home ownership or property status, the SMMT argues.

Jon Lawes, managing director of Novuna Vehicle Solutions, said: “We urgently need a long-term strategy for building advanced automotive manufacturing supply chains in the UK if we are to realise a sustained uptake of electric vehicles.

“At the heart of the problem is the requirement to deliver domestic lithium battery manufacturing at scale which is critical if we are to drive down the cost of EVs for private buyers and achieve zero emission mobility.

“Without a resilient, self-sufficient UK-based battery manufacturing capacity, our ability to make and export EVs and be at the forefront of the net-zero revolution hangs in the balance.”

Gavin Murray, Hive and EV Director at British Gas, added: “If the UK is to keep pace with the electrification curve, we need to see greater collaboration across key stakeholders so that no one is excluded from EV ownership.

“Government and local policy-makers must focus on creating a fit for purpose framework that supports the role out of accessible and user-friendly fast charging stations to ensure an easy switch for consumers to EVs.”

Williams continued: “As we wait for the outcomes of the zero-emissions vehicle mandate, we hope to see the finalised legislation further serve to ensure EV availability in the UK, both for the new and used markets, as well as further investment in innovation and charging capabilities.”

Analysis shows ZEV mandate shortfall and cost to carmakers

Analysis by New AutoMotive reveals that the 32 car manufacturers eligible for inclusion in the ZEV mandate would collectively be 44,000 credits short of meeting their regulatory requirements if the 2024 target were in force in the past 12 months.

This means they would have to either borrow or buy out of their regulatory obligations, raising around £660 million in buy-out revenues.

Ben Nelmes, chief executive at New AutoMotive, said: "Ministers' plans for a California-style zero emissions vehicle mandate are essential to boosting the supply of electric cars as well as boosting charge point installations - but they must come into force in January 2024 so consumers can benefit.

"Petrol registrations are falling significantly, while diesel registrations are now a niche part of the market, as consumers are abandoning polluting vehicles faster than the Government is planning to phase them out."

Login to comment

Comments

No comments have been made yet.