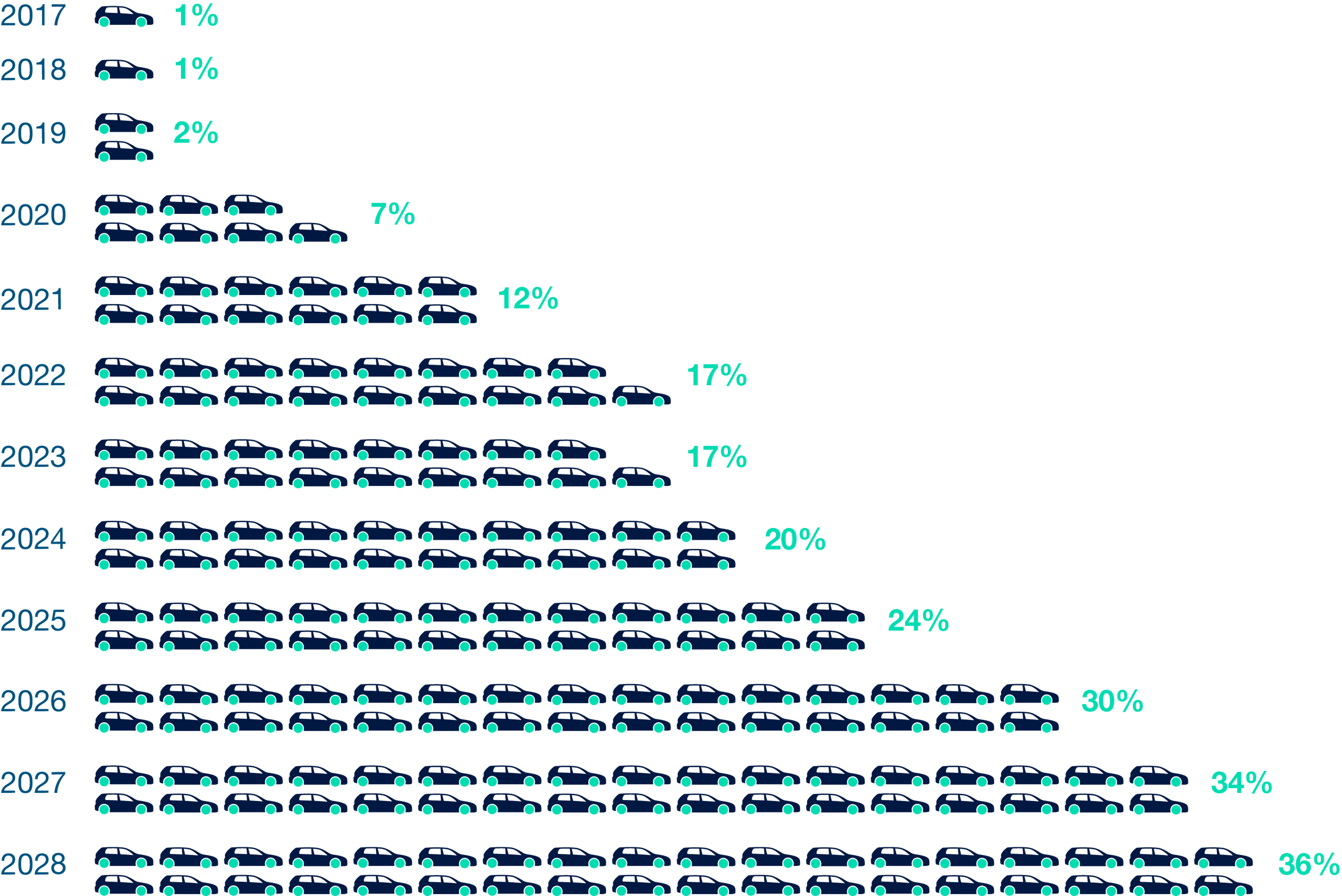

A four-year forecast for new car sales from Cox Automotive reveals a positive trajectory for electric vehicle (EV) adoption in the UK.

The new forecasts provide a first look at the potential growth in the market by 2028, when petrol is expected to represent just under a third (30%) of new registrations as EVs overtake, with a predicted share of 36%.

Despite this falling short of zero emission vehicle (ZEV) mandate targets, it is a positive sign for the industry.

Looking at the changes in the past four years, diesel’s market share has continued to decline representing just over 6% in 2024 - a decrease of more than 2 million units, or a 76.21% drop.

While still retaining the lion’s share, petrol has also seen a reduction, with a loss of 1.4 million units, representing a 26.61% decline over the same period.

Compared to the previous four-year period, the rise of full-battery EVs has been remarkable, says Cox Automotive, with a staggering increase of almost 560%.

Since 2020, approximately 979,000 EVs have entered the market, capturing just shy of 20% of the total market in 2024.

Philip Nothard, insight director at Cox Automotive, said: “The next four years will remain volatile as the sector adapts to economic headwinds and ever-evolving consumer demands.

“We will continue to bear witness to the rise of new manufacturers, including those from China and other international markets, while incumbent manufacturers adjust their in-market strategies. All while the industry responds and adapts to increasingly diverse local and internal regulations.”

Electric vehicle share of new car market

Source: Cox Automotive

The 2025 baseline forecast predicts just over two million car registrations, a modest 1.5% increase over 2024. However, volumes remain 13.3% behind the 2001-2019 average.

Global production of cars and light commercial vehicles has steadily increased and is expected to stabilise through 2025-28.

Registrations fell short of the two million mark in 2024, however, resulting in a significant deficit of 1.7 million fewer vehicles on UK roads between 2020-24.

This challenge was further compounded by the slow recovery of private buyers, whose registrations have declined by 19.2% in the same timeframe.

The new market will also be altered by a host of new brands now available to UK drivers. Following a raft of new market entrants in 2024, including BYD, Jaecoo, Omoda and Skywell, the UK is now home to over 60 manufacturers.

These challenger brands are coming in strong, which is pushing traditional manufacturers to work harder to retain their customer bases and keep pace with evolving technology coming from these new brands.

Nothard continued: “Breaking the two million mark in new car registrations in 2025 will be a pivotal milestone for the UK’s automotive recovery.

“Achieving this target will be heavily dependent on the ability of new market entrants to establish their brands and build trust with UK drivers.

“The confidence of the fleet and leasing sectors will also play a critical role in sustaining growth and driving the transition toward alternative fuel vehicles.”

Cox Automotive’s Insight Quarterly (Q1 2025) features new consumer insights from a joint study with Regit, as well as new and used car forecasts for 2025 and beyond.

Login to comment

Comments

No comments have been made yet.