Cox Automotive has revised its used car forecast for the full year, cautioning against assuming growth seen in the first six months will continue.

Its revised baseline forecast, published in full in its latest Insight Quarterly update, predicts a slight slowdown in activity during Q3 and Q4 compared to its previous forecast, as multiple factors combine to temper wholesale supply and consumer demand.

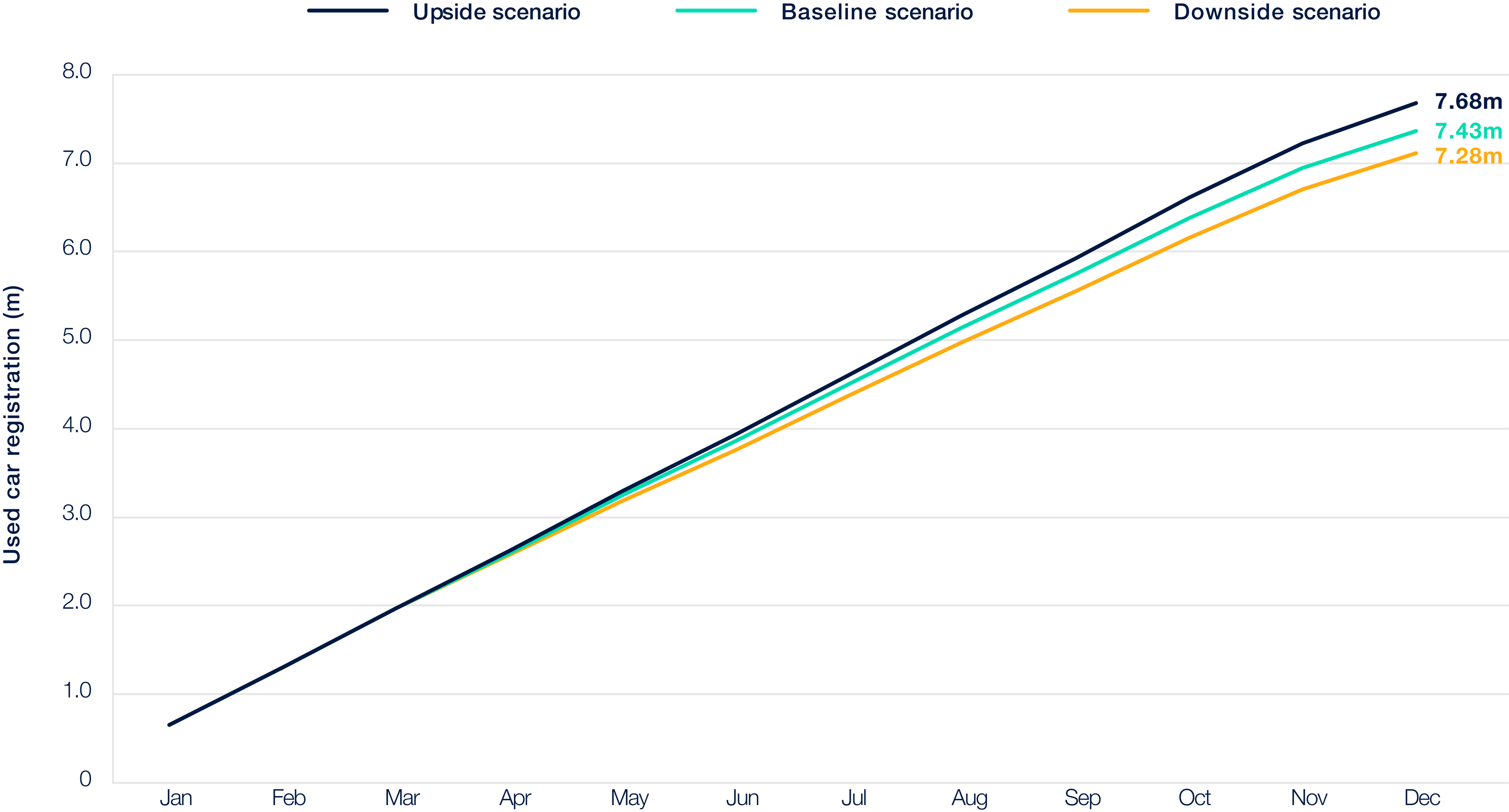

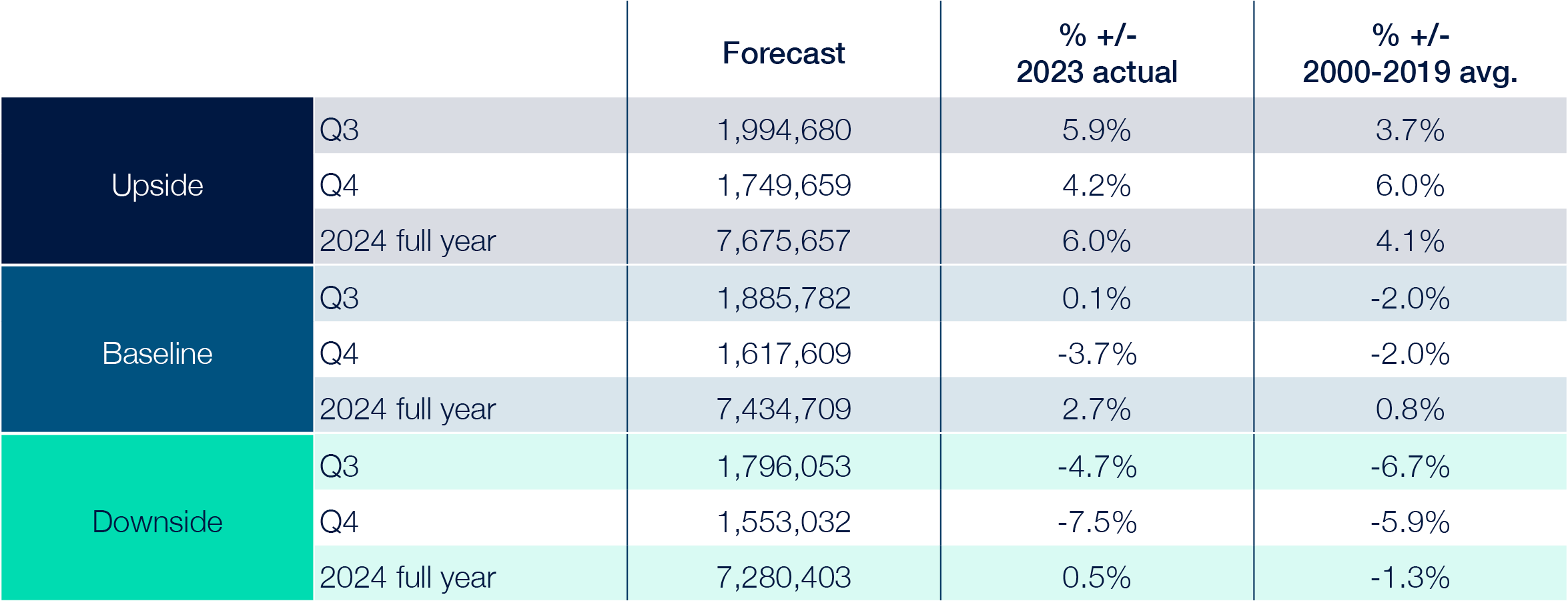

The total number of transactions forecast, however, is marginally ahead of Cox Automotive’s previous forecast and predicts 2024 will conclude with 7,434,709 transactions completed.

It anticipates 1,885,782 transactions in Q3, falling to 1,617,609 in Q4.

The full-year total is a 1.2% increase from Cox Automotive’s previous forecast, 2.7% up from 2023’s total transactions figure, and 0.8% up from the 2001-2019 average.

Cox Automotive insight director, Philip Nothard, explained: “Our revised forecast reflects the positive performance recorded in the first two quarters and the influences we expect the market to encounter during the closing months of the year.

“Despite subdued retail demand, margin pressures, and ongoing constraints in prime three-year-old retail stock, the used market showed remarkable resilience during H1.

“In fact, the total number of transactions in Q1 and Q2 was within a whisker of our upside forecast for H1 and 3.5% ahead of our more conservative baseline forecast.”

However, he said: “We caution against assuming this trajectory will continue.

“The second half of the year will likely see volume cool due to tightening supply into the market, heightening price competition in the new car space, and continued low consumer confidence. Our baseline forecast for the full year, therefore, remains the likely scenario.”

Nothard believes several factors will determine the used market throughout the rest of this and into 2025. These include fast-moving dynamics in the new market, limited availability of in-demand internal combustion engine (ICE) variants, volatile EV values, and consumer appetite for rising prices.

“When looking at the used market, we must always have one eye on the new, which is experiencing significant volatility right now,” he added.

“Supply also remains a hot topic among dealers and securing a reliable and sustainable flow of the vehicles most in demand remains hugely challenging.

“Used dealers also continue to feel the effect of the 3.1 million ‘lost’ registrations from 2020-23. These are the vehicles that ordinarily would now be replenishing forecourts up and down the country and their absence is palpable.”

Cox Automotive is also starting to see the effect of a changing vehicle car parc in terms of fuel type.

“The number of ICE models entering the new market is diminishing rapidly and are not being replaced like-for-like,” said Nothard. These are the cars tomorrow’s used buyers want.

“Used EV values remain volatile and are unlikely to settle until at least 2027. Retail price competition will also influence residual values as manufacturers introduce some astounding deals to force registrations.

“Margin is also under pressure from increased vehicle preparation costs and lead times. Many used dealers have diversified their stock profile to include older vehicles, putting this into sharp focus.

“All of this combines to test even the best used car operator.”

Despite these challenges, Nothard stressed that the automotive sector is renowned for its resilience, and the used sector is no different.

“Significant hurdles are anticipated in the second half of 2024 and into 2025,” he continued. “Still, the volume of transactions we see should be taken as a positive sign that demand and profit opportunities exist.”

Cox Automotive’s IQ is available now to view here. It is a merging of the firm’s annual Insight Report and previous periodical, AutoFocus. Including Cox Automotive’s new and used UK market forecasts and articles from noted industry experts, it is designed to aid manufacturer, fleet and dealer decision-making.

Login to comment

Comments

No comments have been made yet.