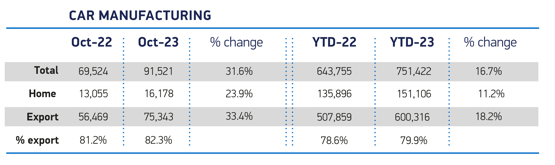

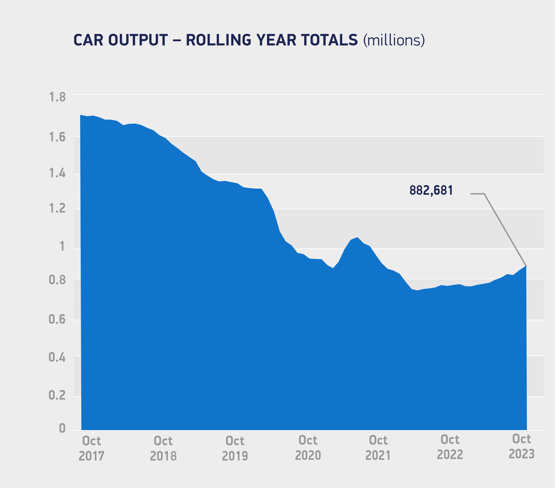

UK car production output surged 31.6% in October, putting the country on track to build one million light vehicles this year.

Figures published by the Society of Motor Manufacturers and Traders (SMMT) 91,512 units left factory gates, marking the best October performance since 2019 and the eighth month of growth this year, .

The news follows recent announcements of significant investment into advanced automotive manufacturing, with some £4 billion committed by Government and industry combined in November alone.

Mike Hawes, SMMT chief executive, said: “These figures, coming on the back of a series of significant investment announcements, signpost a bright 2024 for the UK automotive sector.

"Government and industry are committing billions to transform the industry for a decarbonised future. Last week’s publication of an Advanced Manufacturing Plan and Battery Strategy, the announcement of permanent full expensing in the Chancellor’s Autumn Statement and the £2bn commitment Government has made to advanced automotive manufacturing, underscore the increasing competitiveness of the UK.

"Automotive remains one of the country’s most critical industries, delivering jobs, productivity and economic growth across the country.”

Production for both the home and overseas markets grew in October, up 23.9% and 33.4% respectively, although it was exports which drove output. More than eight in 10 (82.3%) cars were shipped abroad, representing 75,343 units, while 16,178 cars stayed in the UK.

Export growth was driven by rising shipments to the EU, up 58.5%, which remains our largest market by far accounting for almost two-thirds of exports (65.2%), and Turkey, which grew almost four-fold to make it the third largest market above the US, China and Japan.

UK production of battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) vehicles also rose. Combined output grew 52.1% to represent four-in-10 (40.1%) of all cars made in the month, a near record high. Since January, UK factories have turned out 287,408 of these models, up 59.1% on the year before and helping push overall car production up 16.7% to 751,422 units.

The latest independent light vehicle production outlook has been revised and anticipates UK vehicle makers producing 1m cars and light vans in 2023, up 18% on last year, with further growth anticipated in 2024. This outlook is predicated on a workable solution to the EU-UK rules of origin requirements for batteries, which are due to get tougher from January 1, 2024. These rules, if implemented, could see the application of tariffs on electric vehicles traded across the Channel in both directions, risking electric vehicle production and sales in both the UK and EU.

Richard Peberdy, UK head of Automotive for KPMG, said: "In recent months we have seen some very welcome announcements regarding the future of electric vehicle and battery production in the UK, with hopefully more to follow. But with battery production still in its infancy in the UK and EU, the automotive industry is hoping for welcome news in the form of a delay to the 2024 rules of origin changes. They are now only a month away and could result in tariffs being added onto the cost of exporting electric vehicles in either direction across the Channel. Higher costs would threaten market competitiveness at a time when pricing is key to electric vehicle transition.”

Rachel Milloy, senior analyst in manufacturing at RSM UK, added: "The Autumn Statement did deliver positivity for the automotive industry through isolated policies but the UK government still lacks an overarching, long-term industrial strategy which is needed to unlock growth, innovation, talent retention, and greater certainty for investment to allow manufacturers to compete globally within the EV revolution."

Login to comment

Comments

No comments have been made yet.