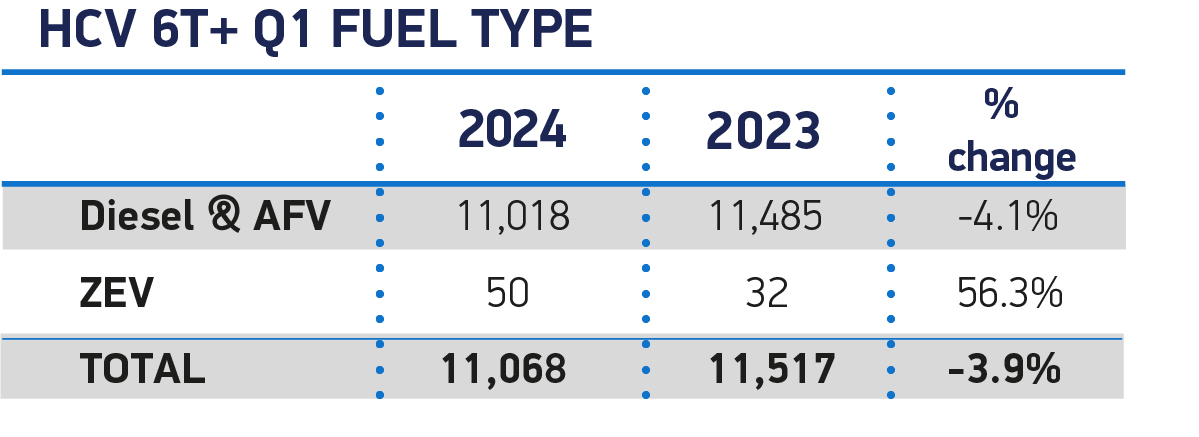

The uptake of zero emission trucks reached 0.5% of overall registrations in Q1 2024, up from 0.3% in the same quarter last year, new figures from the Society of Motor Manufacturers and Traders (SMMT) show.

Although a 56.3% uplift in volume terms on last year, growth remains constricted due to a lack of operator confidence not helped by a grant system introduced almost a decade ago, the trade body claims.

It complains that plug-in truck grant is extraordinarily lengthy which means that fewer than half of all zero emission models available are currently eligible.

The UK also has a dearth of dedicated HGV charging points, says the SMMT, with just one truck-specific charging point in the UK, at the M61 southbound service station.

Mike Hawes, SMMT chief executive, said: “More action is needed to sustain green fleet renewal to decarbonise UK road transport.

“Zero emission truck uptake remains a fractional part of the market but, with just over a decade until the first phase of the end of sale of fossil fuel HGVs, operators need inspirational incentives and infrastructure provision to accelerate their investments.”

The SMMT argues that reforming the grant and implementing a national infrastructure plan would help more businesses switch to zero emission HGVs suitable for a wide range of business needs and help slash around 19 million tonnes of CO2 emissions a year.

The newly published SMMT data for Q1 2024 also shows that new heavy goods vehicle (HGV) registrations fell for the first time in two years, with a 3.9% decline.

Operators still registered 11,068 new HGVs between January and March, just 449 fewer units than the same period in 2023, which was the strongest start to a year since the pandemic.

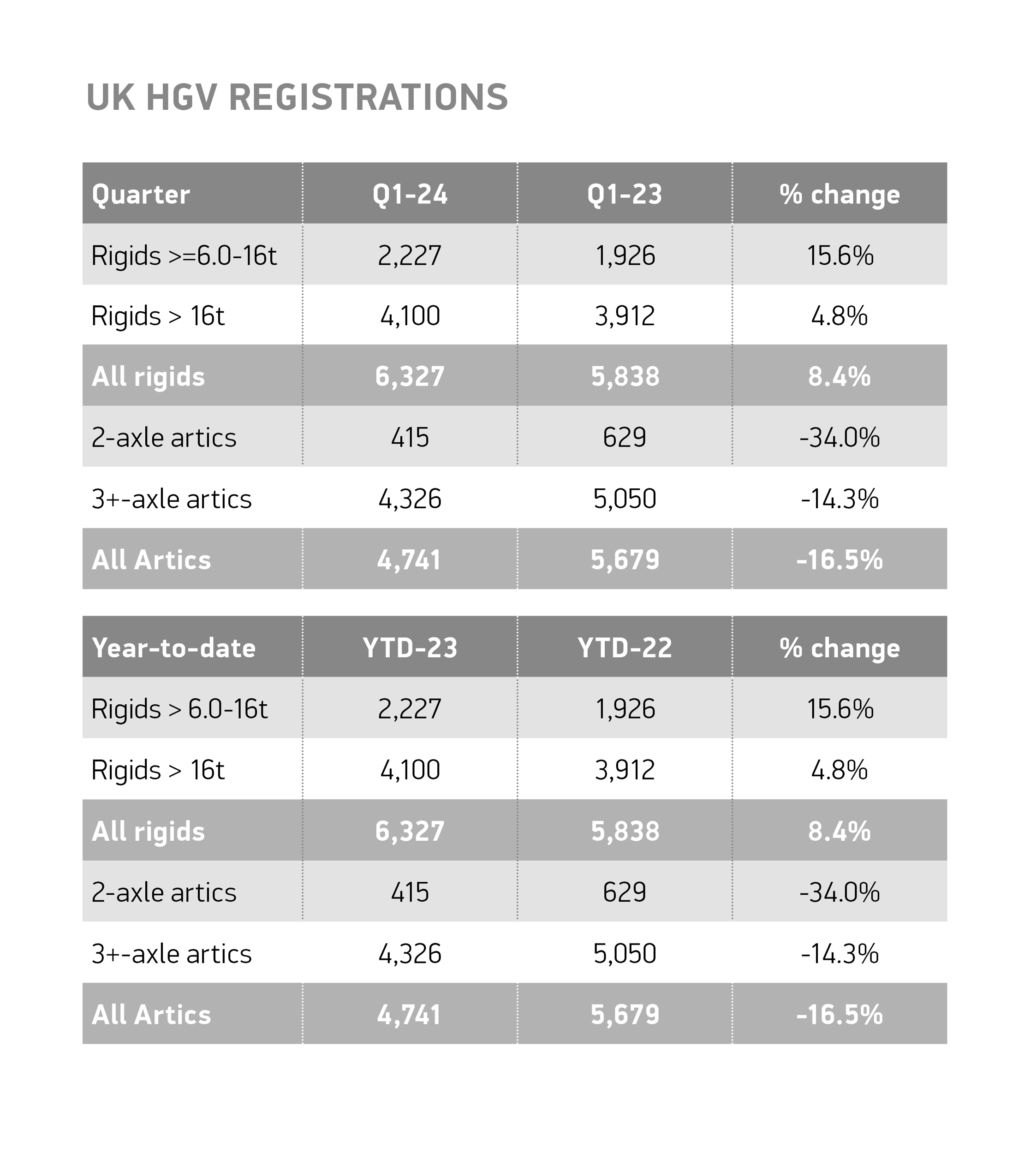

Growth was recorded in rigid HGVs, with overall volumes rising 8.4% year on year to 6,327 units, the largest proportional growth seen in the six to sixteen tonnes weight category, compared with Q1 last year.

Conversely, uptake of articulated HGVs declined by 16.5% year on year to 4,741 units. As a result, the overall market shifted from being split roughly equally between the two vehicle types, to rigids taking almost six in 10 new registrations – representing a normalisation in the market following a fulfilment of pent-up demand over the past 12 months.

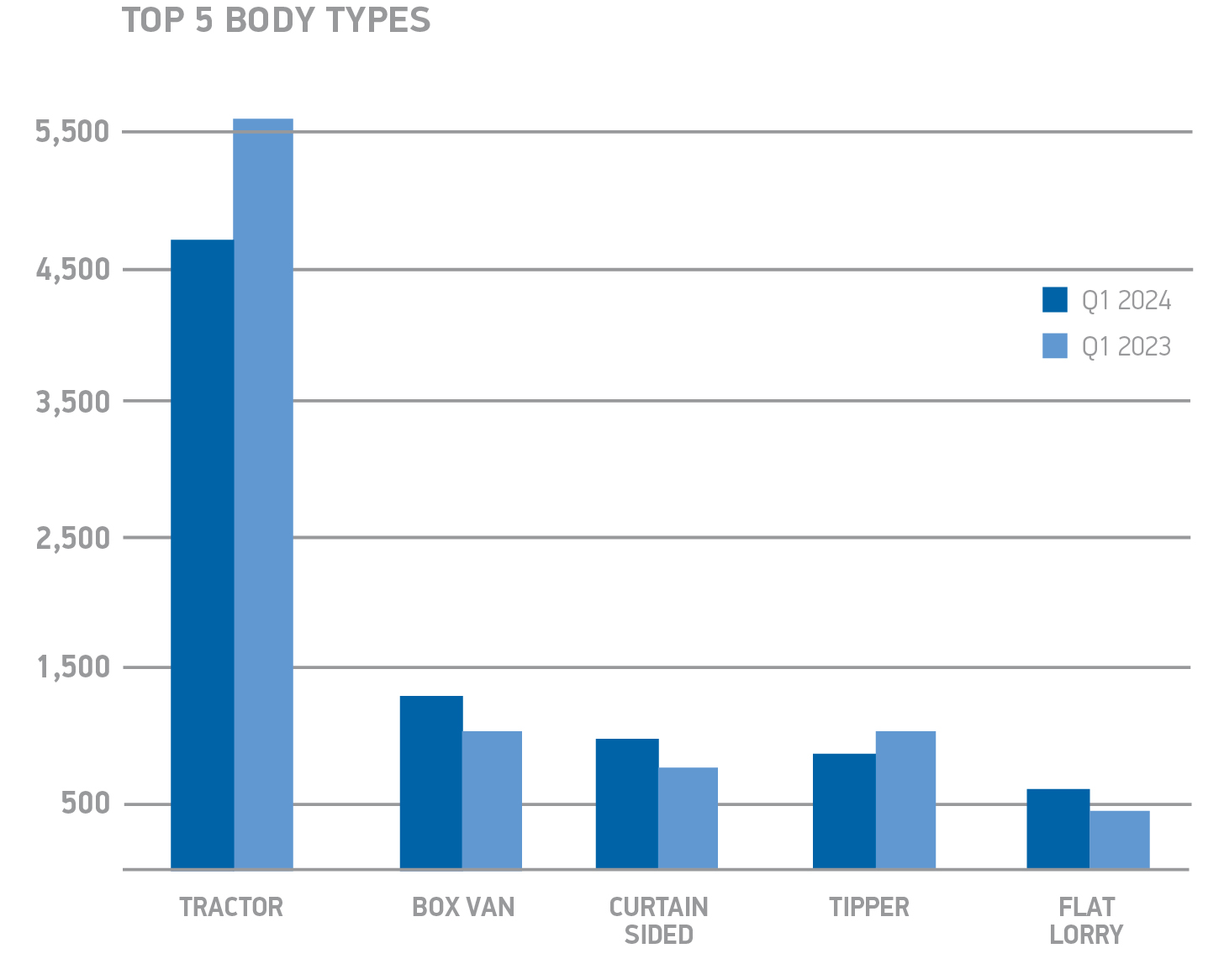

Demand for tractor units, the largest sector of the market, fell 16.7%, while tipper uptake also declined, by 6.3%.

However, strong growth was recorded in curtainsiders (up 23.1%), flat lorries (21.6%) and box vans (20.6%).

Uptake across the country was also variable, with the South West recording proportionally the largest growth in the UK, with 994 new HGVs entering service, up 11.8% on last year.

East Anglia recorded the largest decline, down 26.4% to 457 units.

The South East remained, by a considerable margin, the biggest investor in new heavy vehicles, with 2,351 reaching the road despite a 2.7% decline – more than a fifth of all new registrations.

Login to comment

Comments

No comments have been made yet.